Answered step by step

Verified Expert Solution

Question

1 Approved Answer

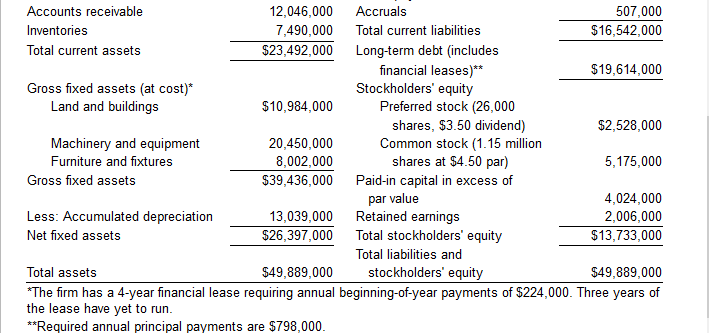

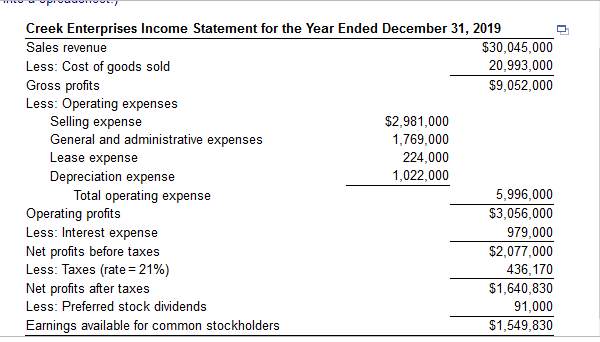

. . Question: Creek Enterprises's fixed-payment coverage ratio (Round to two decimal places.) 507,000 Accounts receivable 12,046,000 Accruals 7,490,000 Inventories Total current liabilities $16,542,000 Total

.

.

Question: Creek Enterprises's fixed-payment coverage ratio (Round to two decimal places.)

507,000 Accounts receivable 12,046,000 Accruals 7,490,000 Inventories Total current liabilities $16,542,000 Total current assets $23.492,000 Long-term debt (includes financial leases)** Stockholders' equity Preferred stock (26,000 $19,614,000 Gross fixed assets (at cost)* Land and buildings $10,984,000 shares, $3.50 dividend) Common stock (1.15 million shares at $4.50 par) $2,528,000 Machinery and equipment Furniture and fixtures 20,450,000 8,002,000 5,175,000 Gross fixed assets Paid-in capital in excess of $39,436,000 par value Retained earnings Total stockholders' equity 4,024,000 Less: Accumulated depreciation 2,006,000 13,039,000 Net fixed assets $26,397,000 $13,733,000 Total liabilities and stockholders' equity $49,889,000 Total assets $49,889,000 The firm has a 4-year financial lease requiring annual beginning-of-year payments of $224,000. Three years of the lease have yet to run **Required annual principal payments are $798,000 Creek Enterprises Income Statement for the Year Ended December 31, 2019 $30,045,000 Sales revenue 20,993,000 Less: Cost of goods sold Gross profits Less: Operating expenses Selling expense General and administrative expenses $9,052,000 $2,981,000 1,769,000 Lease expense Depreciation expense Total operating expense 224,000 1,022,000 5,996,000 Operating profits $3,056,000 Less: Interest expense 979,000 Net profits before taxes Less: Taxes (rate 21%) $2,077,000 436,170 Net profits after taxes $1,640,830 Less: Preferred stock dividends 91,000 Earnings available for common stockholders $1,549,830Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started