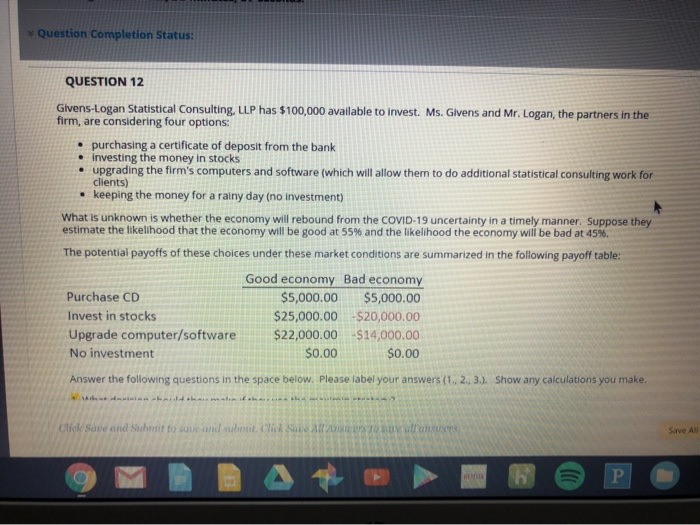

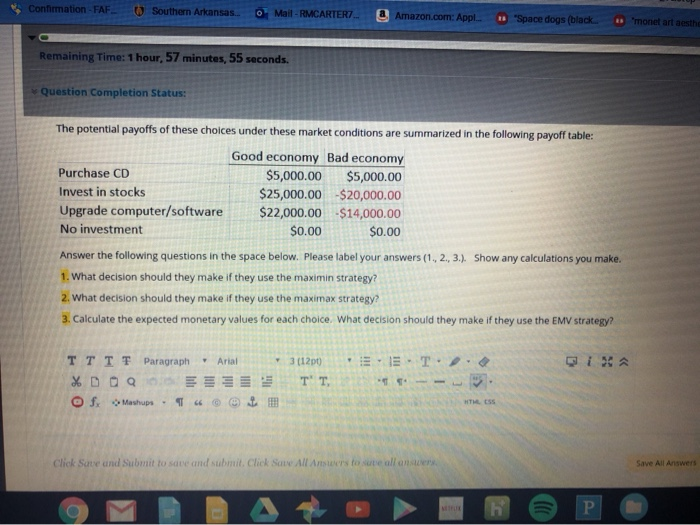

Question Completion Status: QUESTION 12 Givens-Logan Statistical Consulting, LLP has $100,000 available to invest. Ms. Givens and Mr. Logan, the partners in the firm, are considering four options: purchasing a certificate of deposit from the bank investing the money in stocks upgrading the firm's computers and software (which will allow them to do additional statistical consulting work for clients) keeping the money for a rainy day (no investment) What is unknown is whether the economy will rebound from the COVID-19 uncertainty in a timely manner. Suppose they estimate the likelihood that the economy will be good at 55% and the likelihood the economy will be bad at 45% The potential payoffs of these choices under these market conditions are summarized in the following payoff table: Good economy Bad economy Purchase CD $5,000.00 $5,000.00 Invest in stocks $25,000.00 $20,000.00 Upgrade computer/software $22,000.00 $14,000.00 No investment $0.00 $0.00 Answer the following questions in the space below. Please label your answers (1.2.3.). Show any calculations you make. them. . Click Save and submit to save and submit. Click Save an Antonio Save All Confirmation - FAF 0 Southern Arkansas... Mail - RMCARTER @ Amazon.com: Appl. 15 "Space dogs (black. monet art aesthe Remaining Time: 1 hour, 57 minutes, 55 seconds. Question Completion Status: The potential payoffs of these choices under these market conditions are summarized in the following payoff table: Good economy Bad economy Purchase CD $5,000.00 $5,000.00 Invest in stocks $25,000.00 $20,000.00 Upgrade computer/software $22,000.00 $14,000.00 No investment $0.00 $0.00 Answer the following questions in the space below. Please label your answers (1., 2., 3.). Show any calculations you make. 1. What decision should they make if they use the maximin strategy? 2. What decision should they make if they use the maximax strategy? 3. Calculate the expected monetary values for each choice. What decision should they make if they use the EMV strategy? EET TTTT Paragraph Arial %DOO O fx Mashups 16 3 (12pt) T'T QiX HTML CSS Click Save and submit to save and submit. Click Save All Arors to sure all answers Save All Answers Question Completion Status: QUESTION 12 Givens-Logan Statistical Consulting, LLP has $100,000 available to invest. Ms. Givens and Mr. Logan, the partners in the firm, are considering four options: purchasing a certificate of deposit from the bank investing the money in stocks upgrading the firm's computers and software (which will allow them to do additional statistical consulting work for clients) keeping the money for a rainy day (no investment) What is unknown is whether the economy will rebound from the COVID-19 uncertainty in a timely manner. Suppose they estimate the likelihood that the economy will be good at 55% and the likelihood the economy will be bad at 45% The potential payoffs of these choices under these market conditions are summarized in the following payoff table: Good economy Bad economy Purchase CD $5,000.00 $5,000.00 Invest in stocks $25,000.00 $20,000.00 Upgrade computer/software $22,000.00 $14,000.00 No investment $0.00 $0.00 Answer the following questions in the space below. Please label your answers (1.2.3.). Show any calculations you make. them. . Click Save and submit to save and submit. Click Save an Antonio Save All Confirmation - FAF 0 Southern Arkansas... Mail - RMCARTER @ Amazon.com: Appl. 15 "Space dogs (black. monet art aesthe Remaining Time: 1 hour, 57 minutes, 55 seconds. Question Completion Status: The potential payoffs of these choices under these market conditions are summarized in the following payoff table: Good economy Bad economy Purchase CD $5,000.00 $5,000.00 Invest in stocks $25,000.00 $20,000.00 Upgrade computer/software $22,000.00 $14,000.00 No investment $0.00 $0.00 Answer the following questions in the space below. Please label your answers (1., 2., 3.). Show any calculations you make. 1. What decision should they make if they use the maximin strategy? 2. What decision should they make if they use the maximax strategy? 3. Calculate the expected monetary values for each choice. What decision should they make if they use the EMV strategy? EET TTTT Paragraph Arial %DOO O fx Mashups 16 3 (12pt) T'T QiX HTML CSS Click Save and submit to save and submit. Click Save All Arors to sure all answers Save All Answers