Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Description Fill out last slide below. ASSETS Current Assets Cash Petty cash Short-term investments Accounts receivable-net Inventory Supplies Prepaid insurance Other current assets Total

Question Description

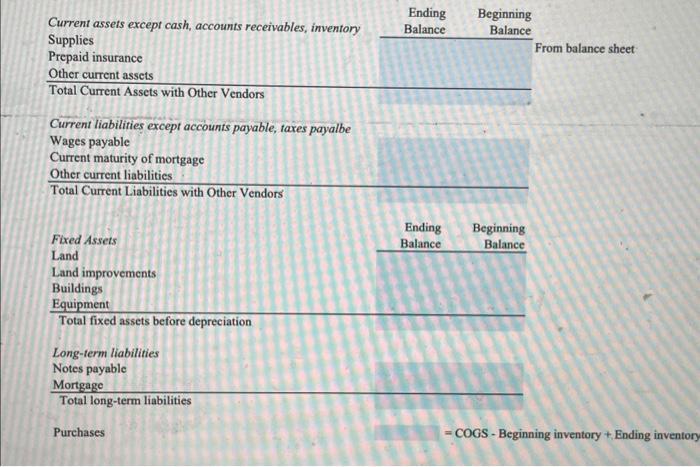

Fill out last slide below.

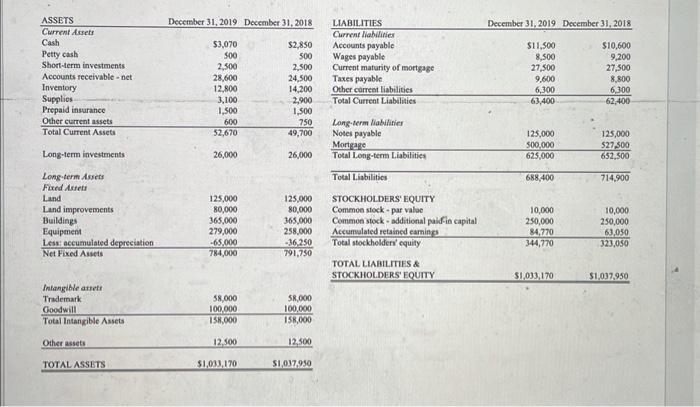

ASSETS Current Assets Cash Petty cash Short-term investments Accounts receivable-net Inventory Supplies Prepaid insurance Other current assets Total Current Assets Long-term investments Long-term Assets Fixed Assets Land Land improvements Buildings Equipment Less: accumulated depreciation Net Fixed Assets Intangible assets Trademark Goodwill Total Intangible Assets Other assets TOTAL ASSETS December 31, 2019 December 31, 2018 $2,850 $3,070 500 2,500 500 2,500 24,500 14,200 2,900 1,500 750 49,700 26,000 28,600 12,800 3,100 1,500 600 52,670 26,000 125,000 80,000 365,000 279,000 -65,000 784,000 58,000 100,000 158,000 12,500 $1,033,170 125,000 80,000 365,000 1,000 -36,250 791,750 58,000 100,000 158,000 12,500 $1,037,950 LIABILITIES Current liabilities Accounts payable Wages payable Current maturity of mortgage Taxes payable Other carrent liabilities Total Current Liabilities Long-term liabilities Notes payable Mortgage Total Long-term Liabilities Total Liabilities STOCKHOLDERS' EQUITY Common stock - par value Common stock additional paid in capital Accumulated retained earnings Total stockholders' equity TOTAL LIABILITIES & STOCKHOLDERS' EQUITY December 31, 2019 December 31, 2018 $11,500 8,500 27,500 9,600 6,300 63,400 125,000 500,000 625,000 688,400 10,000 250,000 84,770 344,770 $1,033,170 $10,600 9,200 27,500 8,800 6,300 62,400 125,000 527,500 652,500 714,900 10,000 250,000 63,050 323,050 $1,037,950

Step by Step Solution

★★★★★

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Answer Ending Balances Begi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started