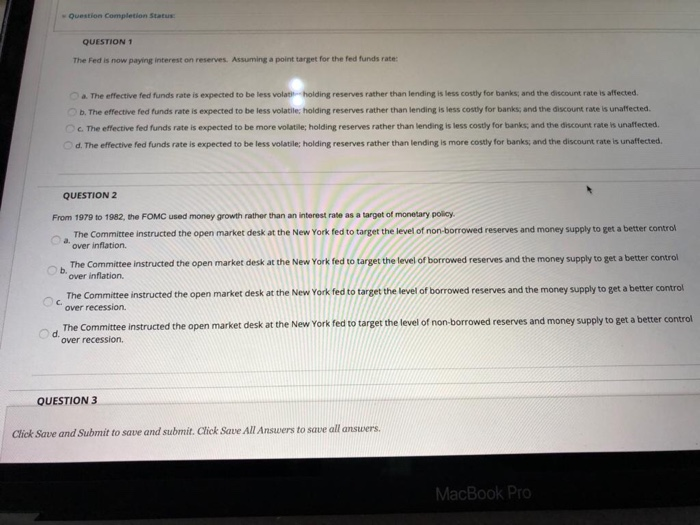

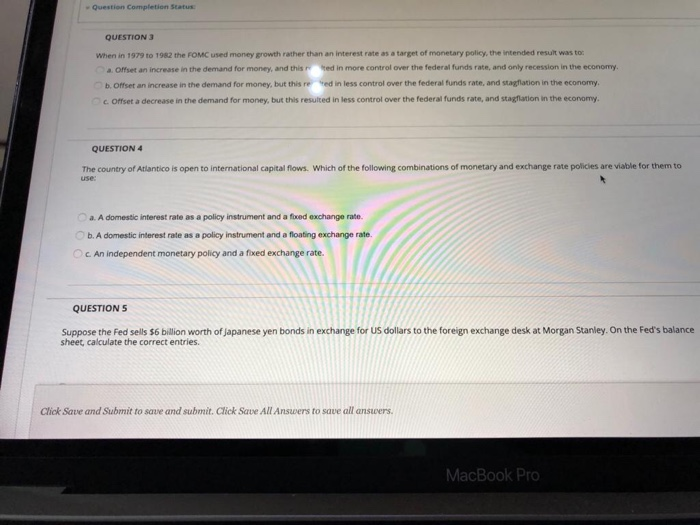

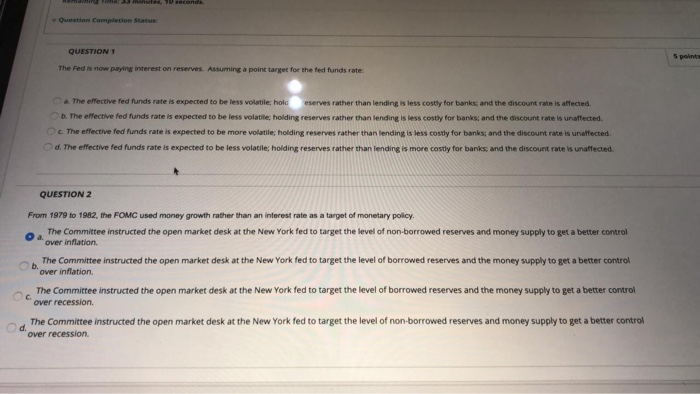

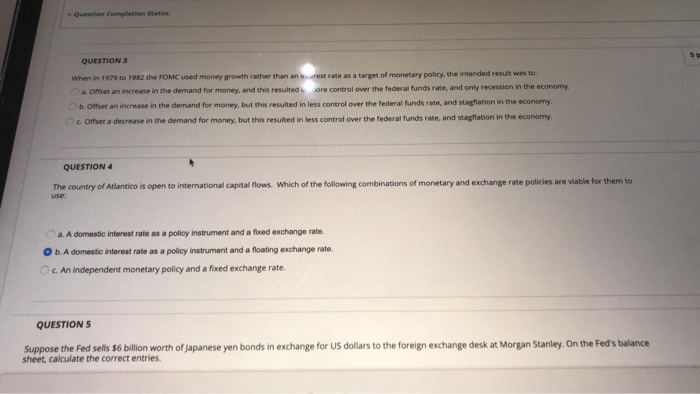

Question Completion Status QUESTION 1 The Fed is now paying interest on reserves. Assuming point target for the fed funds rate a. The effective fed funds rate is expected to be less volt holding reserves rather than lending is less costly for banks and the discount rate is affected b. The effective fed funds rate is expected to be less volatile holding reserves rather than lending is less costly for banks, and the discount rate is unaffected The effective fed funds rate is expected to be more volatile; holding reserves rather than lending is less costly for banks, and the discount rate is unaffected d. The effective fed funds rate is expected to be less volatile; holding reserves rather than lending is more costly for banks, and the discount rate is unaffected. QUESTION 2 From 1979 to 1982, the FOMC used money growth rather than an interest rate as a target of monetary policy The Committee instructed the open market desk at the New York fed to target the level of non borrowed reserves and money supply to get a better control over inflation The Committee instructed the open market desk at the New York fed to target the level of borrowed reserves and the money supply to get a better control over inflation The Committee instructed the open market desk at the New York fed to target the level of borrowed reserves and the money supply to get a better control over recession The Committee instructed the open market desk at the New York fed to target the level of non-borrowed reserves and money supply to get a better control over recession QUESTION 3 Click Save and Submit to save and submit. Click Save All Answers to save all answers. MacBook Pro Question Completion Status QUESTION When in 1979 to 19 the FOMC used money growth rather than an interest rate as a target of monetary policy, the intended resun was to Offset an increase in the demand for money, and thir d in more control over the federal funds rate, and only recession in the economy Offset an increase in the demand for money, but this v ed in less control over the federal funds rate, and station in the economy Offset a decrease in the demand for money, but this resulted in less control over the federal funds , and station in the economy QUESTION 4 The country of Atlantico is open to international capital now. Which of the following combinations of monetary and exchange rate policies are viable for them to a. A domestic interest rate as a policy instrument and a faxed exchange rate b. A domestic interest rate as a policy instrument and a floating exchange rate. c An independent monetary policy and a fixed exchange rate. QUESTION 5 Suppose the Fed sells $6 billion worth of Japanese yen bonds in exchange for US dollars to the foreign exchange desk at Morgan Stanley. On the Fed's balance sheet, calculate the correct entries Click Save and Submit to save and submit. Click Save All Answers to save all answers MacBook Pro Question Completion Status: QUESTION 1 The Fed is now paying interest on reserves. Assuming a point target for the fed funds rate: a. The effective fed funds rate is expected to be less volatile hold e serves rather than lending is less costly for banks, and the discount rate is affected. b. The effective fed funds rate is expected to be less volatile holding reserves rather than lending is less costly for banks; and the discount rate is unaffected. c. The effective fed funds rate is expected to be more volatile; holding reserves rather than lending is less costly for banks and the discount rate is unaffected d. The effective fed funds rate is expected to be less volatile: holding reserves rather than lending is more costly for banks and the discount rate is unaffected QUESTION 2 From 1979 to 1982, the FOMC used money growth rather than an interest rate as a target of monetary policy The Committee instructed the open market desk at the New York fed to target the level of non-borrowed reserves and money supply to get a better control over inflation. The Committee instructed the open market desk at the New York fed to target the level of borrowed reserves and the money supply to get a better control over inflation The Committee instructed the open market desk at the New York fed to target the level of borrowed reserves and the money supply to get a better control over recession. The Committee instructed the open market desk at the New York fed to target the level of non-borrowed reserves and money supply to get a better control d. "over recession Question compte Statue QUESTIONS When in 1979 to 1982 the FOMC used money growth rather than an cestrate as a target of monetary policy, the intended result was to 2. Offset an increase in the demand for money, and this resulted ore control over the federal funds rate, and only recession in the economy b. Offset an increase in the demand for money, but this resulted in less control over the federal funds rate, and stagflation in the economy c Offset a decrease in the demand for money, but this resulted in less control over the federal funds rate, and stagflation in the economy QUESTION 4 The country of Atlantico is open to international capital flows. Which of the following combinations of monetary and exchange rate policies are viable for them to use: a. A domestic interest rate as a policy instrument and a faxed exchange rate O . A domestic interest rate as a policy instrument and a floating exchange rate c. An independent monetary policy and a fixed exchange rate QUESTIONS Suppose the Fed sells $6 billion worth of Japanese yen bonds in exchange for US dollars to the foreign exchange desk at Morgan Stanley. On the Fed's balance sheet calculate the correct entries. Question Completion Status QUESTION 1 The Fed is now paying interest on reserves. Assuming point target for the fed funds rate a. The effective fed funds rate is expected to be less volt holding reserves rather than lending is less costly for banks and the discount rate is affected b. The effective fed funds rate is expected to be less volatile holding reserves rather than lending is less costly for banks, and the discount rate is unaffected The effective fed funds rate is expected to be more volatile; holding reserves rather than lending is less costly for banks, and the discount rate is unaffected d. The effective fed funds rate is expected to be less volatile; holding reserves rather than lending is more costly for banks, and the discount rate is unaffected. QUESTION 2 From 1979 to 1982, the FOMC used money growth rather than an interest rate as a target of monetary policy The Committee instructed the open market desk at the New York fed to target the level of non borrowed reserves and money supply to get a better control over inflation The Committee instructed the open market desk at the New York fed to target the level of borrowed reserves and the money supply to get a better control over inflation The Committee instructed the open market desk at the New York fed to target the level of borrowed reserves and the money supply to get a better control over recession The Committee instructed the open market desk at the New York fed to target the level of non-borrowed reserves and money supply to get a better control over recession QUESTION 3 Click Save and Submit to save and submit. Click Save All Answers to save all answers. MacBook Pro Question Completion Status QUESTION When in 1979 to 19 the FOMC used money growth rather than an interest rate as a target of monetary policy, the intended resun was to Offset an increase in the demand for money, and thir d in more control over the federal funds rate, and only recession in the economy Offset an increase in the demand for money, but this v ed in less control over the federal funds rate, and station in the economy Offset a decrease in the demand for money, but this resulted in less control over the federal funds , and station in the economy QUESTION 4 The country of Atlantico is open to international capital now. Which of the following combinations of monetary and exchange rate policies are viable for them to a. A domestic interest rate as a policy instrument and a faxed exchange rate b. A domestic interest rate as a policy instrument and a floating exchange rate. c An independent monetary policy and a fixed exchange rate. QUESTION 5 Suppose the Fed sells $6 billion worth of Japanese yen bonds in exchange for US dollars to the foreign exchange desk at Morgan Stanley. On the Fed's balance sheet, calculate the correct entries Click Save and Submit to save and submit. Click Save All Answers to save all answers MacBook Pro Question Completion Status: QUESTION 1 The Fed is now paying interest on reserves. Assuming a point target for the fed funds rate: a. The effective fed funds rate is expected to be less volatile hold e serves rather than lending is less costly for banks, and the discount rate is affected. b. The effective fed funds rate is expected to be less volatile holding reserves rather than lending is less costly for banks; and the discount rate is unaffected. c. The effective fed funds rate is expected to be more volatile; holding reserves rather than lending is less costly for banks and the discount rate is unaffected d. The effective fed funds rate is expected to be less volatile: holding reserves rather than lending is more costly for banks and the discount rate is unaffected QUESTION 2 From 1979 to 1982, the FOMC used money growth rather than an interest rate as a target of monetary policy The Committee instructed the open market desk at the New York fed to target the level of non-borrowed reserves and money supply to get a better control over inflation. The Committee instructed the open market desk at the New York fed to target the level of borrowed reserves and the money supply to get a better control over inflation The Committee instructed the open market desk at the New York fed to target the level of borrowed reserves and the money supply to get a better control over recession. The Committee instructed the open market desk at the New York fed to target the level of non-borrowed reserves and money supply to get a better control d. "over recession Question compte Statue QUESTIONS When in 1979 to 1982 the FOMC used money growth rather than an cestrate as a target of monetary policy, the intended result was to 2. Offset an increase in the demand for money, and this resulted ore control over the federal funds rate, and only recession in the economy b. Offset an increase in the demand for money, but this resulted in less control over the federal funds rate, and stagflation in the economy c Offset a decrease in the demand for money, but this resulted in less control over the federal funds rate, and stagflation in the economy QUESTION 4 The country of Atlantico is open to international capital flows. Which of the following combinations of monetary and exchange rate policies are viable for them to use: a. A domestic interest rate as a policy instrument and a faxed exchange rate O . A domestic interest rate as a policy instrument and a floating exchange rate c. An independent monetary policy and a fixed exchange rate QUESTIONS Suppose the Fed sells $6 billion worth of Japanese yen bonds in exchange for US dollars to the foreign exchange desk at Morgan Stanley. On the Fed's balance sheet calculate the correct entries