question details

questions:

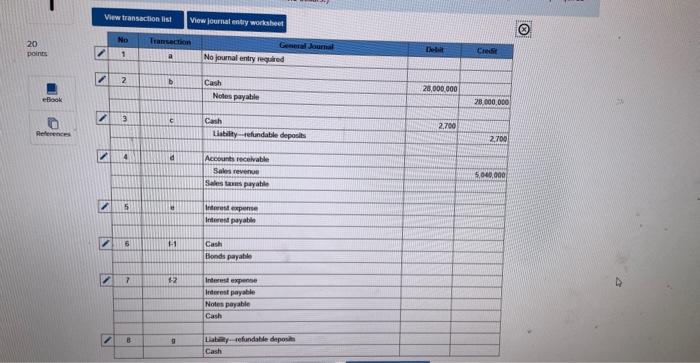

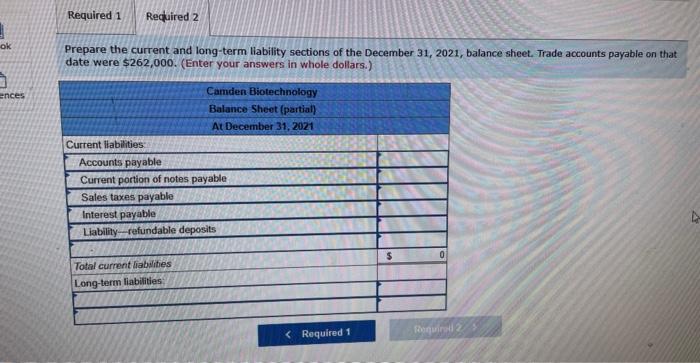

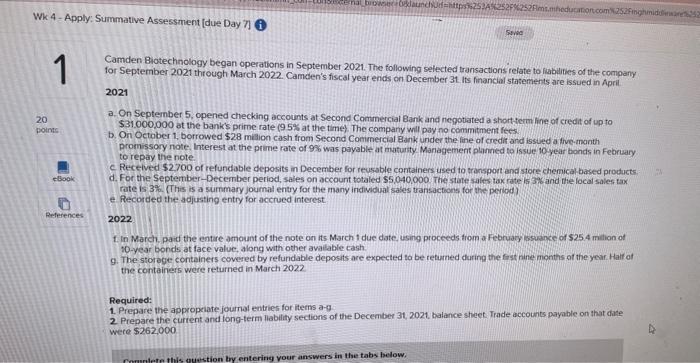

Camden Biotechnology began operations in September 2021 . The following sefected transactions relate to fiablibies of the company for September 2021 through March 2022 . Camden's fiscal year ends on December 31 its financial statements are issued in April. 2021 a. On September 5, opened checking accounts at Second Commercial Bank and nepotated a short tiem line of credit of up to $31000,000 at the bank's prime rate (95% at the time) The company will pay no commitment fees: b. On Oetober 1, borrowed $28 million cash from Second Comimercial Bank under the fine of credit and issted a the manth promissory note, Interest at the prime rate of 98 was payable at maturity Maragement planned to is isue to year bonds in Febinary to repay the note. c. Recelved $2700 of refundable deposits in December for reusable containers used to transpont and store chemical based products. d. For the September-December period, sales on account totaled 55,040,000. The state sales tax rate is 35 and the local sales tax rate is 3\%. (This is a summary joumal entry for the many individual sales transactions for the perica) e. Recorded the adjusting entry for accrued interest. 2022 1. In March. paid the entre amount of the note on its March 1 due date, using proceeds trom a Februacy 5 suance of $25.4 mition of 70-year bonds at face value, along with other avalable cash. 9. The storege cortainers covered by refundable deposits are expected to be refurned daring the fest nine months ot the year. Haif of the containers were returned in March 2022 Required: 1. Prepare the appropciate journat entries for items a-y 2. Prepare the current and long-term llability sections of the December 3t, 2021, balance shicet. Irade accounts payable on that date were $262,000 Prepare the current and long-term liability sections of the December 31,2021 , balance sheet. Trade aocounts payable on that date were $262,000. (Enter your answers in whole dollars.) Camden Biotechnology began operations in September 2021 . The following sefected transactions relate to fiablibies of the company for September 2021 through March 2022 . Camden's fiscal year ends on December 31 its financial statements are issued in April. 2021 a. On September 5, opened checking accounts at Second Commercial Bank and nepotated a short tiem line of credit of up to $31000,000 at the bank's prime rate (95% at the time) The company will pay no commitment fees: b. On Oetober 1, borrowed $28 million cash from Second Comimercial Bank under the fine of credit and issted a the manth promissory note, Interest at the prime rate of 98 was payable at maturity Maragement planned to is isue to year bonds in Febinary to repay the note. c. Recelved $2700 of refundable deposits in December for reusable containers used to transpont and store chemical based products. d. For the September-December period, sales on account totaled 55,040,000. The state sales tax rate is 35 and the local sales tax rate is 3\%. (This is a summary joumal entry for the many individual sales transactions for the perica) e. Recorded the adjusting entry for accrued interest. 2022 1. In March. paid the entre amount of the note on its March 1 due date, using proceeds trom a Februacy 5 suance of $25.4 mition of 70-year bonds at face value, along with other avalable cash. 9. The storege cortainers covered by refundable deposits are expected to be refurned daring the fest nine months ot the year. Haif of the containers were returned in March 2022 Required: 1. Prepare the appropciate journat entries for items a-y 2. Prepare the current and long-term llability sections of the December 3t, 2021, balance shicet. Irade accounts payable on that date were $262,000 Prepare the current and long-term liability sections of the December 31,2021 , balance sheet. Trade aocounts payable on that date were $262,000. (Enter your answers in whole dollars.)