Answered step by step

Verified Expert Solution

Question

1 Approved Answer

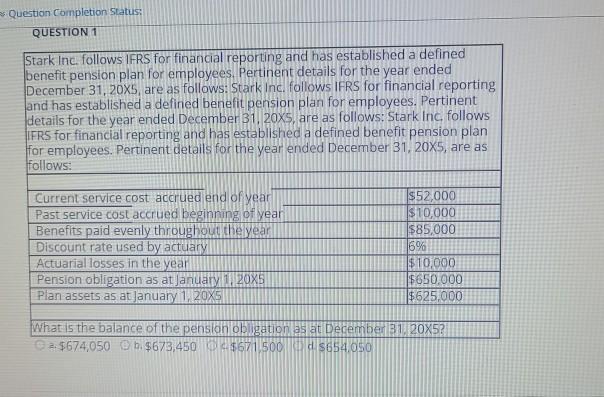

Question Completion Status: QUESTION 1 Stark Inc follows IFRS for financial reporting and has established a defined benefit pension plan for employees. Pertinent details for

Question Completion Status: QUESTION 1 Stark Inc follows IFRS for financial reporting and has established a defined benefit pension plan for employees. Pertinent details for the year ended December 31, 2005, are as follows: Stark Inc. follows IFRS for financial reporting and has established a defined benefit pension plan for employees. Pertinent details for the year ended December 31, 20x5, are as follows: Stark Inc, follows IFRS for financial reporting and has established a defined benefit pension plan for employees. Pertinent details for the year ended December 31, 20X5, are as follows: Current service cost accrued end of year Past service cost accrued beginning of year Benefits paid evenly throughout the year Discount rate used by actuary Actuarial losses in the year Pension obligation as at January 20X5 Plan assets as at January 1, 20X5. $52,000 $10,000 $85,000 16% $10,000 $650,000 $625,000 What is the balance of the pension obligations at Dedembede,120X522 2. $674,050 $673,450 8671.500 d8654.050

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started