Answered step by step

Verified Expert Solution

Question

1 Approved Answer

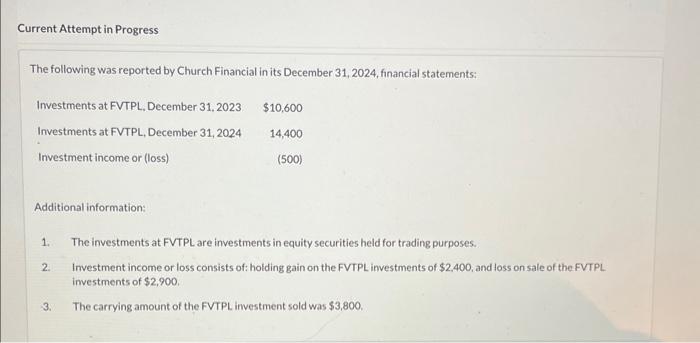

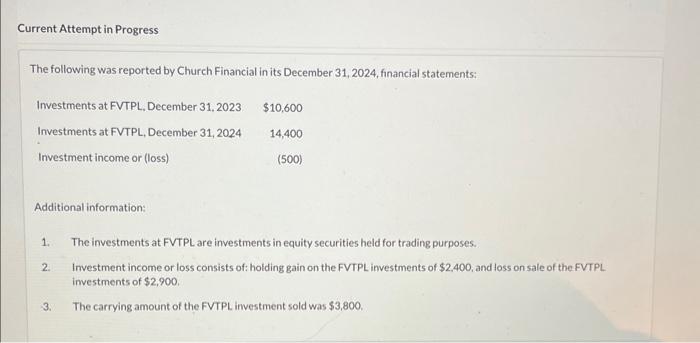

question d please Current Attempt in Progress The following was reported by Church Financial in its December 31,2024 , financial statements: Additional information: 1. The

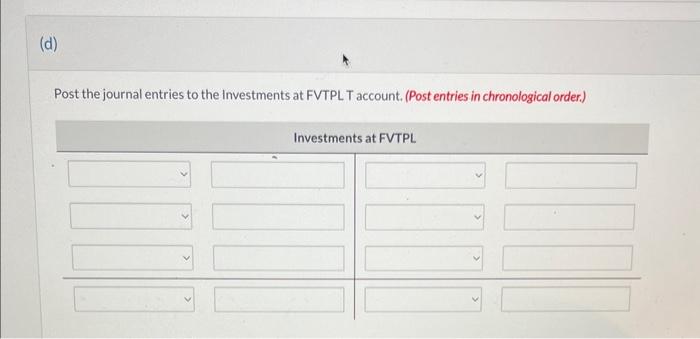

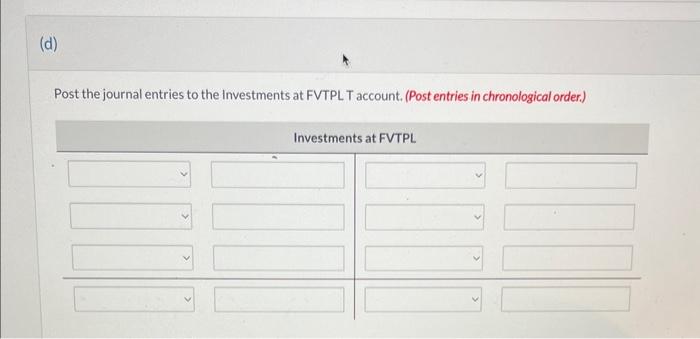

question d please

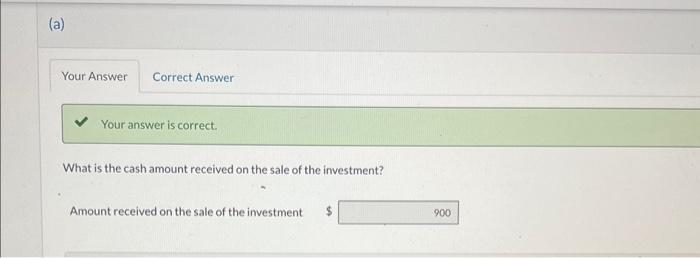

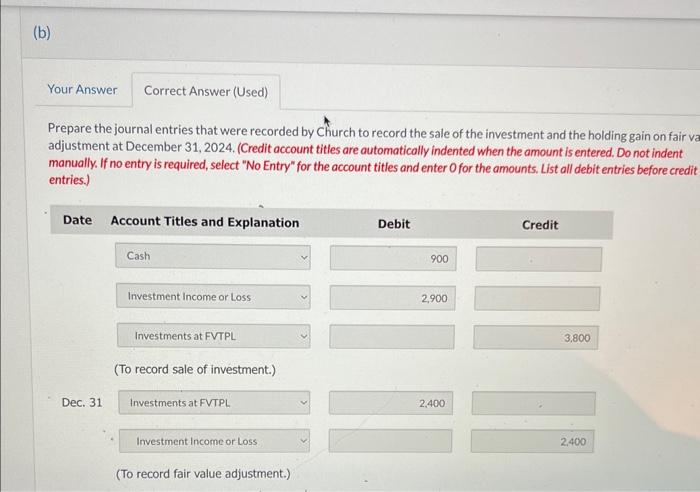

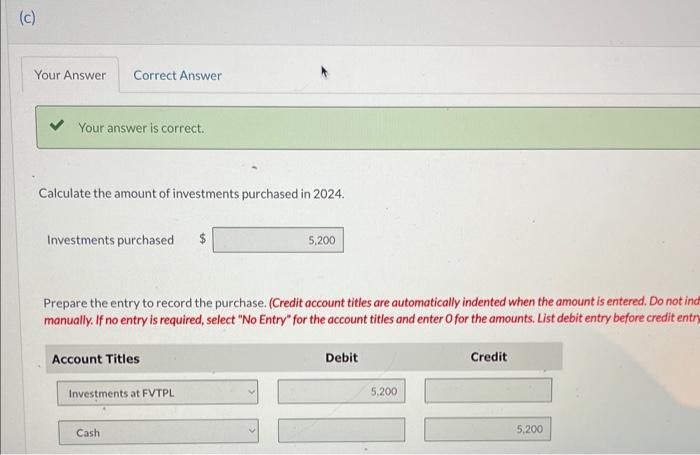

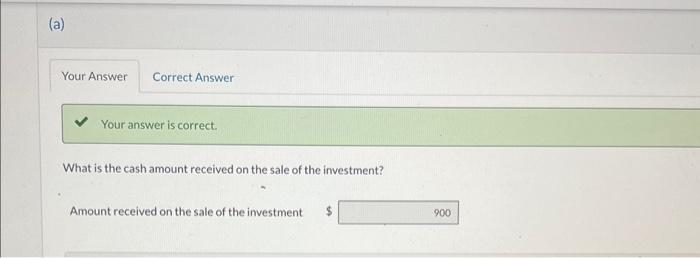

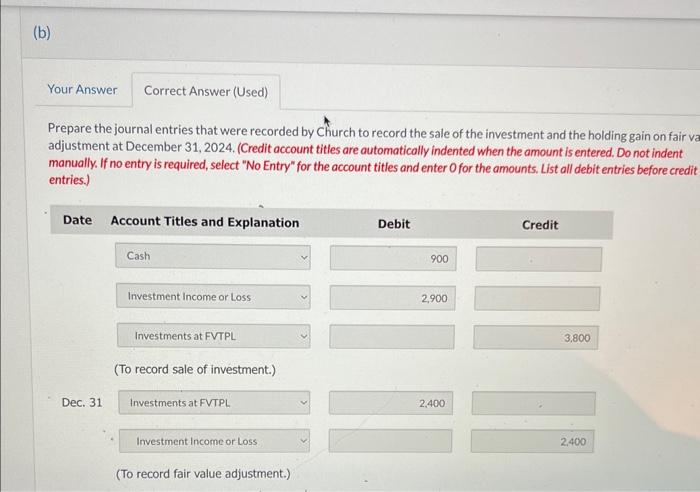

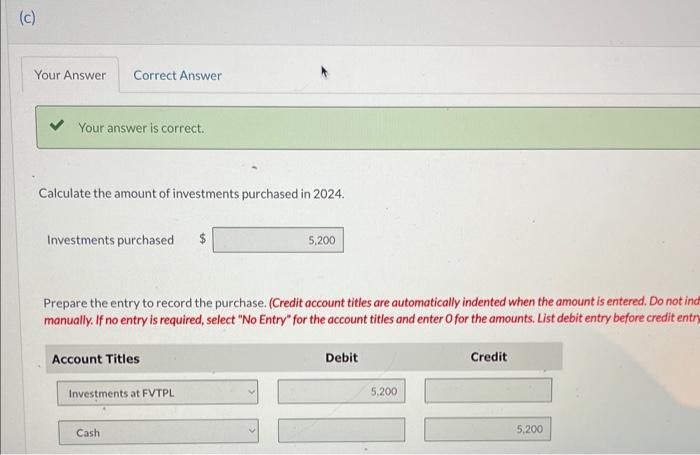

Current Attempt in Progress The following was reported by Church Financial in its December 31,2024 , financial statements: Additional information: 1. The investments at FVTPL are investments in equity securities held for trading purposes. 2. Investment income or loss consists of: holding gain on the FVTPL investments of $2,400, and foss on sale of the FVTPL investments of $2,900. 3. The carrying amount of the FVTPL investment sold was $3,800. Your answer is correct. What is the cash amount received on the sale of the investment? Amount received on the sale of the investment Prepare the journal entries that were recorded by Church to record the sale of the investment and the holding gain on fair va adjustment at December 31, 2024. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts, List all debit entries before credit entries.) Your answer is correct. Calculate the amount of investments purchased in 2024. Investments purchased Prepare the entry to record the purchase. (Credit account titles are automatically indented when the amount is entered. Do not ind manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entr) Post the journal entries to the investments at FVTPLT account. (Post entries in chronological order.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started