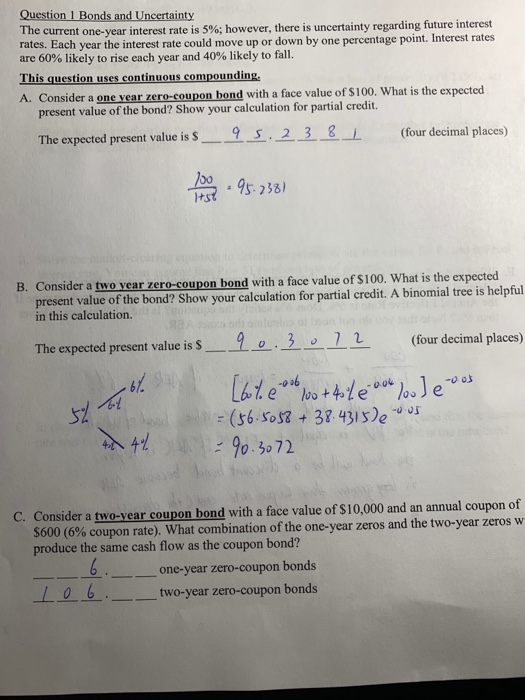

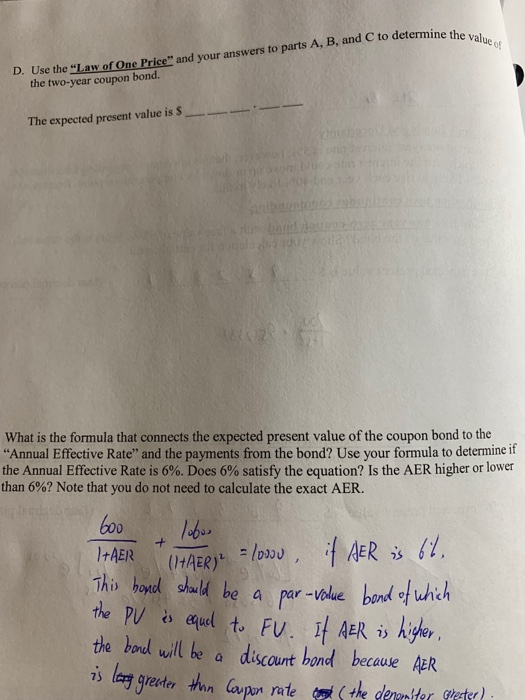

Question 1 Bonds and Uncertainty The current one-year interest rate is 5%; however, there is uncertainty regarding future interest rates. Each year the interest rate could move up or down by one percentage point. Interest rates are 60% likely to rise each year and 40% likely to fall. This question uses continuous compounding. A. Consider a one year zero-coupon bond with a face value of $100. What is the expected present value of the bond? Show your calculation for partial credit. The expected present value is $_9 5 . 2 3 8 pon -95.7381 B. Consider a two year zero-coupon bond with a face value of $100. What is the expected present value of the bond? Show your calculation for partial credit. A binomial tree is helpful in this calculation. 1 0 The expected present value is $ .3 0 / 2 (four decimal places) 6. I had 42 4% Totoob o +4 46 004 lou] e os = (36.5058 + 38.4315) e us -90.3072 C. Consider a two-year coupon bond with a face value of $10,000 and an annual coupon of $600 (6% coupon rate). What combination of the one-year zeros and the two-year zeros w produce the same cash flow as the coupon bond? one-year zero-coupon bonds Lob. two-year zero-coupon bonds bine the value to determine the D. Use the Law of One Price and your answers to parts A, B, and the two-year coupon bond. - The expected present value is What is the formula that connects the expected present value of the coupon bond to the "Annual Effective Rate" and the payments from the bond? Use your formula to determine if the Annual Effective Rate is 6%. Does 6% satisfy the equation? Is the AER higher or lower than 6%? Note that you do not need to calculate the exact AER. 600 lobor I+AER 0+AER) = loou, if AR is 67. This hand should be a par-volue bond of which the PV is equal to FU. It AE is higher, the band will be a discount bond because AER is leor greater than Caupon rate cool the dengaiter greater) Question 1 Bonds and Uncertainty The current one-year interest rate is 5%; however, there is uncertainty regarding future interest rates. Each year the interest rate could move up or down by one percentage point. Interest rates are 60% likely to rise each year and 40% likely to fall. This question uses continuous compounding. A. Consider a one year zero-coupon bond with a face value of $100. What is the expected present value of the bond? Show your calculation for partial credit. The expected present value is $_9 5 . 2 3 8 pon -95.7381 B. Consider a two year zero-coupon bond with a face value of $100. What is the expected present value of the bond? Show your calculation for partial credit. A binomial tree is helpful in this calculation. 1 0 The expected present value is $ .3 0 / 2 (four decimal places) 6. I had 42 4% Totoob o +4 46 004 lou] e os = (36.5058 + 38.4315) e us -90.3072 C. Consider a two-year coupon bond with a face value of $10,000 and an annual coupon of $600 (6% coupon rate). What combination of the one-year zeros and the two-year zeros w produce the same cash flow as the coupon bond? one-year zero-coupon bonds Lob. two-year zero-coupon bonds bine the value to determine the D. Use the Law of One Price and your answers to parts A, B, and the two-year coupon bond. - The expected present value is What is the formula that connects the expected present value of the coupon bond to the "Annual Effective Rate" and the payments from the bond? Use your formula to determine if the Annual Effective Rate is 6%. Does 6% satisfy the equation? Is the AER higher or lower than 6%? Note that you do not need to calculate the exact AER. 600 lobor I+AER 0+AER) = loou, if AR is 67. This hand should be a par-volue bond of which the PV is equal to FU. It AE is higher, the band will be a discount bond because AER is leor greater than Caupon rate cool the dengaiter greater)