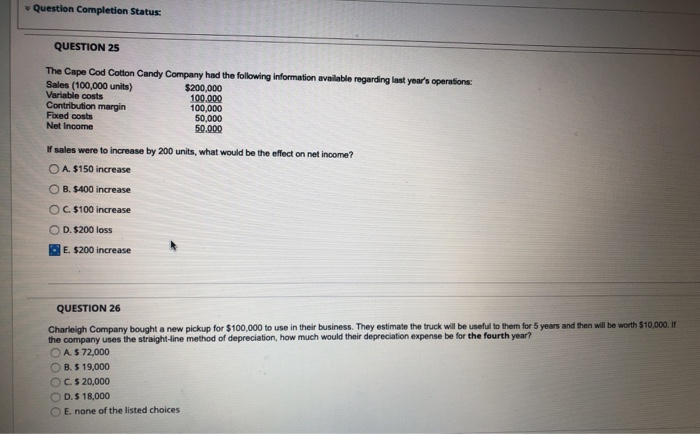

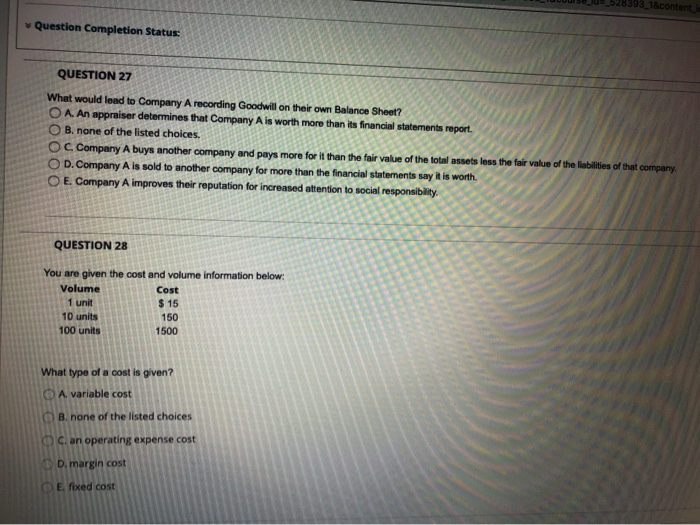

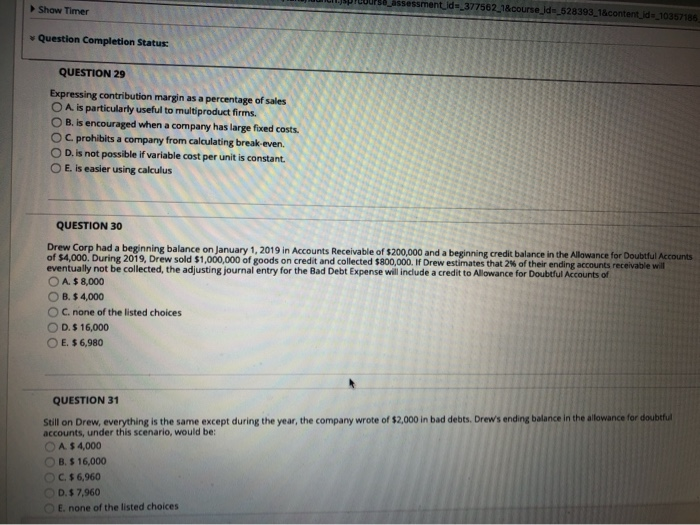

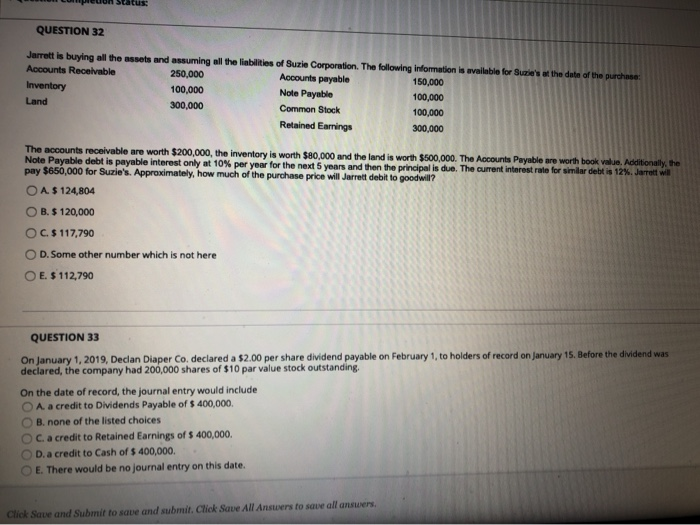

Question Completion Status: QUESTION 25 The Cape Cod Cotton Candy Company had the following information available regarding last year's operations Sales (100,000 units) $200,000 Variable costs 100.000 Contribution margin 100,000 Fixed costs 50,000 Net Income 50.000 If sales were to increase by 200 units, what would be the effect on net income? O A. $150 increase O B. 5400 increase OC $100 increase OD. $200 loss DE $200 increase QUESTION 26 Charleigh Company bought a new pickup for $100,000 to use in their business. They estimate the truck will be useful to them for 5 years and then will be worth $10,000. If the company uses the straight-line method of depreciation, how much would their depreciation expense be for the fourth year? A. $72,000 OB. $ 19,000 OC. $ 20,000 OD. $ 18,000 O E. none of the listed choices Tuuseu=528393_1&content Question Completion Status: QUESTION 27 What would lead to Company A recording Goodwill on their own Balance Sheet? O A An appraiser determines that Company A is worth more than its financial statements report. O B. none of the listed choices. O c. Company A buys another company and pays more for it than the fair value of the total assets less the fair value of the abilities of that company O D. Company A is sold to another company for more than the financial statements say it is worth O E. Company A improves their reputation for increased attention to social responsibility QUESTION 28 You are given the cost and volume information below: Volume Cost 1 unit $ 15 10 units 100 units 1500 150 What type of a cost is given? A. variable cost B. none of the listed choices c. an operating expense cost D. margin cost E. fixed cost ISPILUurse assessment id=_377562_18 courseld_528393_1&content id=_10357185 Show Timer 1 Question Completion Status QUESTION 29 Expressing contribution margin as a percentage of sales O A is particularly useful to multiproduct firms. OB. Is encouraged when a company has large fixed costs. OC. prohibits a company from calculating break-even. OD, is not possible if variable cost per unit is constant E. is easier using calculus QUESTION 30 Drew Corp had a beginning balance on January 1, 2019 in Accounts Receivable of $200,000 and a beginning credit balance in the Allowance for Doubtful Accounts of $4,000. During 2019, Drew sold $1,000,000 of goods on credit and collected $800,000. If Drew estimates that 2% of their ending accounts receivable will eventually not be collected, the adjusting journal entry for the Bad Debt Expense will include a credit to Allowance for Doubtful Accounts of OA. $ 8,000 OB. $ 4,000 OC. none of the listed choices OD. $ 16,000 OE. $ 6,980 QUESTION 31 Still on Drew, everything is the same except during the year, the company wrote of $2,000 in bad debts. Drew's ending balance in the allowance for doubtful accounts, under this scenario, would be: O A $4,000 OB. $ 16,000 OC. $ 6,960 D. $ 7,960 E none of the listed choices cumpeun Status: QUESTION 32 the date Jarrett is buying all the assets and assuming all the liabilities of Suzie Corporation. The following information is available for sure Accounts Receivable 250,000 Accounts payable 150,000 Inventory 100,000 Note Payable 100,000 Land 300,000 Common Stock 100,000 Retained Earnings 300,000 The accounts receivable are worth $200,000, the inventory is worth $80,000 and the land is worth $500,000. The Accounts Payable are worth book value. Additionally, the Note Payable debt is payable interest only at 10% per year for the next 5 years and then the principal is due. The current interest rate for similar debt is 12%. Jarrett will pay $650,000 for Suzie's. Approximately, how much of the purchase price will Jarrett debit to goodwill? O A $ 124,804 OB.$ 120,000 OC. $ 117,790 OD. Some other number which is not here OE. $ 112,790 QUESTION 33 On January 1, 2019, Declan Diaper Co. declared a $2.00 per share dividend payable on February 1, to holders of record on January 15. Before the dividend was declared, the company had 200,000 shares of $10 par value stock outstanding, On the date of record, the journal entry would include O A a credit to Dividends Payable of $ 400,000 OB. none of the listed choices OC. a credit to Retained Earnings of $ 400,000 D. a credit to Cash of $ 400,000 O E. There would be no journal entry on this date. Click Save and Submit to save and submit. Click Save All Answers to save all answers