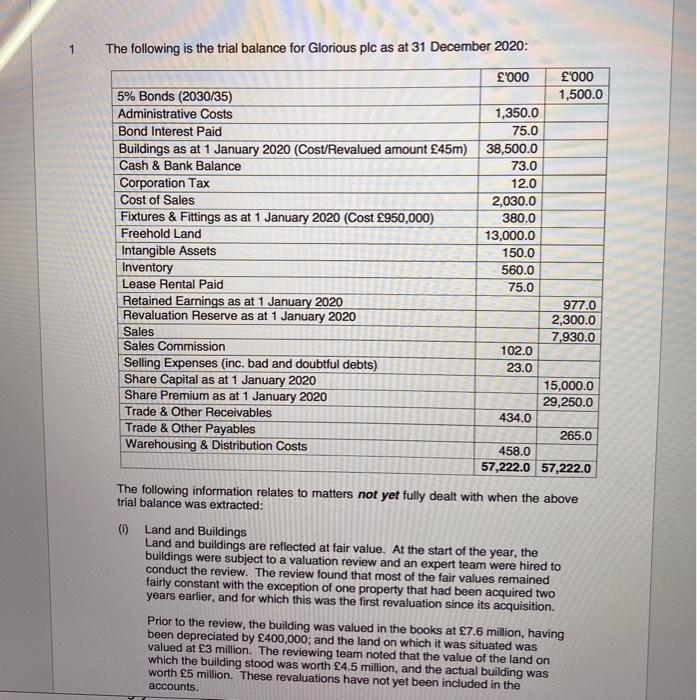

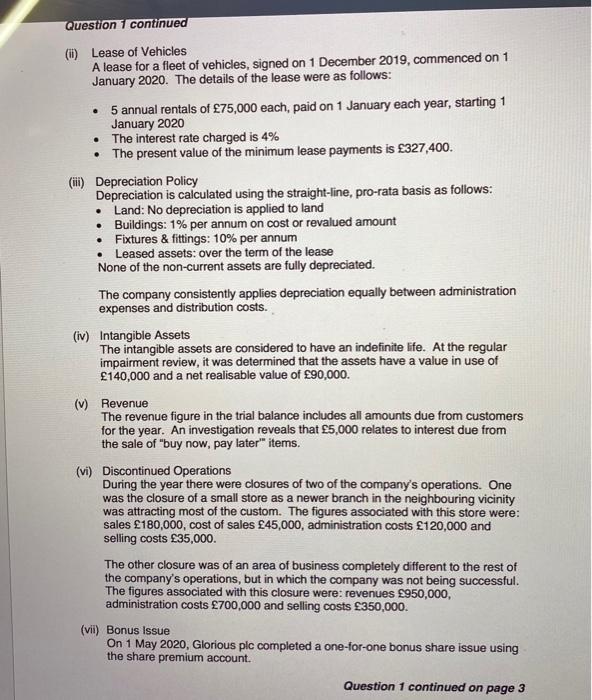

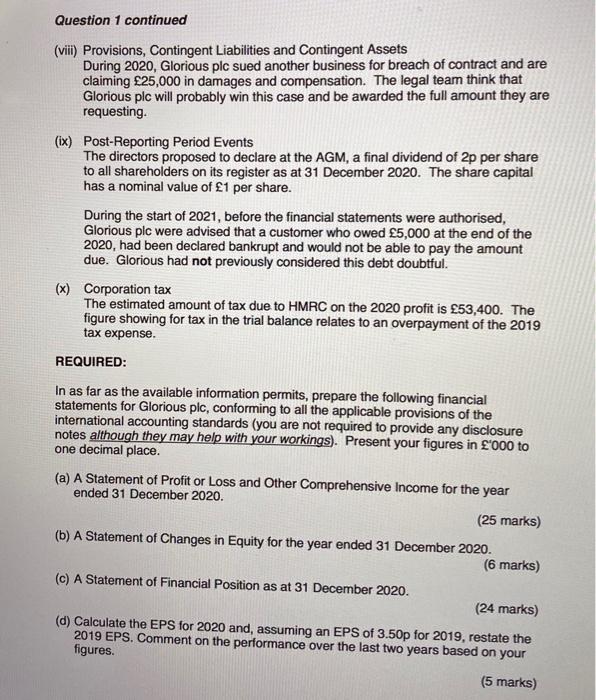

Question continued . (1) Lease of Vehicles A lease for a fleet of vehicles, signed on 1 December 2019, commenced on 1 January 2020. The details of the lease were as follows: 5 annual rentals of 75,000 each, paid on 1 January each year, starting 1 January 2020 The interest rate charged is 4% The present value of the minimum lease payments is 327,400. (ii) Depreciation Policy Depreciation is calculated using the straight-line, pro-rata basis as follows: Land: No depreciation is applied to land Buildings: 1% per annum on cost or revalued amount Fixtures & fittings: 10% per annum Leased assets: over the term of the lease None of the non-current assets are fully depreciated. The company consistently applies depreciation equally between administration expenses and distribution costs. (iv) Intangible Assets The intangible assets are considered to have an indefinite life. At the regular impairment review, it was determined that the assets have a value in use of 140,000 and a net realisable value of 90,000. (v) Revenue The revenue figure in the trial balance includes all amounts due from customers for the year. An investigation reveals that 5,000 relates to interest due from the sale of "buy now, pay later" items. (vi) Discontinued Operations During the year there were closures of two of the company's operations. One was the closure of a small store as a newer branch in the neighbouring vicinity was attracting most of the custom. The figures associated with this store were: sales 180,000, cost of sales 45,000, administration costs 120,000 and selling costs 35,000 The other closure was of an area of business completely different to the rest of the company's operations, but in which the company was not being successful. The figures associated with this closure were: revenues 950,000, administration costs 700,000 and selling costs 350,000. (vii) Bonus Issue On 1 May 2020, Glorious plc completed a one-for-one bonus share issue using the share premium account. Question 1 continued on page 3 Question 1 continued (viii) Provisions, Contingent Liabilities and Contingent Assets During 2020, Glorious plc sued another business for breach of contract and are claiming 25,000 in damages and compensation. The legal team think that Glorious plc will probably win this case and be awarded the full amount they are requesting. (ix) Post-Reporting Period Events The directors proposed to declare at the AGM, a final dividend of 2p per share to all shareholders on its register as at 31 December 2020. The share capital has a nominal value of 1 per share. During the start of 2021, before the financial statements were authorised, Glorious plc were advised that a customer who owed 5,000 at the end of the 2020, had been declared bankrupt and would not be able to pay the amount due. Glorious had not previously considered this debt doubtful. (x) Corporation tax The estimated amount of tax due to HMRC on the 2020 profit is 53,400. The figure showing for tax in the trial balance relates to an overpayment of the 2019 tax expense. REQUIRED: In as far as the available information permits, prepare the following financial statements for Glorious plc, conforming to all the applicable provisions of the international accounting standards (you are not required to provide any disclosure notes although they may help with your workings). Present your figures in '000 to one decimal place. (a) A Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2020. (25 marks) (b) A Statement of Changes in Equity for the year ended 31 December 2020. (6 marks) (c) A Statement of Financial Position as at 31 December 2020. (24 marks) (d) Calculate the EPS for 2020 and, assuming an EPS of 3.50p for 2019, restate the 2019 EPS. Comment on the performance over the last two years based on your figures. (5 marks) Question continued . (1) Lease of Vehicles A lease for a fleet of vehicles, signed on 1 December 2019, commenced on 1 January 2020. The details of the lease were as follows: 5 annual rentals of 75,000 each, paid on 1 January each year, starting 1 January 2020 The interest rate charged is 4% The present value of the minimum lease payments is 327,400. (ii) Depreciation Policy Depreciation is calculated using the straight-line, pro-rata basis as follows: Land: No depreciation is applied to land Buildings: 1% per annum on cost or revalued amount Fixtures & fittings: 10% per annum Leased assets: over the term of the lease None of the non-current assets are fully depreciated. The company consistently applies depreciation equally between administration expenses and distribution costs. (iv) Intangible Assets The intangible assets are considered to have an indefinite life. At the regular impairment review, it was determined that the assets have a value in use of 140,000 and a net realisable value of 90,000. (v) Revenue The revenue figure in the trial balance includes all amounts due from customers for the year. An investigation reveals that 5,000 relates to interest due from the sale of "buy now, pay later" items. (vi) Discontinued Operations During the year there were closures of two of the company's operations. One was the closure of a small store as a newer branch in the neighbouring vicinity was attracting most of the custom. The figures associated with this store were: sales 180,000, cost of sales 45,000, administration costs 120,000 and selling costs 35,000 The other closure was of an area of business completely different to the rest of the company's operations, but in which the company was not being successful. The figures associated with this closure were: revenues 950,000, administration costs 700,000 and selling costs 350,000. (vii) Bonus Issue On 1 May 2020, Glorious plc completed a one-for-one bonus share issue using the share premium account. Question 1 continued on page 3 Question 1 continued (viii) Provisions, Contingent Liabilities and Contingent Assets During 2020, Glorious plc sued another business for breach of contract and are claiming 25,000 in damages and compensation. The legal team think that Glorious plc will probably win this case and be awarded the full amount they are requesting. (ix) Post-Reporting Period Events The directors proposed to declare at the AGM, a final dividend of 2p per share to all shareholders on its register as at 31 December 2020. The share capital has a nominal value of 1 per share. During the start of 2021, before the financial statements were authorised, Glorious plc were advised that a customer who owed 5,000 at the end of the 2020, had been declared bankrupt and would not be able to pay the amount due. Glorious had not previously considered this debt doubtful. (x) Corporation tax The estimated amount of tax due to HMRC on the 2020 profit is 53,400. The figure showing for tax in the trial balance relates to an overpayment of the 2019 tax expense. REQUIRED: In as far as the available information permits, prepare the following financial statements for Glorious plc, conforming to all the applicable provisions of the international accounting standards (you are not required to provide any disclosure notes although they may help with your workings). Present your figures in '000 to one decimal place. (a) A Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2020. (25 marks) (b) A Statement of Changes in Equity for the year ended 31 December 2020. (6 marks) (c) A Statement of Financial Position as at 31 December 2020. (24 marks) (d) Calculate the EPS for 2020 and, assuming an EPS of 3.50p for 2019, restate the 2019 EPS. Comment on the performance over the last two years based on your figures