Question:

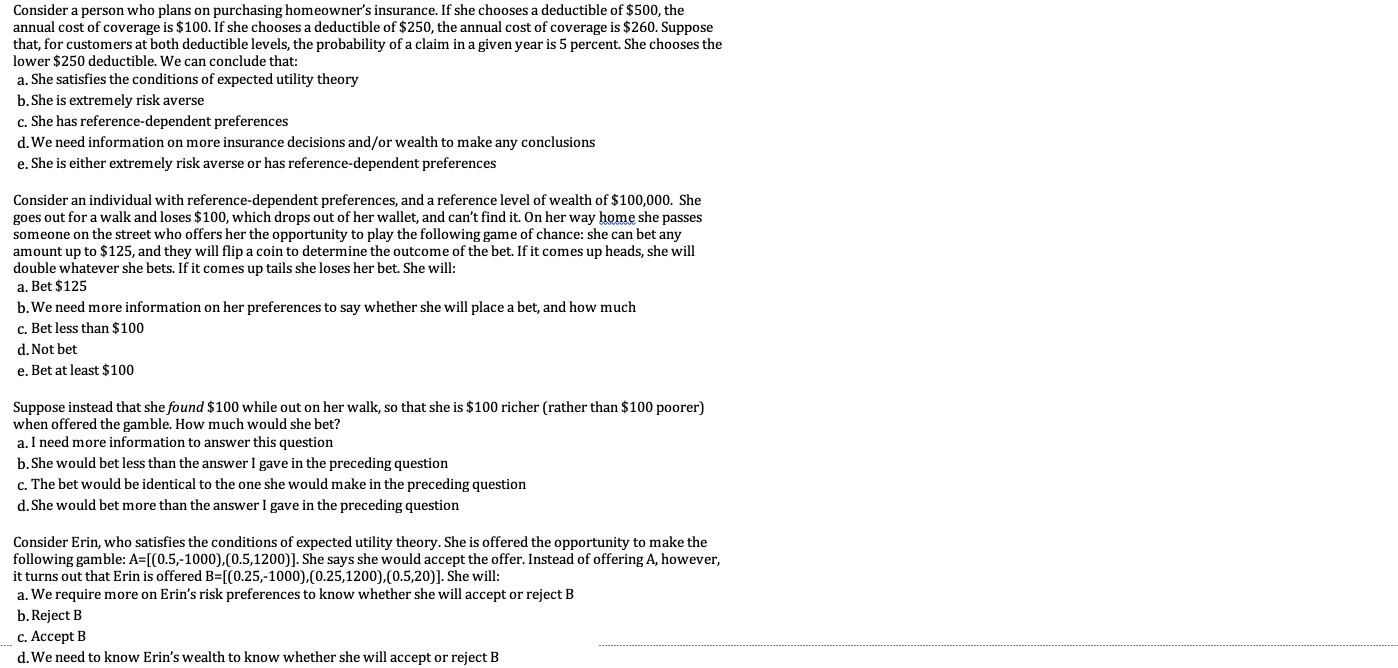

Consider a person who plans on purchasing homeowner's insurance. If she chooses a deductible of $500, the annual cost of coverage is $100. If she chooses a deductible of $250, the annual cost of coverage is $260. Suppose that, for customers at both deductible levels, the probability of a claim in a given year is 5 percent. She chooses the lower $250 deductible. We can conclude that: a. She satisfies the conditions of expected utility theory b. She is extremely risk averse c. She has reference-dependent preferences d. We need information on more insurance decisions and/or wealth to make any conclusions e. She is either extremely risk averse or has reference-dependent preferences Consider an individual with reference-dependent preferences, and a reference level of wealth of $100,000. She goes out for a walk and loses $100, which drops out of her wallet, and can't find it. On her way home she passes someone on the street who offers her the opportunity to play the following game of chance: she can bet any amount up to $125, and they will flip a coin to determine the outcome of the bet. If it comes up heads, she will double whatever she bets. If it comes up tails she loses her bet. She will: a. Bet $125 b. We need more information on her preferences to say whether she will place a bet, and how much c. Bet less than $100 d. Not bet e. Bet at least $100 Suppose instead that she found $100 while out on her walk, so that she is $100 richer (rather than $100 poorer) when offered the gamble. How much would she bet? a. I need more information to answer this question b. She would bet less than the answer I gave in the preceding question c. The bet would be identical to the one she would make in the preceding question d. She would bet more than the answer I gave in the preceding question Consider Erin, who satisfies the conditions of expected utility theory. She is offered the opportunity to make the following gamble: A=[(0.5,-1000),(0.5,1200)]. She says she would accept the offer. Instead of offering A, however, it turns out that Erin is offered B=[(0.25,-1000),(0.25,1200),(0.5,20)]. She will: a. We require more on Erin's risk preferences to know whether she will accept or reject B b. Reject B C. Accept B d. We need to know Erin's wealth to know whether she will accept or reject B