Answered step by step

Verified Expert Solution

Question

1 Approved Answer

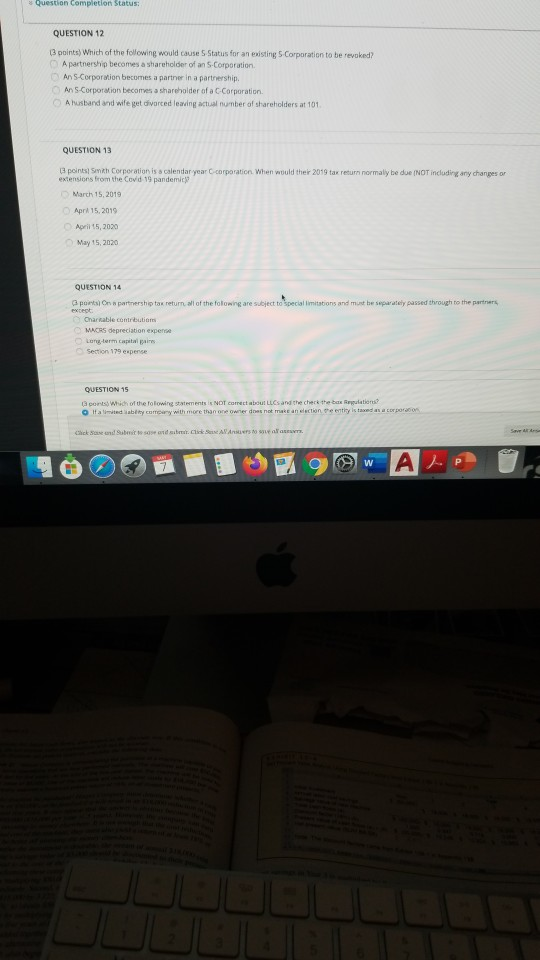

Question Completion Status: QUESTION 12 3 points) Which of the following would causes Status for an existing Corporation to be revoked? Apartnership becomes a shareholder

Question Completion Status: QUESTION 12 3 points) Which of the following would causes Status for an existing Corporation to be revoked? Apartnership becomes a shareholder of an S-Corporation Ans Corporation becomes a partner in a partnership. An S.Corporation becomes a shareholder of a C-Corporation A husband and wife get divorced leaving actual number of shareholders at 101 QUESTION 13 3 points Sith Corporation is a calendar year extensions from the Covd 19 pandemic corporation. When would their 2019 tax return normally be due NOT including any changes or March 15, 2019 Apr 15, 2019 April 15, 2000 May 15, 2020 QUESTION 14 potan partnership tax return wi of the following are s Special limitations and must be separately passed through to the Charitable contribution MORS depreciation expense Long-term capital gains Section 179 expense QUESTION 15 ponts Which of the folowing statements is NOT correc lated abity company with more than one owned t and the check the box Rulations? Chick and soon bar. SAVAS a Z 1A glw AP

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started