Question

Question Details Transactions for December 20xx December 01 Borrowed $50,000.00 from North Bank by signing a 6%, 12 month note. Interest payments are due on

Question Details

Transactions for December 20xx December 01 Borrowed $50,000.00 from North Bank by signing a 6%, 12 month note. Interest payments are due on January 01 and July 01 throughout the life of the note. December 01 Issued Check No. 5855 for $3,840.00 to Rainey Dae Insurance Company for a one-year insurance policy on the building, effective January 01 next year. December 01 Issued Check No. 5857 for $1,600.00 to Sterling Supply Company in exchange for office supplies. December 01 Distributed the net salaries amount for the bi-weekly period ending 11/30/xx, which was accrued in November, to employees via direct deposits. ote: This entry should include a credit to the Cash account. December 02 Issued Check No. 5858 for $4,500.00 to Xtreme Sports Magazine to run a two page advertisement for six months, effective January 01 next year. December 02 Issued Check No. 5859 for $1,727.18 to Portland Lending Bank for monthly mortgage payment: Interest Payable for $ 643.85 and Mortgage Payable for $1,083.33. December 03 Sold two XTRM - X23F ATVs to a cash customer for $6,500.00 each. December 03 Billed customer A. Reece $565.24, for service work performed on his XTRM - X23F ATV. The costs of parts and accessories totaled $367.41 (Invoice No. SA20123). December 04 Received a check for $6,370.00 from customer C. Diaz as payment on her account, less discount (Invoice No. SI18453). 8 December 04 Purchased ATV parts and accessories from supplier Dust Quest ATV Supply Company on account for $1,365.25 (Invoice No. SP11653). Freight costs amounted to $24.50, with terms FOB destination. December 07 Issued Check No. 5860 for $1,765.26 to purchase office equipment from P.N. Sill Equipment Company. December 07 Issued Check No. 5861 for $27,300.00 to Winding Trail ATVs as payment on their account, less discount, on a November 27 purchase of merchandise inventory (Invoice No. IP5676). The terms of the purchase were 2/15, n/60. December 08 Sold on account three XTRM - X23F ATVs to customer S. Paulson for $6,500.00 each, terms 2/15, n/60 (Invoice No. S12861). The goods were shipped FOB destination point via carrier US Shipping Company. The transportation costs will be paid later upon receipt of the invoice. December 08 Exchanged an old truck and signed a $14,000.00 6%, 4 month note for a similar new truck. The old truck had an original cost of $32,000.00, accumulated depreciation of $11,000.00, and a fair value of $21,000.00. December 09 Issued Check No. 5862 for $475.29 to We Fix It Truck Repair Services for repair and maintenance work performed on trucks. December 09 Received a check for $6500.00, in exchange for the sale of one XTRM - X23F ATV. December 10 Owner A. Marks withdrew $4,000.00 cash for personal use (Check No. 5864). December 11 Purchased office furniture from Woodland Furniture, Inc., for $10,000.00 by signing a 6%, 5 month note. December 11 Sold on account one XTRM - X23F ATV to customer S. Thompson for $6,500.00, terms 2/10, n/30 (Invoice No. S12862). Freight costs amounted to $104.20, with terms FOB shipping point. 9 December 11 Issued Check No. 5865 for $201.23 to Portland Utilities Co. to pay the November 20xx utilities bill. December 11 Issued Check No. 5866 for $1,365.25 to Dust Quest ATV Supply Company for ATV parts and accessories purchased on December 04 (Invoice No. SP11653). December 14 Granted customer S. Paulson credit for one XTRM - X23F ATV returned from the December 08 transaction (Invoice No. S2861). December 14 The bi-weekly payroll for the period ending December 14 is as follows: Salaries: Store Salaries $2,000 Office Salaries 4,080 Total $6,080 Witholdings: FICA Taxes $547 Federal Income Tax Withholding 1,155 Total $1,702 Net Salaries $4,378 The payroll distribution of the net salaries amount is made to employees via direct deposits. ote: The entry for the payment made to employees should include a credit to the Cash account. December 14 The following represents the employers payroll taxes: Payroll Taxes FICA Taxes $547 Federal Unemployment Tax 36 State Unemployment Tax 243 Total $826 Payment of Payroll Taxes will be made to the appropriate government authorities next month. 10 December 15 Issued Check No. 5867 to the appropriate government authorities to pay for the prior months FICA Taxes $1,094.00, Federal Income Tax Withholding $2,310.00, Federal Unemployment Tax $72.00, and State Unemployment Tax $486.00. December 15 Received a check for $754.54 from customer L. Walker as payment on his account (Invoice No. SA20122). December 16 Purchased merchandise from supplier Quest ATVs on account for $16,900.00, terms 2/15, n/60 (Invoice No. IP12003). December 16 Received a check for $13,000.00 from customer H. Lincoln as payment on her account (Invoice No. SI18452). December 16 Issued Check No. 5868 for $12,223.12 to Dirty Trail ATVs as payment on their account, less discount, on a November 30 purchase of merchandise inventory (Invoice No. IP2576). The terms of the purchase were 1/20, n/45. December 17 Issued Check No. 5869 for $181.23 to US Shipping Company for payment of shipping costs incurred on the December 08 sale to customer S. Paulson. December 18 Returned and was granted credit for two XTRM - X23F ATVs purchased on December 16 from supplier Quest ATVs. The total costs of the merchandise returned amounted to $8,450.00. December 21 Purchased ATV parts and accessories from supplier ATV Supply Company on account for $2,500.23 (Invoice No. SP11983). December 21 Received a check from S. Paulson as payment for the balance due from his purchase on December 08, less discount (Invoice No. S2861). December 21 Received a check from S. Thompson as payment for the net balance due from his purchase on December 11, (Invoice No. S2862). 11 December 22 Issued check No. 5870 for $279.42 to US Shipping Company for payment of shipping costs incurred on merchandise purchased. December 23 Issued Check No. 5871 for $1,125.45 to ATV Supply Company as payment for ATV parts and accessories purchased on account on November 23 (Invoice No. SP32653). December 23 Issued Check No. 5872 for $4,671.99 to purchase a photocopy machine from OfficeThings.com, an eBusiness. December 28 Received a check for $873.25, for service work performed on a customers XTRM - X23F ATV. The costs of parts and accessories totaled $567.61 (Invoice No. SA20123). December 28 Sold on account two XTRM - X23F ATVs to customer P. Simon for $6,500.00 each, terms 2/10, n/30 (Invoice No. S12863). December 28 The bi-weekly payroll for the period ending December 28 is as follows: Salaries: Store Salaries $2,000 Office Salaries 4,080 Total $6,080 Witholdings: FICA Taxes $547 Federal Income Tax Withholding 1,155 Total $1,702 Net Salaries $4,378 The payroll distribution of the net salaries amount is made to employees via direct deposits. ote: The entry for the payment made to employees should include a credit to the Cash account. 12 December 28 The following represents the employers payroll taxes: Payroll Taxes FICA Taxes $547 Federal Unemployment Tax 36 State Unemployment Tax 243 Total $826 Payment of Payroll taxes will be made to the appropriate government authorities next month. December 29 Issued Check No. 5873 for $650.00 to purchase additional office supplies from Sterling Supply Company. December 30 Received a check from customer A. Reece for service work performed on his XTRM - X23F ATVs on December 03 (Invoice No. SA20123). December 31 Received $19,500.00 from R. Morizio, a long standing customer, as an advance payment for two XTRM - X23F ATVs to be held for him until January 15 next year, when he returns from his European vacation. December 31 The Company hired Ms. Johanna Lopez as a Sales Clerk. It was agreed that she will be paid $600 per week, and her starting date would be on Monday, January 04 next year.

Answer Details

1-Dec | Cash |

| 50000 |

|

|

| Notes Payable |

|

|

| 50000 |

|

|

|

|

|

|

1-Dec | Prepaid Insurance |

| 3840 |

|

|

| Bank |

|

|

| 3840 |

|

|

|

|

|

|

1-Dec | Supplies |

| 1600 |

|

|

| Bank |

|

|

| 1600 |

| ... | ||||

1-Dec | Cash |

| 50000 |

|

|

| Notes Payable |

|

|

| 50000 |

|

|

|

|

|

|

1-Dec | Prepaid Insurance |

| 3840 |

|

|

| Bank |

|

|

| 3840 |

|

|

|

|

|

|

1-Dec | Supplies |

| 1600 |

|

|

| Bank |

|

|

| 1600 |

|

|

|

|

|

|

1-Dec | Salaries Payable |

|

|

|

|

| Cash |

|

|

|

|

|

|

|

|

|

|

2-Dec | Prepaid Advertising |

| 4500 |

|

|

| Cash |

|

|

| 4500 |

|

|

|

|

|

|

2-Dec | Interest Payable |

| 643.85 |

|

|

| Mortgage Note Payable |

| 1727.18 |

|

|

| Cash |

|

|

| 1727.18 |

|

|

|

|

|

|

3-Dec | Cash |

| 13000 |

|

|

| Sales Revenue |

|

|

| 13000 |

|

|

|

|

|

|

3-Dec | Accounts Receivable |

| 565.24 |

|

|

| Sales and Service Revenue |

|

|

| 565.24 |

|

|

|

|

|

|

3-Dec | Cost of Spare parts |

| 367.24 |

|

|

| Inventory of spare parts |

|

|

| 367.24 |

|

|

|

|

|

|

4-Dec | Cash |

| 6370 |

|

|

| Accounts Receivable |

|

|

| 6370 |

|

|

|

|

|

|

4-Dec | TV Parts and Accessories Inventory |

| 1365.25 |

|

|

| Accounts Payable |

|

|

| 1365.25 |

|

|

|

|

|

|

7-Dec | Office Equipment |

| 1765.26 |

|

|

| Bank |

|

|

| 1765.26 |

|

|

|

|

|

|

7-Dec | Accounts Payable |

| 27857.14 |

|

|

| Cash |

|

|

| 27300 |

| Discount Received |

|

|

| 557.14 |

|

|

|

|

|

|

8-Dec | Accounts Receivable |

| 19500 |

|

|

| Sales and Service Revenue |

|

|

| 19500 |

|

|

|

|

|

|

8-Dec | New Truck |

| 35000 |

|

|

| Accumulated Depreciation |

| 11000 |

|

|

| Old Truck |

|

|

| 32000 |

| Notes Payable |

|

|

| 14000 |

|

|

|

|

|

|

9-Dec | Repair Services |

| 475.29 |

|

|

| Bank |

|

|

| 475.29 |

|

|

|

|

|

|

9-Dec | Bank |

| 6500 |

|

|

| Services Revenue |

|

|

| 6500 |

|

|

|

|

|

|

10-Dec | Drawings |

| 4000 |

|

|

| Cash |

|

|

| 4000 |

|

|

|

|

|

|

11-Dec | Office Furniture |

| 10000 |

|

|

| Notes Payable |

|

|

| 10000 |

|

|

|

|

|

|

11-Dec | Accounts Receivable |

| 6500 |

|

|

| Sales and Service Revenue |

|

|

| 6500 |

|

|

|

|

|

|

11-Dec | Accounts Payable |

| 201.23 |

|

|

| Cash |

|

|

| 201.23 |

|

|

|

|

|

|

11-Dec | Accounts Payable |

| 1365.25 |

|

|

| Cash |

|

|

| 1365.25 |

|

|

|

|

|

|

14-Dec | Sales Returns |

| 6500 |

|

|

| Accounts Receivable |

|

|

| 6500 |

|

|

|

|

|

|

14-Dec | Salaries Expense |

| 6080 |

|

|

| Salaries Payable |

|

|

| 4378 |

| Taxes Payable |

|

|

| 1702 |

|

|

|

|

|

|

| Salaries Payable |

| 4378 |

|

|

| Cash |

|

|

| 4378 |

|

|

|

|

|

|

14-Dec | Tax Expense |

| 826 |

|

|

| FICA Taxes |

|

|

| 547 |

| Federal Unemployment Tax |

|

|

| 36 |

| State Unemployment Tax |

|

|

| 243 |

|

|

|

|

|

|

15-Dec | Taxes Payable |

| 3962 |

|

|

| Cash |

|

|

| 3962 |

|

|

|

|

|

|

16-Dec | Merchandise Inventory |

| 16900 |

|

|

| Accounts Payable |

|

|

|

|

|

|

|

|

|

|

16-Dec | Cash |

| 13000 |

|

|

| Accounts Receivable |

|

|

| 13000 |

|

|

|

|

|

|

17-Dec | Accounts Payable |

| 12346.58 |

|

|

| Cash |

|

|

| 12223.12 |

| Discount Received |

|

|

| 123.46 |

|

|

|

|

|

|

17-Dec | Transportation Costs |

| 181.23 |

|

|

| Bank |

|

|

| 181.23 |

|

|

|

|

|

|

18-Dec | Accounts Payable |

| 8450 |

|

|

| Merchandise Inventory |

|

|

| 8450 |

|

|

|

|

|

|

21-Dec | Merchandise Inventory |

| 2500.23 |

|

|

| Accounts Payable |

|

|

| 2500.23 |

|

|

|

|

|

|

21-Dec | Cash |

| 6370 |

|

|

| Discount Expense |

| 130 |

|

|

| Accounts Receivable |

|

|

| 6500 |

|

|

|

|

|

|

22-Dec | Shipping Expenses |

| 279.42 |

|

|

| Shipping Expenses |

|

|

| 279.42 |

|

|

|

|

|

|

23-Dec | Accounts Payable |

| 125.45 |

|

|

| Cash |

|

|

| 125.45 |

|

|

|

|

|

|

23-Dec | Office Equipment |

| 4671.99 |

|

|

| Bank |

|

|

| 4671.99 |

|

|

|

|

|

|

28-Dec | Bank |

| 873.25 |

|

|

| Sales and Service Revenue |

|

|

| 873.25 |

|

|

|

|

|

|

28-Dec | Cost of Sales and Service Revenue |

| 561.61 |

|

|

| Parts and Accessories Inventories |

|

|

| 561.61 |

|

|

|

|

|

|

28-Dec | Accounts Receivable |

| 6500 |

|

|

| Sales Revenue |

|

|

| 6500 |

|

|

|

|

|

|

28-Dec | Salaries Expense |

| 6080 |

|

|

| Salaries Payable |

|

|

| 4378 |

| Taxes Payable |

|

|

| 1702 |

|

|

|

|

|

|

28-Dec | Tax Expense |

| 826 |

|

|

| FICA Tax |

|

|

| 547 |

| Federal Unemployment Tax |

|

|

| 36 |

| State Unemployment Tax |

|

|

| 243 |

|

|

|

|

|

|

29-Dec | Office Supplies |

| 650 |

|

|

| Bank |

|

|

| 650 |

|

|

|

|

|

|

30-Dec | Bank |

| 564.24 |

|

|

| Accounts Receivable |

|

|

| 564.24 |

|

|

|

|

|

|

31-Dec | Cash |

| 19500 |

|

|

| Unearned Sales and Service Revenue |

Trial Balance on December 31, 20xx Is Below

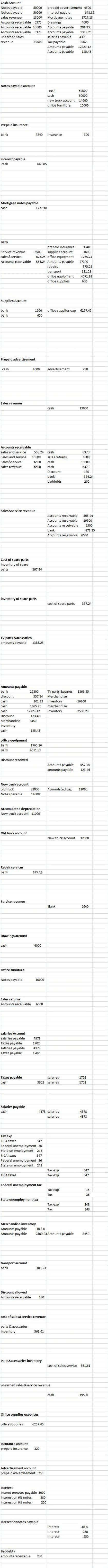

Journalize and post adjusting journal entries at December 31, 20xx. (Note: Omit explanations for journal entries). Answer is below:

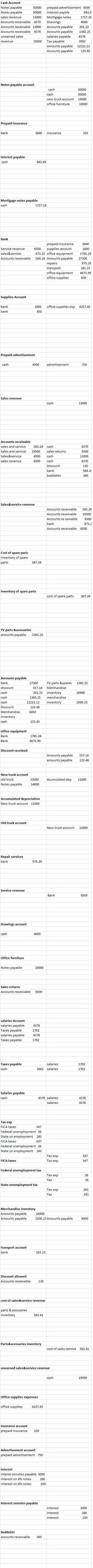

The journal entries to their respective accounts in the General Ledger and the Subsidiary Ledgers is below:

This Is A Journalize the December 20xx transactions for the Company in the General Journal. (Note: Omit explanations for journal entries).

| 1-Dec | Cash | 50000 | |||

| Notes Payable | 50000 | ||||

| 1-Dec | Prepaid Insurance | 3840 | |||

| Bank | 3840 | ||||

| 1-Dec | Supplies | 1600 | |||

| Bank | 1600 | ||||

| 1-Dec | Salaries Payable | ||||

| Cash | |||||

| 2-Dec | Prepaid Advertising | 4500 | |||

| Cash | 4500 | ||||

| 2-Dec | Interest Payable | 643.85 | |||

| Mortgage Note Payable | 1727.18 | ||||

| Cash | 1727.18 | ||||

| 3-Dec | Cash | 13000 | |||

| Sales Revenue | 13000 | ||||

| 3-Dec | Accounts Receivable | 565.24 | |||

| Sales and Service Revenue | 565.24 | ||||

| 3-Dec | Cost of Spare parts | 367.24 | |||

| Inventory of spare parts | 367.24 | ||||

| 4-Dec | Cash | 6370 | |||

| Accounts Receivable | 6370 | ||||

| 4-Dec | TV Parts and Accessories Inventory | 1365.25 | |||

| Accounts Payable | 1365.25 | ||||

| 7-Dec | Office Equipment | 1765.26 | |||

| Bank | 1765.26 | ||||

| 7-Dec | Accounts Payable | 27857.14 | |||

| Cash | 27300 | ||||

| Discount Received | 557.14 | ||||

| 8-Dec | Accounts Receivable | 19500 | |||

| Sales and Service Revenue | 19500 | ||||

| 8-Dec | New Truck | 35000 | |||

| Accumulated Depreciation | 11000 | ||||

| Old Truck | 32000 | ||||

| Notes Payable | 14000 | ||||

| 9-Dec | Repair Services | 475.29 | |||

| Bank | 475.29 | ||||

| 9-Dec | Bank | 6500 | |||

| Services Revenue | 6500 | ||||

| 10-Dec | Drawings | 4000 | |||

| Cash | 4000 | ||||

| 11-Dec | Office Furniture | 10000 | |||

| Notes Payable | 10000 | ||||

| 11-Dec | Accounts Receivable | 6500 | |||

| Sales and Service Revenue | 6500 | ||||

| 11-Dec | Accounts Payable | 201.23 | |||

| Cash | 201.23 | ||||

| 11-Dec | Accounts Payable | 1365.25 | |||

| Cash | 1365.25 | ||||

| 14-Dec | Sales Returns | 6500 | |||

| Accounts Receivable | 6500 | ||||

| 14-Dec | Salaries Expense | 6080 | |||

| Salaies Payable | 4378 | ||||

| Taxes Payable | 1702 | ||||

| Salaies Payable | 4378 | ||||

| Cash | 4378 | ||||

| 14-Dec | Tax Expense | 826 | |||

| FICA Taxes | 547 | ||||

| Federal Unemployment Tax | 36 | ||||

| State Unemployment Tax | 243 | ||||

| 15-Dec | Taxes Payable | 3962 | |||

| Cash | 3962 | ||||

| 16-Dec | Merchandise Inventory | 16900 | |||

| Accounts Payable | |||||

| 16-Dec | Cash | 13000 | |||

| Accounts Receivable | 13000 | ||||

| 17-Dec | Accounts Payable | 12346.58 | |||

| Cash | 12223.12 | ||||

| Discount Received | 123.46 | ||||

| 17-Dec | Transportation Costs | 181.23 | |||

| Bank | 181.23 | ||||

| 18-Dec | Accounts Payable | 8450 | |||

| Merchandise Inventory | 8450 | ||||

| 21-Dec | Merchandise Inventory | 2500.23 | |||

| Accounts Payable | 2500.23 | ||||

| 21-Dec | Cash | 6370 | |||

| Disount Expense | 130 | ||||

| Accounts Receivable | 6500 | ||||

| 22-Dec | Shipping Expenses | 279.42 | |||

| Shipping Expenses | 279.42 | ||||

| 23-Dec | Accounts Payable | 125.45 | |||

| Cash | 125.45 | ||||

| 23-Dec | Office Equipment | 4671.99 | |||

| Bank | 4671.99 | ||||

| 28-Dec | Bank | 873.25 | |||

| Sales and Service Revenue | 873.25 | ||||

| 28-Dec | Cost of Sales and Service Revenue | 561.61 | |||

| Parts and Accessories Inventories | 561.61 | ||||

| 28-Dec | Accounts Recivable | 6500 | |||

| Sales Revenue | 6500 | ||||

| 28-Dec | Salaries Expense | 6080 | |||

| Salaries Payable | 4378 | ||||

| Taxes Payble | 1702 | ||||

| 28-Dec | Tax Expense | 826 | |||

| FICA Tax | 547 | ||||

| Federal Unemployment Tax | 36 | ||||

| State Unemployment Tax | 243 | ||||

| 29-Dec | Office Supplies | 650 | |||

| Bank | 650 | ||||

| 30-Dec | Bank | 564.24 | |||

| Accounts Receivable | 564.24 | ||||

| 31-Dec | Cash | 19500 | |||

| Unearned Sales and Service Revenue | 19500 | ||||

| No journal Entry required |

Instructions With regards to the December 20xx activities for Offroad ATV Company, you are required to complete the following:

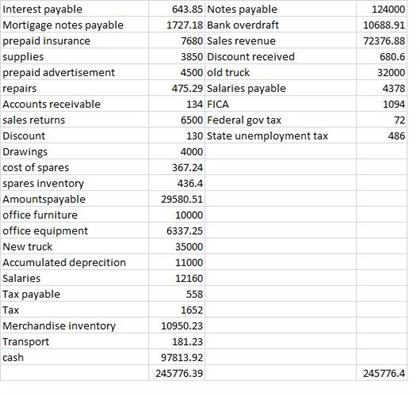

1) Prepare an Adjusted Trial Balance on December 31, 20xx.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started