Answered step by step

Verified Expert Solution

Question

1 Approved Answer

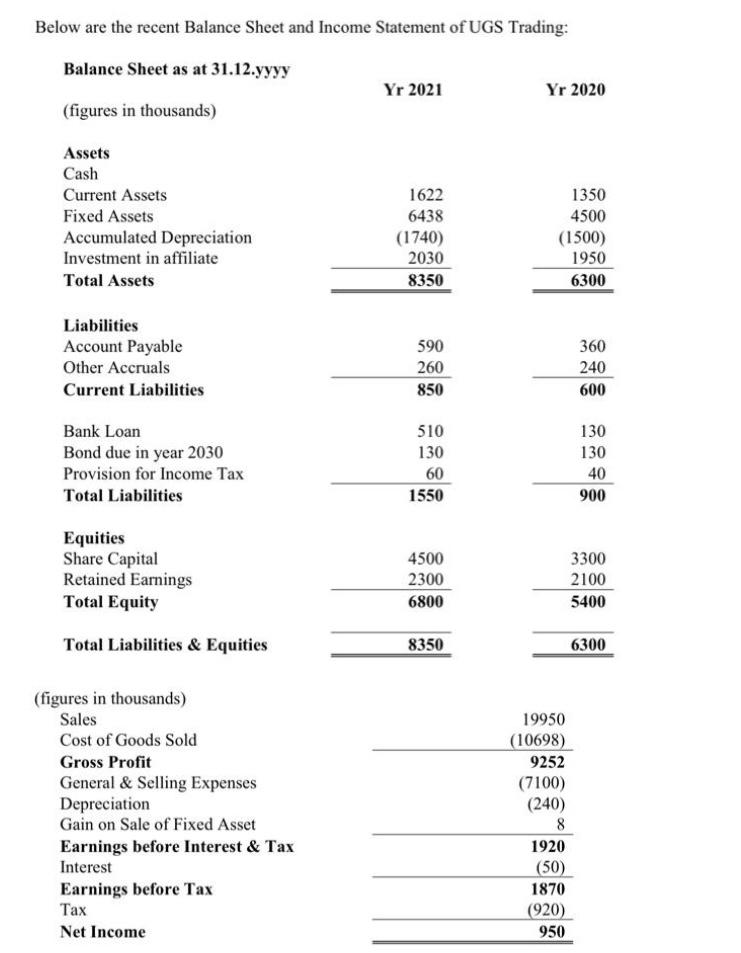

question: Discuss how the firm was financed in Year 2021 by commenting on the level of gearing in Year 2021. Below are the recent Balance

question: Discuss how the firm was financed in Year 2021 by commenting on the level of gearing in Year 2021.

Below are the recent Balance Sheet and Income Statement of UGS Trading: Balance Sheet as at 31.12.yyyy Yr 2021 Yr 2020 (figures in thousands) Assets Cash Current Assets Fixed Assets Accumulated Depreciation Investment in affiliate Total Assets 1622 6438 (1740) 2030 8350 1350 4500 (1500) 1950 6300 590 360 Liabilities Account Payable Other Accruals Current Liabilities 260 240 600 850 Bank Loan Bond due in year 2030 Provision for Income Tax Total Liabilities 510 130 60 1550 130 130 40 900 Equities Share Capital Retained Earnings Total Equity 4500 2300 6800 3300 2100 5400 Total Liabilities & Equities 8350 6300 (figures in thousands) Sales Cost of Goods Sold Gross Profit General & Selling Expenses Depreciation Gain on Sale of Fixed Asset Earnings before Interest & Tax Interest Earnings before Tax Tax Net Income 19950 (10698) 9252 (7100) (240) 8 1920 (50) 1870 (920) 950 Below are the recent Balance Sheet and Income Statement of UGS Trading: Balance Sheet as at 31.12.yyyy Yr 2021 Yr 2020 (figures in thousands) Assets Cash Current Assets Fixed Assets Accumulated Depreciation Investment in affiliate Total Assets 1622 6438 (1740) 2030 8350 1350 4500 (1500) 1950 6300 590 360 Liabilities Account Payable Other Accruals Current Liabilities 260 240 600 850 Bank Loan Bond due in year 2030 Provision for Income Tax Total Liabilities 510 130 60 1550 130 130 40 900 Equities Share Capital Retained Earnings Total Equity 4500 2300 6800 3300 2100 5400 Total Liabilities & Equities 8350 6300 (figures in thousands) Sales Cost of Goods Sold Gross Profit General & Selling Expenses Depreciation Gain on Sale of Fixed Asset Earnings before Interest & Tax Interest Earnings before Tax Tax Net Income 19950 (10698) 9252 (7100) (240) 8 1920 (50) 1870 (920) 950Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started