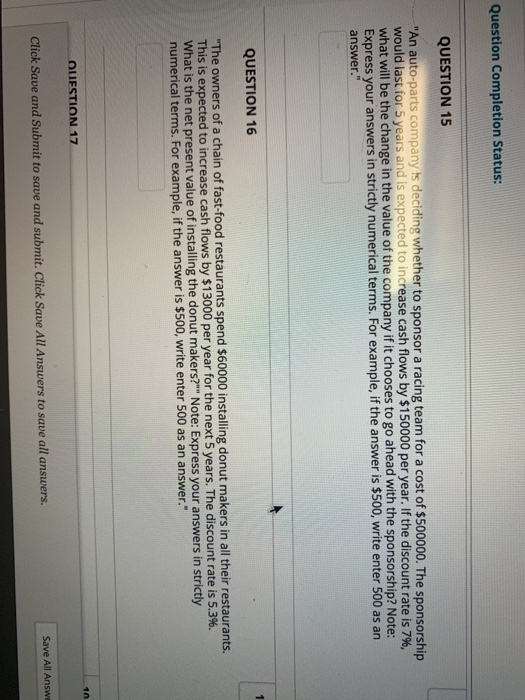

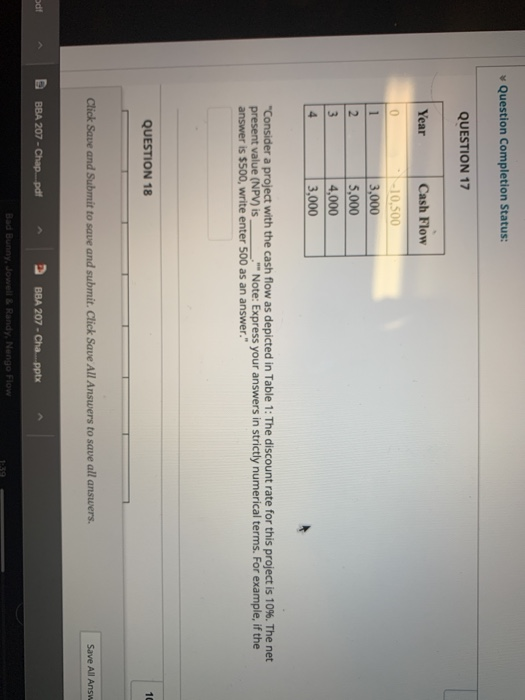

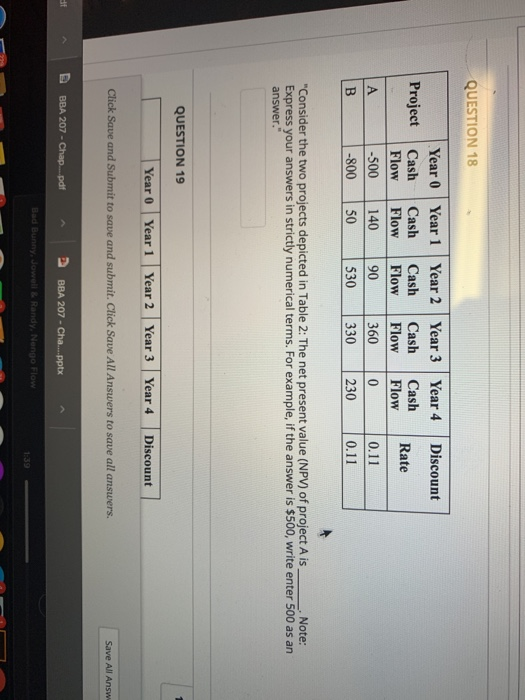

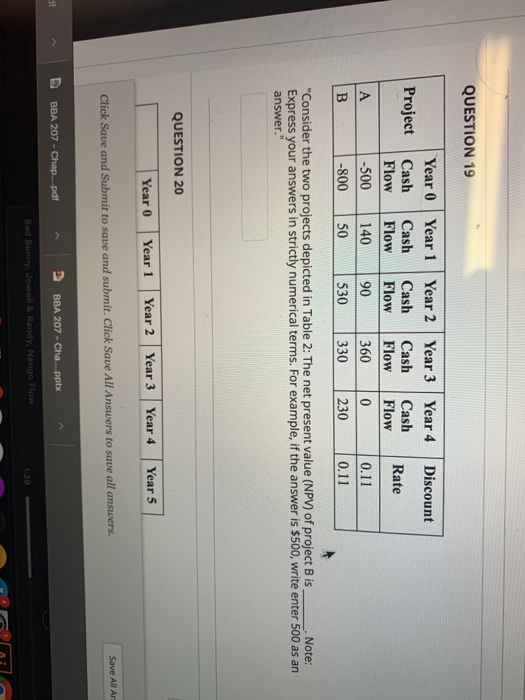

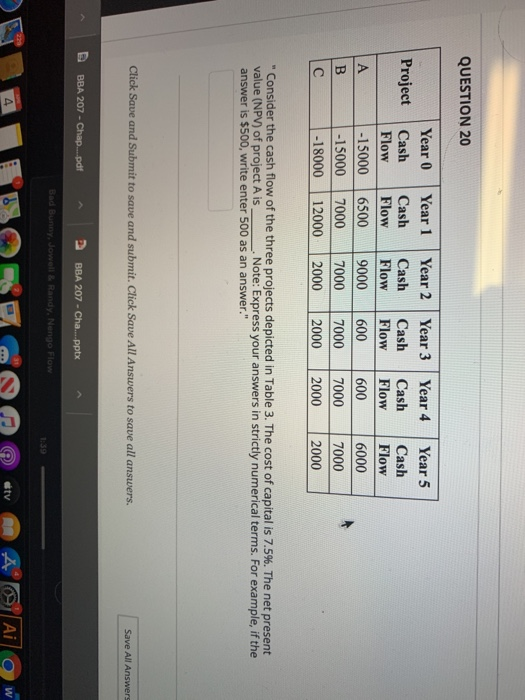

Question Completion Status: QUESTION 15 "An auto-Darts company is deciding whether to sponsor a range any is deciding whether to sponsor a racing team for a cost of $500000. The sponsorship 000 per year if the discount rate is 796, would last for 5 years and is expected to increase cash flows by $150000 per year. If the discount rate is 7%, what will be the change in the value of the company if it chooses to go ahead with the sponsorship? Note: Express your answers in strictly numerical terms. For example, if the answer is $500, write enter 500 as an answer. QUESTION 16 "The owners of a chain of fast-food restaurants spend $60000 installing donut makers in all their restaurants. This is expected to increase cash flows by $13000 per year for the next 5 years. The discount rate is 5.3%. What is the net present value of installing the donut makers?"" Note: Express your answers in strictly numerical terms. For example, if the answer is $500, write enter 500 as an answer." QUESTION 17 Save All Answd Click Save and Submit to save and submit. Click Save All Answers to save all answers. Question Completion Status: QUESTION 17 Year Cash Flow -10.500 3,000 5,000 4,000 3,000 "Consider a project with the cash flow as depicted in Table 1: The discount rate for this project is 10%. The net present value (NPV) is ." Note: Express your answers in strictly numerical terms. For example, if the answer is $500, write enter 500 as an answer." QUESTION 18 Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answ od E BBA 207 - Chap...pdf P BBA 207 - Cha...pptx Bad Bunny Jowell & Randy. Nengo Flow QUESTION 18 Discount Project Year 0 Cash Flow -500 |-800 Rate Year 1 Cash Flow 140 50 Year 2 Cash Flow 90 5 30 Year 3 Cash Flow 360 330 Year 4 Cash Flow 0.11 0.11 B 230 "Consider the two projects depicted in Table 2: The net present value (NPV) of project A is Note: Express your answers in strictly numerical terms. For example, if the answer is $500, write enter 500 as an answer." QUESTION 19 Year 0 Year 1 Year 2 Year 3 Year 4 Discount Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answ of BBA 207 - Chap...pdf BBA 207. Cha....pptx Bad Bunny, Jowell & Randy, Nengo Flow QUESTION 19 Discount Project Year 0 Cash Flow -500 -800 Year 1 Cash Flow 140 Rate Year 2 Year 3 Cash Cash Flow Flow 3600 330 Year 4 Cash Flow 90 530 0.11 0.11 50 230 "Consider the two projects depicted in Table 2: The net present value (NPV) of project Bis Note: Express your answers in strictly numerical terms. For example, if the answer is $500, write enter 500 as an answer. QUESTION 20 Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Save All Art Click Save and Submit to save and submit. Click Save All Answers to save all answers. af BBA 207 - Chap...pdf ^ BBA 207 - Cha....pptx Bad Bunny, Jowell & Randy, Nengo Flow Tamil QUESTION 20 Year 0 Year 1 Project Flow -15000 - 15000 -18000 Flow 6500 7000 12000 Year 2 Cash Flow 9000 7000 2000 Year 3 Cash Flow 600 7000 2000 Year 4 Cash Flow 600 7000 2000 Year 5 Cash Flow 6000 7000 2000 "Consider the cash flow of the three projects depicted in Table 3. The cost of capital is 7.5%. The net present value (NPV) of project A is . Note: Express your answers in strictly numerical terms. For example, if the answer is $500, write enter 500 as an answer." Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers BBA 207 - Chap...pdf P BBA 207 - Cha....pptx Bad Bunny, Jowell & Randy, Nengo Flow AINARA O avm A Ai o w