Answered step by step

Verified Expert Solution

Question

1 Approved Answer

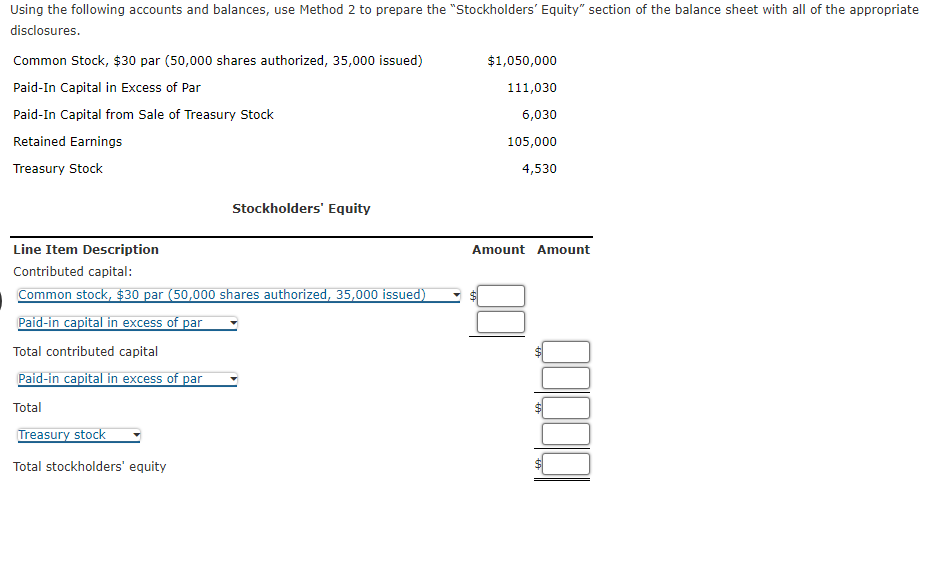

Question Content AreaUsing the following accounts and balances, use Method 2 to prepare the Stockholders' Equity section of the balance sheet with all of the

Question Content AreaUsing the following accounts and balances, use Method to prepare the "Stockholders' Equity" section of the balance sheet with all of the appropriate

disclosures.

Stockholders' Equity

Using the following accounts and balances, use Method to prepare the Stockholders Equity section of the balance sheet with all of the appropriate disclosures.

Line Item Description Amount

Common Stock, $ par shares authorized, issued $

PaidIn Capital in Excess of Par

PaidIn Capital from Sale of Treasury Stock

Retained Earnings

Treasury Stock

blank

Stockholders' Equity

blank

Line Item Description Amount Amount

Contributed capital:

Common stock, $ par shares authorized, issued

$Common stock, $ par shares authorized, issued

Select

Total contributed capital $Total contributed capital

Select

Total $Total

Select

Total stockholders' equity $Total stockholders' equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started