Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION ( continued ) From 3 0 June 2 0 1 7 , Snap Ltd purchased inventory from Crackle Ltd at a mark - up

QUESTION continued

From June Snap Ltd purchased inventory from Crackle Ltd at a markup of on

cost price. You may assume that inventories on hand at yearend in the accounting records

of Snap Ltd are sold in the first month of the following year.

The following relates to the above mentioned:

Sales from Crackle Ltd to Snap Ltd

Inventory of Snap Ltd on hand.

On December Snap Ltd acquired an additional ordinary shares in Crackle Ltd

from other shareholders at a cost price of R The income and expenses of Crackle Ltd

were earned evenly throughout the current year.

On January Snap Ltd acquired of the issued ordinary shares of Pop Ltd and paid

a cash amount of R for the shares. At the date of acquisition the retained earnings of

Pop Ltd amounted to R After considering all the requirements of IFRS Joint

Arrangements, the joint arrangement was classified as a joint venture.

From January Pop Ltd purchased inventory from Snap Ltd at a markup of on

cost price. You may assume that the inventories on hand at yearend in the accounting records

of Pop Ltd are sold in the first month of the following year.

The following relates to the above mentioned:

Sales from Snap Ltd to Pop Ltd

Inventory of Pop Ltd on hand

Snap Ltd measures its investments in equity instruments at cost price in its separate

accounting records in accordance with IAS Separate financial statements.

The Snap Ltd Group measures noncontrolling interests at fair value at acquisition date. The

fair value of noncontrolling interests at acquisition date in Crackle Ltd amounted to R

The SA normal tax rate is and capital gains tax is calculated at thereof. You may

assume that the tax rates have remained unchanged since January

Each share carries one vote and the issued share capital of all entities in the group has

remained unchanged since January

All the companies in the Snap Ltd Group have a February yearend.

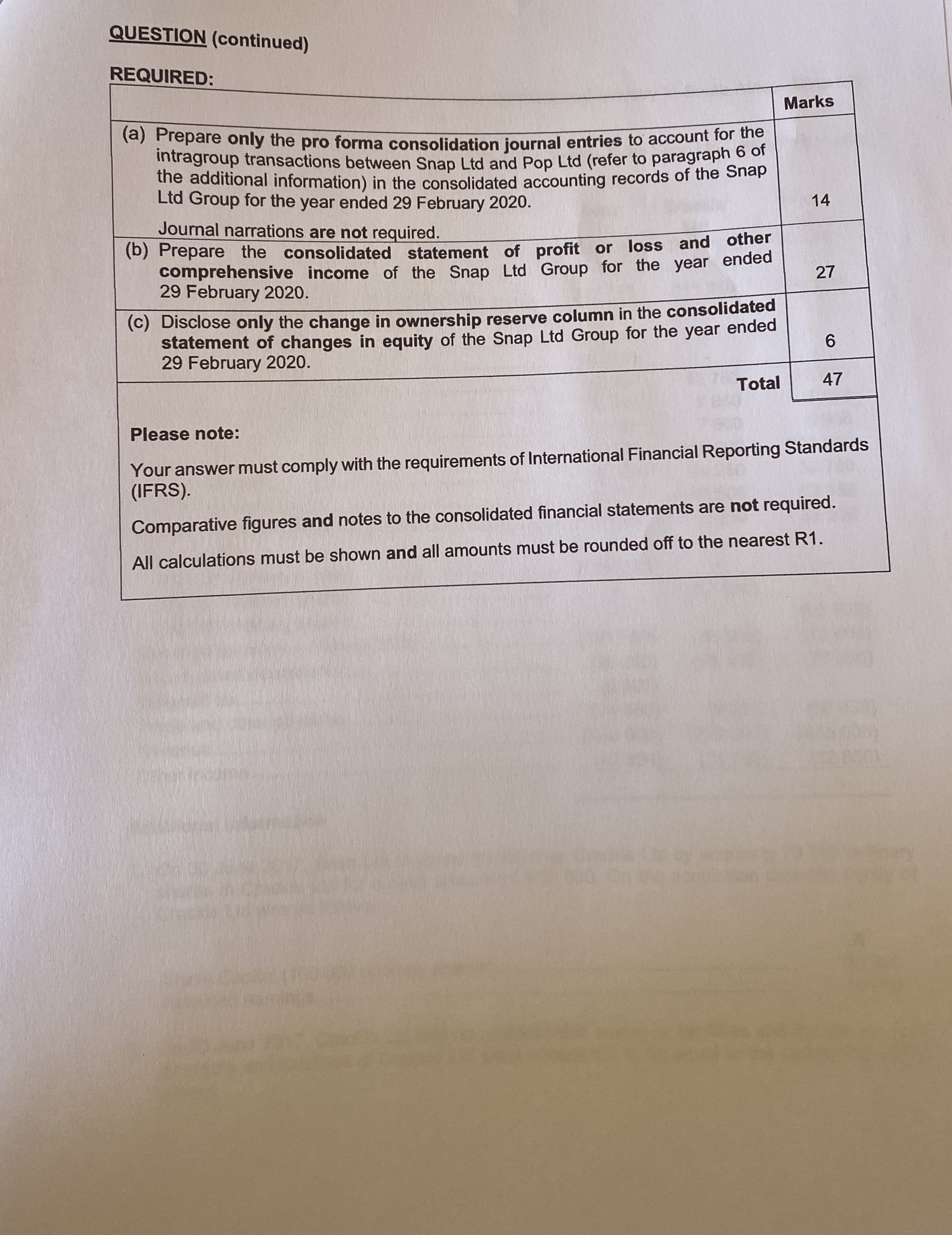

QUESTION continued

REQUIRED:

Please note:

Your answer must comply with the requirements of International Financial Reporting Standards

IFRS

Comparative figures and notes to the consolidated financial statements are not required.

All calculations must be shown and all amounts must be rounded off to the nearest R

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started