Question:

Dexter Company is considering purchasing equipment. The equipment will produce the following cash flows:

| Year 1 | $60,000 |

| Year 2 | $100,000 |

Dexter requires a minimum rate of return of 10%. What is the maximum price Dexter should pay for this equipment?

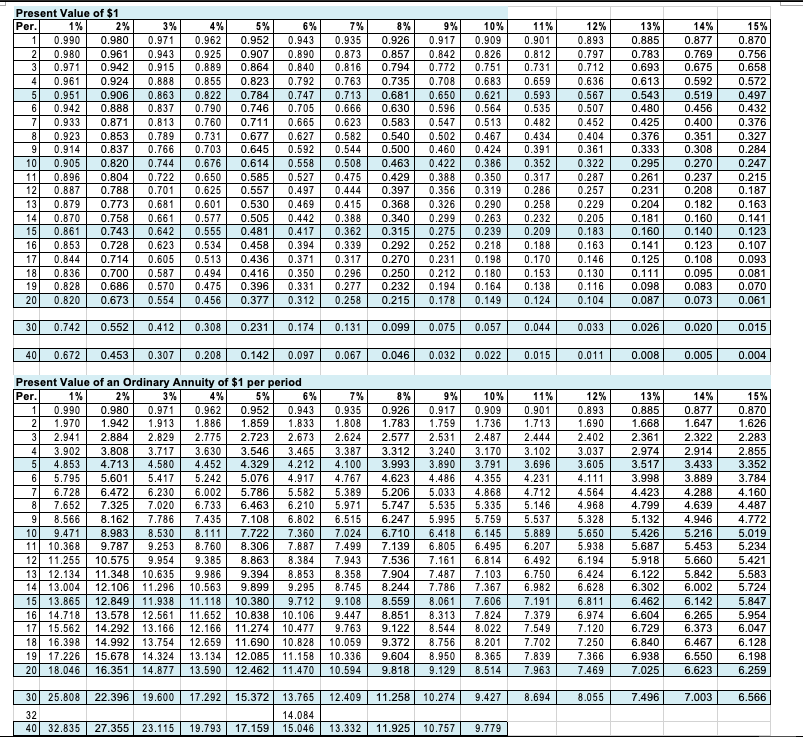

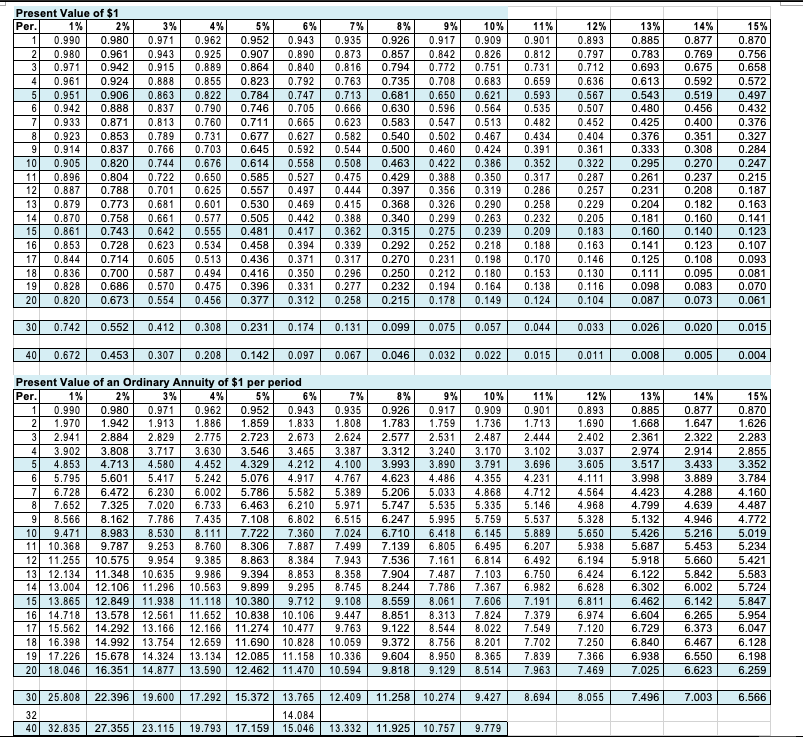

2 Present Value of $1 Per. 1% 2% 1 0.990 0.980 0.980 0.961 3 0.971 0.942 4 0.961 0.924 5 0.951 0.906 0.942 0.888 7 0.933 0.871 8 0.923 0.853 9 0.914 0.837 10 0.905 0.820 11 0.896 0.804 12 0.887 0.788 13 0.879 0.773 14 0.870 0.758 15 0.861 0.743 16 0.853 0.728 17 0.844 0.714 18 0.836 0.700 19 0.828 0.686 20 0.820 0.673 3% 0.971 0.943 0.915 0.888 0.863 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0.642 0.623 0.605 0.587 0.570 0.554 4% 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 0.555 0.534 0.513 0.494 0.475 0.456 5% 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 0.585 0.557 0.530 0.505 0.481 0.458 0.436 0.416 0.396 0.377 6% 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 0.527 0.497 0.469 0.442 0.417 0.394 0.371 0.350 0.331 0.312 7% 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0.388 0.362 0.339 0.317 0.296 0.277 0.258 8% 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 9% 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 0.388 0.356 0.326 0.299 0.275 0.252 0.231 0.212 0.194 0.178 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149 11% 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 13% 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0.295 0.261 0.231 0.204 0.181 1.160 0.141 0.125 0.111 0.098 0.087 14% 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 0.237 0.208 0.182 0.160 0.140 0.123 0.108 0.095 0.083 0.073 15% 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 0.247 0.215 0.187 0.163 0.141 .123 0.107 0.093 0.081 0.070 0.061 PIT 30 0.742 0.552 0.412 0.308 0.231 0.174 0.131 0.099 0.075 0.057 0.044 0.033 0.026 0.020 0.015 40 0.672 0.453 0.307 0.208 0.142 0.097 0.067 0.046 0.032 0.022 0.015 0.011 0.008 0.005 0.004 2 Present Value of an ordinary Annuity of $1 per period Per. 1% 2% 3% 4% 5% 6% 1 0.990 0.980 0.971 0.962 0.952 0.943 1.970 1.942 1.913 1.886 1.859 1.833 3 2.941 2.884 829 2.775 2.723 2.673 4 3.902 3.808 3.717 3.630 3.546 3.465 5 4.853 4.713 4.580 4.452 4.329 4.212 6 5.795 5.601 5.417 5.242 5.076 4.917 7 6.728 6.472 6.230 6.002 5.786 5.582 8 7.652 7.325 7.020 6.733 6.463 6.210 9 8.566 8.162 7.786 7.435 7.108 6.802 10 9.471 8.983 8.530 8.111 7.722 7.360 11 10.368 9.787 9.253 8.760 8.306 7.887 12 11.255 10.575 9.954 9.385 8.863 8.384 13 12.134 11.348 10.635 9.986 9.394 8.853 14 13.004 12.106 11.296 10.563 9.899 9.295 15 13.865 12.849 11.938 11.118 10.380 9.712 16 14.718 13.578 12.561 11.652 10.838 10.106 17| 15.562 14.292 13.166 12.166 11.274 10.477 18 16.398 14.992 13.754 12.659 11.690 10.828 19 17.226 15.678 14.324 13.134 12.085 11.158 2018.046 16.351 14.877 13.590 12.462 11.470 7% 0.935 1.808 2.624 3.387 4.100 4.767 5.389 5.971 6.515 7.024 7.499 7.943 8.358 8.745 9.108 9.447 9.763 10.059 10.336 10.594 int- 8% 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8.851 9.122 9.372 9.604 9.818 9% 0.917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5.995 6.418 6.805 7.161 7.487 7.786 8.061 8.313 8.544 8.756 8.950 9.129 10% 0.909 1.736 2.487 3.170 3.791 4.355 4.868 5.335 5.759 6.145 6.495 6.814 7.103 7.367 7.606 7.824 8.022 8.201 8.365 8.514 11% 0.901 1.713 2.444 3.102 3.696 4.231 4.712 5.146 5.537 5.889 6.207 6.492 6.750 6.982 7.191 7.379 7.549 7.702 7.839 7.963 12% 0.893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 5.938 6.194 6.424 6.628 6.811 6.974 7.120 7.250 7.366 7.469 13% 0.885 1.668 2.361 2.974 3.517 3.998 4.423 4.799 5.132 5.426 5.687 5.918 6.122 6.302 6.462 6.604 6.729 6.840 6.938 7.025 14% 0.877 1.647 2.322 2.914 3.433 3.889 4.288 4.639 4.946 5.216 5.453 5.660 5.842 6.002 6.142 6.265 6.373 6.467 6.550 6.623 15% 0.870 1.626 .283 2.855 3.352 3.784 4.160 4.487 4.772 5.019 5.234 5.421 5.583 5.724 5.847 5.954 6.047 6.128 6.198 6.259 22.396 19.600 17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.694 8.055 7.496 7.003 6.566 30 25.808 32 40 32.835 14.084 15.046 27.355 23.115 19.793 17.159 13.332 11.925 10.757 9.779