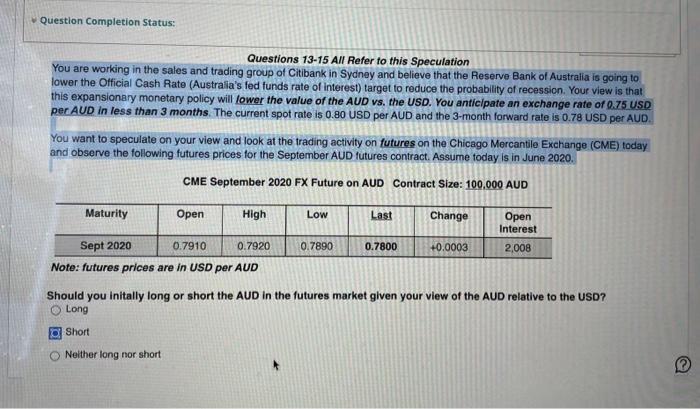

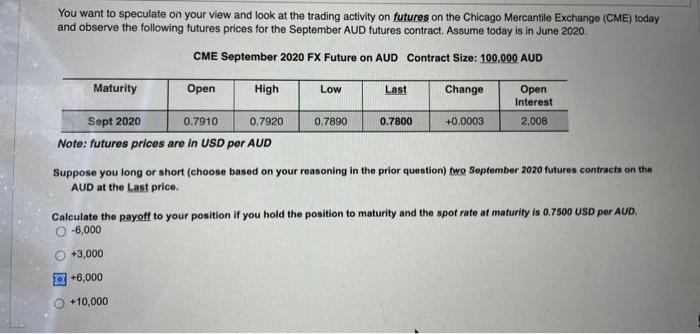

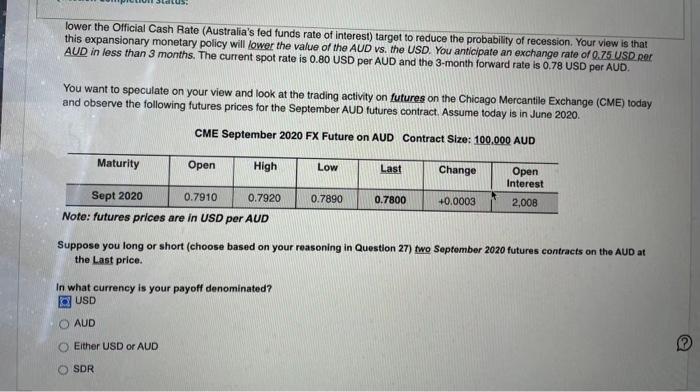

Question Completion Status: Questions 13-15 All Refer to this Speculation You are working in the sales and trading group of Citibank in Sydney and believe that the Reserve Bank of Australia is going to lower the Official Cash Rate (Australia's fed funds rate of interest) target to reduce the probability of recession. Your view is that this expansionary monetary policy will lower the value of the AUD vs. the USD. You anticipate an exchange rate of 0.75 USD per AUD in less than 3 months. The current spot rate is 0.80 USD per AUD and the 3-month forward rate is 0.78 USD per AUD You want to speculate on your view and look at the trading activity on futures on the Chicago Mercantile Exchange (CME) today and observe the following futures prices for the September AUD futures contract. Assume today is in June 2020. CME September 2020 FX Future on AUD Contract Size: 100.000 AUD Maturity Open High Low Last Change Open Interest 0.7890 0.7800 +0.0003 2,008 Sept 2020 0.7910 0.7920 Note: futures prices are in USD per AUD Should you initally long or short the AUD in the futures market given your view of the AUD relative to the USD? Long Short Neither long nor short You want to speculate on your view and look at the trading activity on futures on the Chicago Mercantile Exchange (CME) today and observe the following futures prices for the September AUD futures contract. Assume today is in June 2020 CME September 2020 FX Future on AUD Contract Size: 100.000 AUD Maturity Open High Low Last Change Open Interest Sept 2020 0.7910 0.7920 0.7890 0.7800 +0.0003 2,008 Note: futures prices are in USD per AUD Suppose you long or short (choose based on your reasoning in the prior question) two September 2020 futures contracts on the AUD at the Last price. Calculate the payoff to your position if you hold the position to maturity and the spot rate at maturity is 0.7500 USD per AUD. O -6,000 +3,000 +6,000 +10,000 lower the Official Cash Rate (Australia's fed funds rate of interest) target to reduce the probability of recession. Your view is that this expansionary monetary policy will lower the value of the AUD vs. the USD. You anticipate an exchange rate of 0.75 USD per AUD in less than 3 months. The current spot rate is 0.80 USD per AUD and the 3-month forward rate is 0.78 USD per AUD. You want to speculate on your view and look at the trading activity on futures on the Chicago Mercantile Exchange (CME) today and observe the following futures prices for the September AUD futures contract. Assume today is in June 2020 CME September 2020 FX Future on AUD Contract Size: 100.000 AUD Maturity Open High Low Last Change Open Interest Sept 2020 0.7910 0.7920 0.7890 0.7800 +0.0003 2,008 Note: futures prices are in USD per AUD Suppose you long or short (choose based on your reasoning in Question 27) two September 2020 futures contracts on the AUD at the Last price. In what currency is your payoff denominated? USD AUD Either USD or AUD OSOR