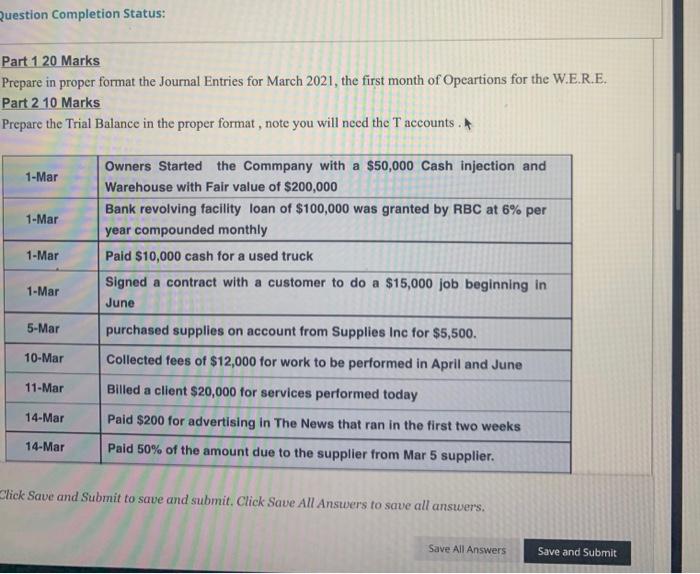

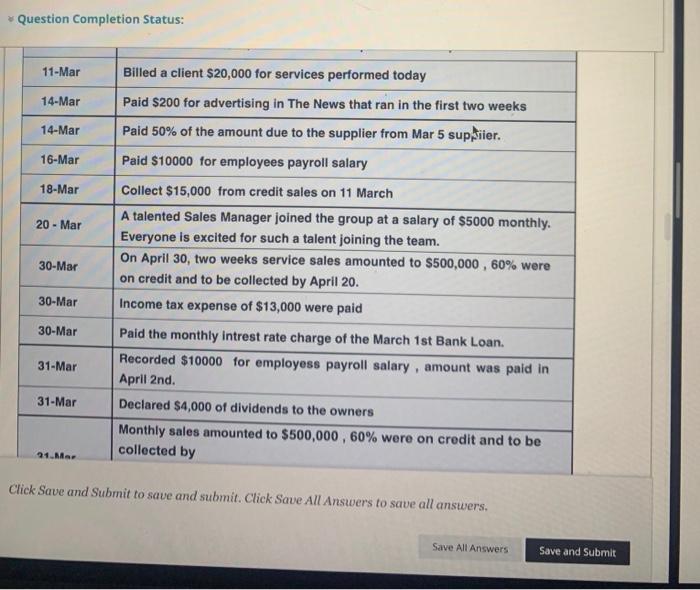

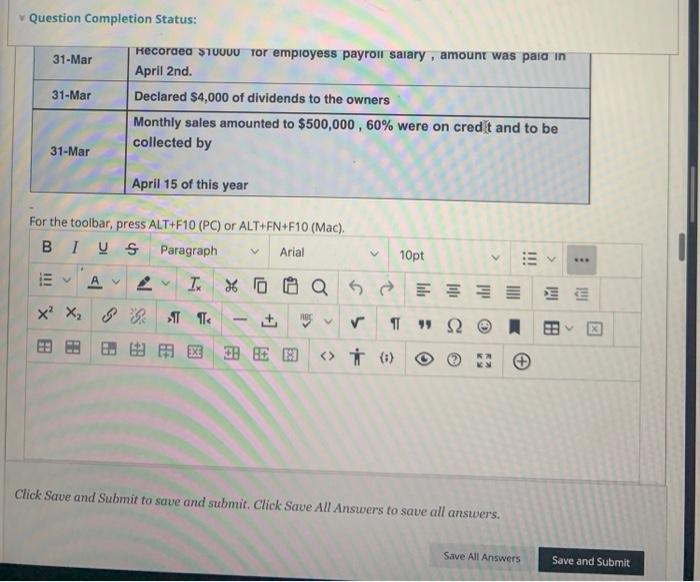

Question Completion Status: Part 1 20 Marks Prepare in proper format the Journal Entries for March 2021, the first month of Opeartions for the W.E.R.E. Part 2 10 Marks Prepare the Trial Balance in the proper format , note you will need the T accounts. 1-Mar 1-Mar Owners Started the Commpany with a $50,000 Cash injection and Warehouse with Fair value of $200,000 Bank revolving facility loan of $100,000 was granted by RBC at 6% per year compounded monthly Paid $10,000 cash for a used truck Signed a contract with a customer to do a $15,000 job beginning in June 1-Mar 1-Mar 5-Mar purchased supplies on account from Supplies Inc for $5,500. 10-Mar Collected fees of $12,000 for work to be performed in April and June 11-Mar Billed a client $20,000 for services performed today 14-Mar Paid $200 for advertising in The News that ran in the first two weeks 14-Mar Paid 50% of the amount due to the supplier from Mar 5 supplier. Click Save and Submit to save and submit. Click Save All Answers to save all answers, Save All Answers Save and Submit Question Completion Status: 11-Mar Billed a client $20,000 for services performed today 14-Mar Paid $200 for advertising in The News that ran in the first two weeks Paid 50% of the amount due to the supplier from Mar 5 supSiier. 14-Mar 16-Mar 18-Mar 20 - Mar Paid $10000 for employees payroll salary Collect $15,000 from credit sales on 11 March A talented Sales Manager joined the group at a salary of $5000 monthly. Everyone is excited for such a talent joining the team. On April 30, two weeks service sales amounted to $500,000, 60% were on credit and to be collected by April 20. Income tax expense of $13,000 were paid 30-Mar 30-Mar 30-Mar Paid the monthly intrest rate charge of the March 1st Bank Loan. Recorded $10000 for employess payroll salary, amount was paid in April 2nd. 31-Mar 31-Mar Declared $4,000 of dividends to the owners Monthly sales amounted to $500,000, 60% were on credit and to be collected by 21. Mar Click Save and Submit to save and submit. Click Save All Answers to save all answers, Save All Answers Save and Submit Question Completion Status: 31-Mar Recorded $10000 or employess payroll salary, amount was paid in April 2nd. 31-Mar Declared $4,000 of dividends to the owners Monthly sales amounted to $500,000, 60% were on cred t and to be collected by 31-Mar April 15 of this year For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BI V S Paragraph Arial > 10pt !!! V A I % 0 Xiii 06 X X X & T T 111c ROC + V V T 99 92 X (1) + 9 Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Save and Submit Question Completion Status: Part 1 20 Marks Prepare in proper format the Journal Entries for March 2021, the first month of Opeartions for the W.E.R.E. Part 2 10 Marks Prepare the Trial Balance in the proper format , note you will need the T accounts. 1-Mar 1-Mar Owners Started the Commpany with a $50,000 Cash injection and Warehouse with Fair value of $200,000 Bank revolving facility loan of $100,000 was granted by RBC at 6% per year compounded monthly Paid $10,000 cash for a used truck Signed a contract with a customer to do a $15,000 job beginning in June 1-Mar 1-Mar 5-Mar purchased supplies on account from Supplies Inc for $5,500. 10-Mar Collected fees of $12,000 for work to be performed in April and June 11-Mar Billed a client $20,000 for services performed today 14-Mar Paid $200 for advertising in The News that ran in the first two weeks 14-Mar Paid 50% of the amount due to the supplier from Mar 5 supplier. Click Save and Submit to save and submit. Click Save All Answers to save all answers, Save All Answers Save and Submit Question Completion Status: 11-Mar Billed a client $20,000 for services performed today 14-Mar Paid $200 for advertising in The News that ran in the first two weeks Paid 50% of the amount due to the supplier from Mar 5 supSiier. 14-Mar 16-Mar 18-Mar 20 - Mar Paid $10000 for employees payroll salary Collect $15,000 from credit sales on 11 March A talented Sales Manager joined the group at a salary of $5000 monthly. Everyone is excited for such a talent joining the team. On April 30, two weeks service sales amounted to $500,000, 60% were on credit and to be collected by April 20. Income tax expense of $13,000 were paid 30-Mar 30-Mar 30-Mar Paid the monthly intrest rate charge of the March 1st Bank Loan. Recorded $10000 for employess payroll salary, amount was paid in April 2nd. 31-Mar 31-Mar Declared $4,000 of dividends to the owners Monthly sales amounted to $500,000, 60% were on credit and to be collected by 21. Mar Click Save and Submit to save and submit. Click Save All Answers to save all answers, Save All Answers Save and Submit Question Completion Status: 31-Mar Recorded $10000 or employess payroll salary, amount was paid in April 2nd. 31-Mar Declared $4,000 of dividends to the owners Monthly sales amounted to $500,000, 60% were on cred t and to be collected by 31-Mar April 15 of this year For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BI V S Paragraph Arial > 10pt !!! V A I % 0 Xiii 06 X X X & T T 111c ROC + V V T 99 92 X (1) + 9 Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Save and Submit