Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question: Data to help answer the question: Exxon' and a marine equipment firm, 'Marine Conglomerated', have merged to form a new marine exploration and mineral

Question:

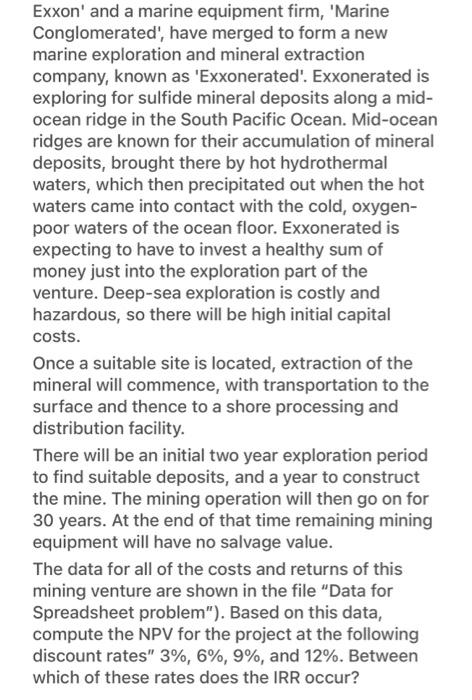

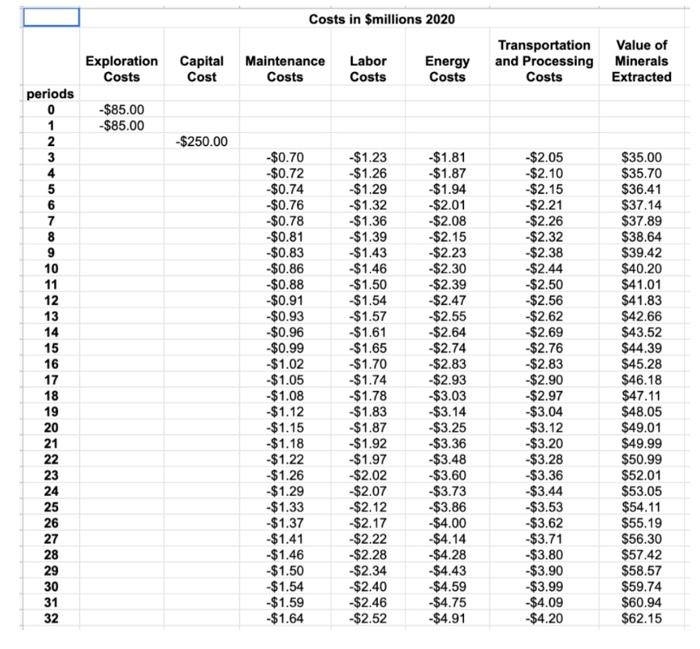

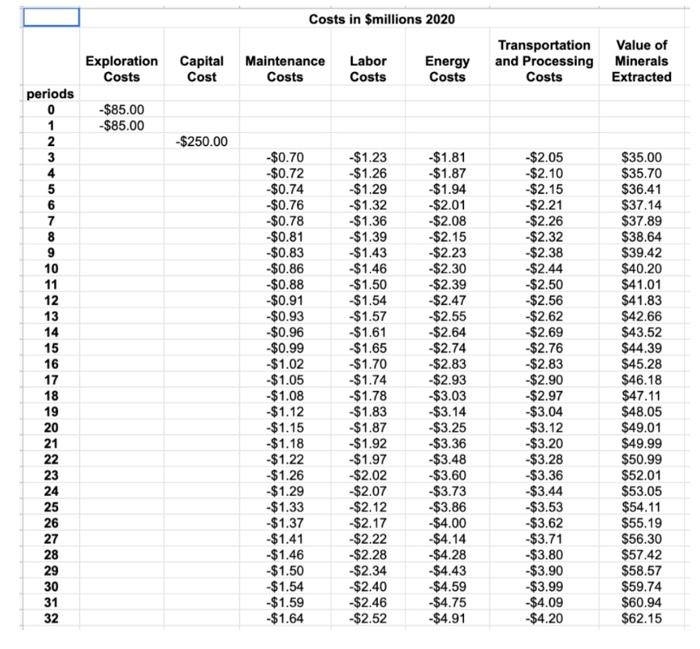

Exxon' and a marine equipment firm, 'Marine Conglomerated', have merged to form a new marine exploration and mineral extraction company, known as 'Exxonerated'. Exxonerated is exploring for sulfide mineral deposits along a mid- ocean ridge in the South Pacific Ocean. Mid-ocean ridges are known for their accumulation of mineral deposits, brought there by hot hydrothermal waters, which then precipitated out when the hot waters came into contact with the cold, oxygen- poor waters of the ocean floor. Exxonerated is expecting to have to invest a healthy sum of money just into the exploration part of the venture. Deep-sea exploration is costly and hazardous, so there will be high initial capital costs. Once a suitable site is located, extraction of the mineral will commence, with transportation to the surface and thence to a shore processing and distribution facility. There will be an initial two year exploration period to find suitable deposits, and a year to construct the mine. The mining operation will then go on for 30 years. At the end of that time remaining mining equipment will have no salvage value. The data for all of the costs and returns of this mining venture are shown in the file "Data for Spreadsheet problem"). Based on this data, compute the NPV for the project at the following discount rates" 3%, 6%, 9%, and 12%. Between which of these rates does the IRR occur? Costs in Smillions 2020 Exploration Capital Maintenance Costs Cost Costs Labor Costs Energy Costs Transportation Value of and Processing Minerals Costs Extracted -$85.00 -$85.00 -$250.00 periods 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 -$0.70 $0.72 $0.74 $0.76 -$0.78 -$0.81 $0.83 -$0.86 -$0.88 -$0.91 -$0.93 -$0.96 $0.99 $1.02 -$1.05 $1.08 -$1.12 $1.15 $1.18 $1.22 $1.26 $1.29 -$1.33 -$1.37 $1.41 -$1.46 -$1.50 $1.54 $1.59 $1.64 -$1.23 -$1.26 $1.29 -$1.32 $1.36 $1.39 $1.43 $1.46 -$1.50 -$1.54 -$1.57 $1.61 $1.65 $1.70 -$1.74 -$1.78 $1.83 $1.87 -$1.92 -$1.97 -$2.02 $2.07 -$2.12 -$2.17 -$2.22 -$2.28 -$2.34 $2.40 -$2.46 -$2.52 -$1.81 $1.87 $1.94 -$2.01 -$2.08 -$2.15 -$2.23 -$2.30 -$2.39 -$2.47 -$2.55 -$2.64 -$2.74 -$2.83 $2.93 -$3.03 -$3.14 -$3.25 -$3.36 -$3.48 -$3.60 -$3.73 -$3.86 -$4.00 $4.14 -$4.28 -$4.43 $4.59 -$4.75 -$4.91 -$2.05 -$2.10 -$2.15 -$2.21 -$2.26 -$2.32 -$2.38 $2.44 $2.50 -$2.56 -$2.62 -$2.69 -$2.76 -$2.83 -$2.90 -$2.97 $3.04 $3.12 -$3.20 $3.28 $3.36 -$3.44 $3.53 -$3.62 $3.71 -$3.80 $3.90 $3.99 -$4.09 $4.20 $35.00 $35.70 $36.41 $37.14 $37.89 $38.64 $39.42 $40.20 $41.01 $41.83 $42.66 $43.52 $44.39 $45.28 $46.18 $47.11 $48.05 $49.01 $49.99 $50.99 $52.01 $53.05 $54.11 $55.19 $56.30 $57.42 $58.57 $59.74 $60.94 $62.15

Data to help answer the question:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started