Answered step by step

Verified Expert Solution

Question

1 Approved Answer

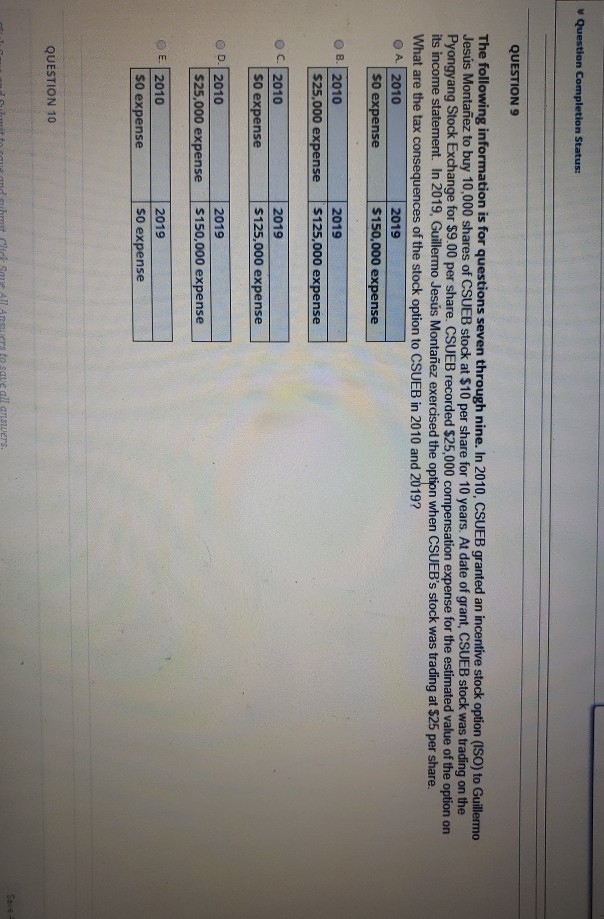

Question Completion Status: QUESTION 9 The following information is for questions seven through nine. In 2010, CSUEB granted an incentive stock option (ISO) to Guillermo

Question Completion Status: QUESTION 9 The following information is for questions seven through nine. In 2010, CSUEB granted an incentive stock option (ISO) to Guillermo Jess Montaez to buy 10,000 shares of CSUEB stock at $10 per share for 10 years. At date of grant, CSUEB stock was trading on the Pyongyang Stock Exchange for $9.00 per share. CSUEB recorded $25,000 compensation expense for the estimated value of the option on its income statement. In 2019, Guillermo Jess Montaez exercised the option when CSUEB's stock was trading at $25 per share. What are the tax consequences of the stock option to CSUEB in 2010 and 2019? OA 2010 2019 $0 expense S150,000 expense B. 2010 $25,000 expense 2019 $125,000 expense OC 2010 so expense 2019 $125,000 expense OD 2010 $25,000 expense 2019 S150,000 expense OE 2010 SO expense 2019 so expense QUESTION 10 it to come and unit Cil Se All Arts Sale all answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started