Question

QUESTION: Determine whether Bathu (Pty) Ltd meets the minimum investment criteria set by the Investment Board of Bigvest Company. You must also discuss how each

QUESTION: Determine whether Bathu (Pty) Ltd meets the minimum investment criteria set by the Investment Board of Bigvest Company. You must also discuss how each of the ratios can be improved in the future. [Show all calculations.]

INFORMATION TO QUESTION:

Bigvest Company (or Bigvest) is a proudly South African multinational corporation listed on the Johannesburg Stock Exchange (JSE) with a market capitalisation of R200 billion as at 31 August 2023 financial year-end. Bigvest Company is a holding entity which invests in unique business ventures across the country and has a strong presence in different regions across Africa. The company has interests in financial services, mining, logistics, clothing, personal care, beverages and food products. Bigvest has different ownership structures in its related entities, including wholly and partly owned subsidiaries, joint ventures, once-off or limited-timespan projects, significant or minority shareholding, agency and franchising. The companys head offices are in Kempton Park, South Africa, where the Investment Board (which is responsible for all the investment decisions of the company) is based. The Investment Board sets out different minimum investment criteria which need to be met before investing in a new capital project (acquisition of assets apart from entities with running operations) or in a target company (with already running operations).

For capital projects, the requirement is that the project should yield a minimum profitability index of 1,05 and have a payback period (discounted) that is not longer than five years. The company may undertake as many capital projects as possible if funds permit, but where the company can only choose one of the given alternatives (because initiatives on the different projects cannot coexist), then the one that yields the shortest payback period will be chosen, provided that the minimum investment criteria are still met.

For investing in target companies, the minimum investment criteria are as follows: The target company must have been in existence for at least 4 years; and The target company must have received an unqualified audit report for the 3 preceding financial years; and The financial performance in the target companys latest audited financial year should meet the following minimum requirements (using closing balances where necessary): o Minimum interest cover of 8 times; and o A debt-equity ratio of not greater than 75%; and o Minimum return on capital employed of 20%. In computing ratios and where applicable, the Investment Board uses Net operating profit after tax (NOPAT) as a standard measure of sustainable earnings before interest and after tax.

INVESTMENT PROJECTS FOR 2023/2024

The Investment Board has already identified possible new investments for the 2024 financial year and some preliminary due diligence and engagements have already been initiated. The potential investments are as follows:

Bathu (Pty) Ltd Project

Bathu (Pty) Ltd (Bathu) is the designer and manufacturer of South Africas most trusted sneaker brand that was founded by Tim Baloyi in 2010. This company is 100% black-owned and black- managed and currently employs more than 1 000 people, the majority of whom are black. Bathu has caught the attention of many JSE-listed clothing retail companies for possible takeover as these companies continue to seek for ways to maximise shareholders wealth (their P/E multiples average 14,5 times).

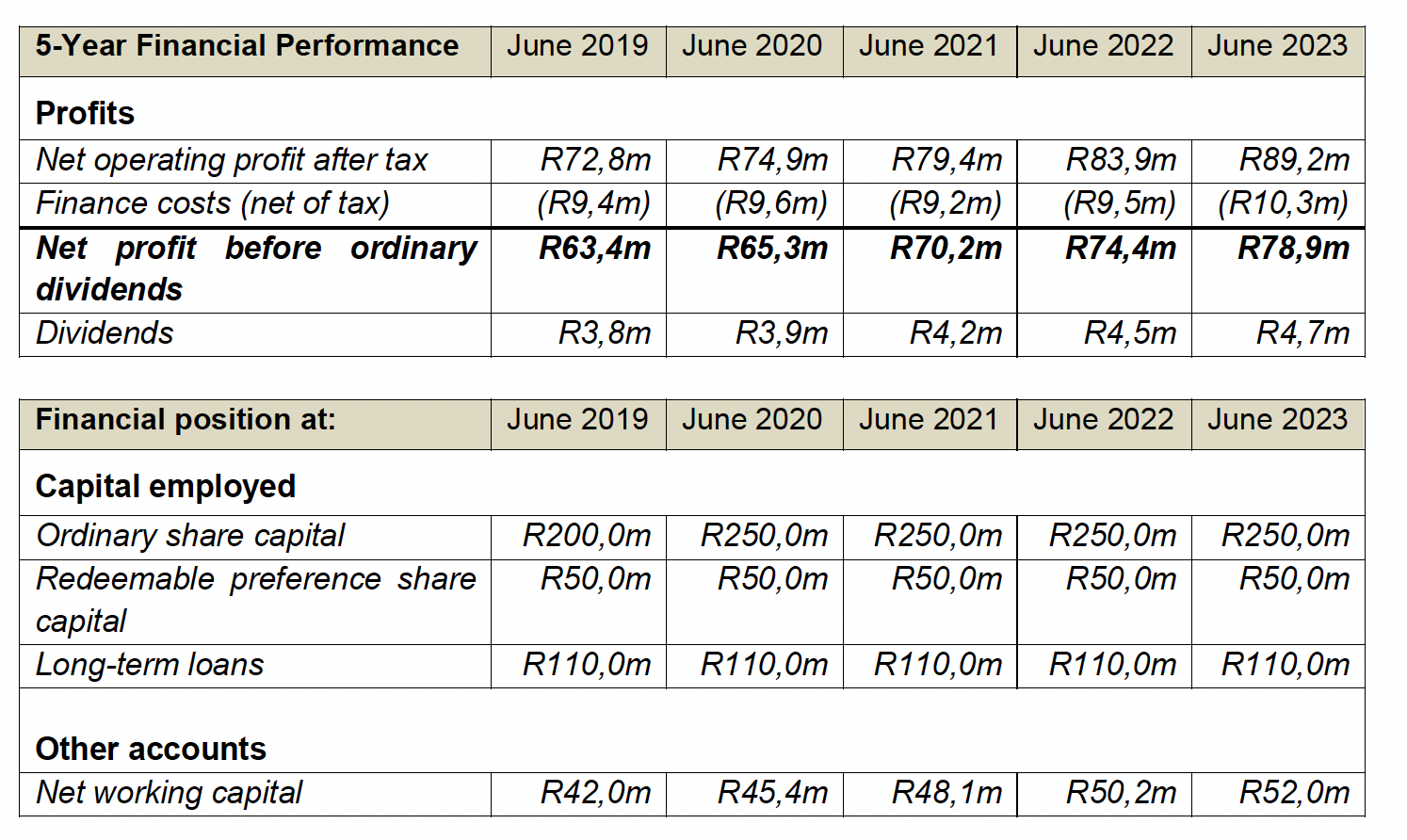

Bathu only started declaring dividends from 2019 as it had until that time primarily focused on expanding its footprint across the country. Bathu (Pty) Ltd has obtained a clean audit (unqualified report) for the past five years. The average percentage growth in dividends over these years is also expected to be maintained by Bathu (Pty) Ltd. The company currently has four million shares in issue. In the past few years, including Covid-19 years, Bathu has been able to produce strong financial results annually, as shown below:

Should the investment criteria be met, Bigvest intends making an offer to acquire a 30% stake in Bathu (Pty) Ltd. Bigvest is considering proposing the following to facilitate the settlement of the acquisition:

- 50% of the offer amount will be through cash injection into Bathu (Pty) Ltd in order to fast track the expansion of the company; and

- 50% of the offer amount will be through the issue of Bigvest shares.

Other information relating to Bigvest Company

Assume a weighted average cost of capital of 16% in evaluating all investment projects.

The South African corporate taxation rate is 27%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started