Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Completion Status: QUESTION 48 On January 1, 2019, Hongkang Company purchased equipment for $35,000. The company expects to use the equipment for 3 years.

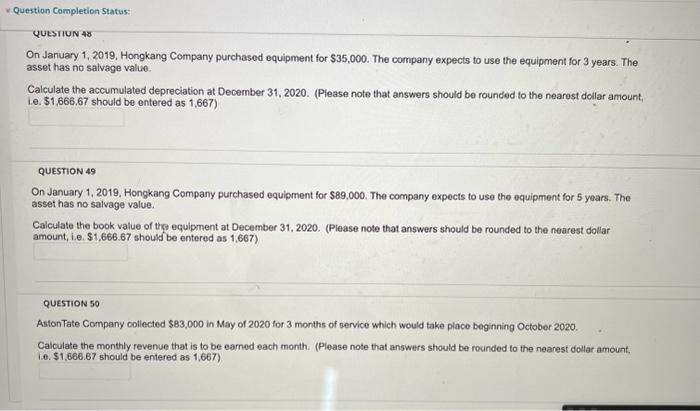

Question Completion Status: QUESTION 48 On January 1, 2019, Hongkang Company purchased equipment for $35,000. The company expects to use the equipment for 3 years. The asset has no salvage value. Calculate the accumulated depreciation at December 31, 2020. (Please note that answers should be rounded to the nearest dollar amount, i.e. $1,666.67 should be entered as 1,667) QUESTION 49 On January 1, 2019, Hongkang Company purchased equipment for $89,000. The company expects to use the equipment for 5 years. The asset has no salvage value. Calculate the book value of the equipment at December 31, 2020. (Please note that answers should be rounded to the nearest dollar amount, i.e. $1,666.67 should be entered as 1,667) QUESTION 50 Aston Tate Company collected $83,000 in May of 2020 for 3 months of service which would take place beginning October 2020. Calculate the monthly revenue that is to be earned each month. (Please note that answers should be rounded to the nearest dollar amount, i.e. $1,666.67 should be entered as 1,667)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started