Answered step by step

Verified Expert Solution

Question

1 Approved Answer

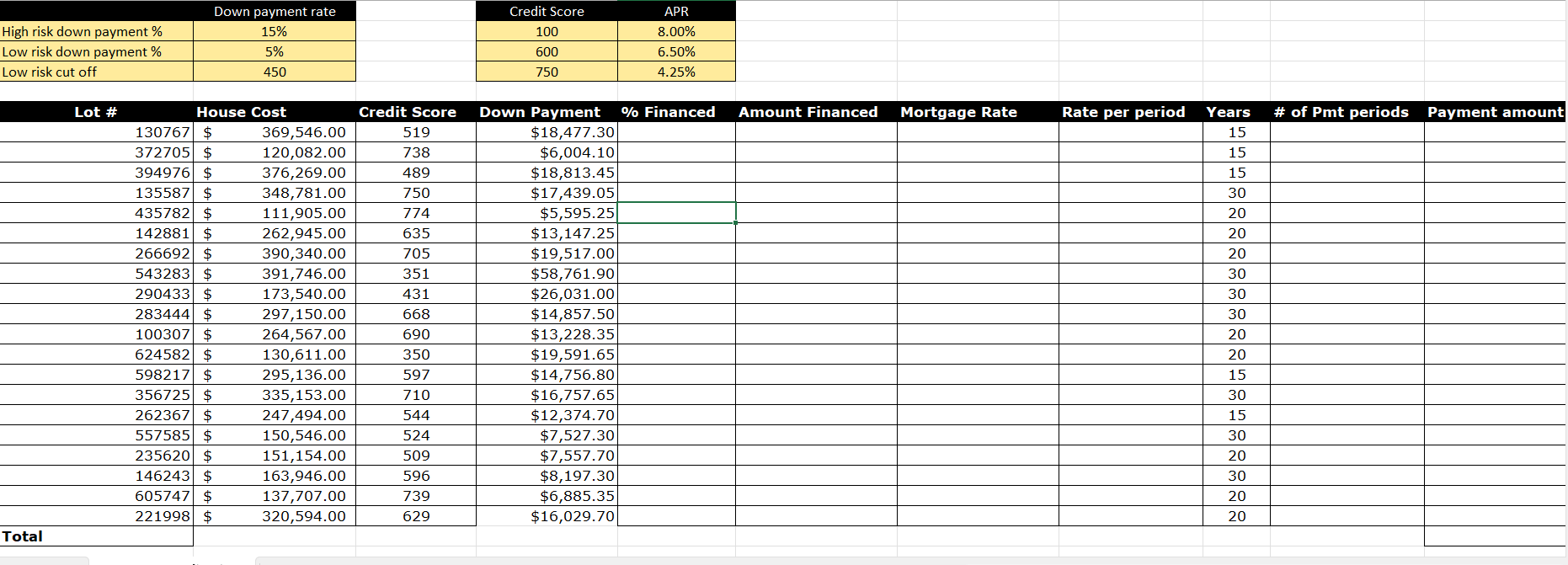

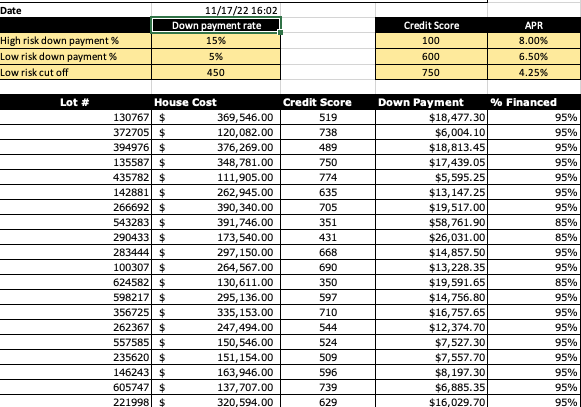

Question: Enter a formula to calculate the percent financed in cell E9. The percent financed is the amount financed/purchase price. Next use the fill handle

Question: Enter a formula to calculate the percent financed in cell E9. The percent financed is the amount financed/purchase price. Next use the fill handle to copy the formula down, stopping cell E28.

Final result: Please help

\begin{tabular}{|l|c|} \hline High risk down payment % & Down payment rate \\ \hline Low risk down payment % & 15% \\ \hline Low risk cut off & 5% \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline Credit Score & APR \\ \hline 100 & 8.00% \\ \hline 600 & 6.50% \\ \hline 750 & 4.25% \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|} \hline Lot \# & Ho & Cost & Credit Score & Down Payment & % Financed & Amount Financed & Mortgage Rate & Rate per period & Years & \# of Pmt periods & Payment amount \\ \hline 130767 & $ & 369,546.00 & 519 & $18,477.30 & & & & & 15 & & \\ \hline 372705 & $ & 120,082.00 & 738 & $6,004.10 & & & & & 15 & & \\ \hline 394976 & $ & 376,269.00 & 489 & $18,813.45 & & & & & 15 & & \\ \hline 135587 & $ & 348,781.00 & 750 & $17,439.05 & & & & & 30 & & \\ \hline 435782 & $ & 111,905.00 & 774 & $5,595.25 & & & & & 20 & & \\ \hline 142881 & $ & 262,945.00 & 635 & $13,147.25 & & & & & 20 & & \\ \hline 266692 & $ & 390,340.00 & 705 & $19,517.00 & & & & & 20 & & \\ \hline 543283 & $ & 391,746.00 & 351 & $58,761.90 & & & & & 30 & & \\ \hline 290433 & $ & 173,540.00 & 431 & $26,031.00 & & & & & 30 & & \\ \hline 283444 & $ & 297,150.00 & 668 & $14,857.50 & & & & & 30 & & \\ \hline 100307 & $ & 264,567.00 & 690 & $13,228.35 & & & & & 20 & & \\ \hline 624582 & $ & 130,611.00 & 350 & $19,591.65 & & & & & 20 & & \\ \hline 598217 & $ & 295,136.00 & 597 & $14,756.80 & & & & & 15 & & \\ \hline 356725 & $ & 335,153.00 & 710 & $16,757.65 & & & & & 30 & & \\ \hline 262367 & $ & 247,494.00 & 544 & $12,374.70 & & & & & 15 & & \\ \hline 557585 & $ & 150,546.00 & 524 & $7,527.30 & & & & & 30 & & \\ \hline 235620 & $ & 151,154.00 & 509 & $7,557.70 & & & & & 20 & & \\ \hline 146243 & $ & 163,946.00 & 596 & $8,197.30 & & & & & 30 & & \\ \hline 605747 & $ & 137,707.00 & 739 & $6,885.35 & & & & & 20 & & \\ \hline 221998 & $ & 320,594.00 & 629 & $16,029.70 & & & & & 20 & & \\ \hline tal & & & & & & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline Date & & 11/17/2216:02 & & & \\ \hline & & jayment rate & & Credit Score & APR \\ \hline High risk down payment % & & 15% & & 100 & 8.00% \\ \hline Low risk down payment % & & 5% & & 600 & 6.50% \\ \hline Low risk cut off & & 450 & & 750 & 4.25% \\ \hline Lot \# & & & Credit Score & Down Payment & % Financed \\ \hline 130767 & $ & 369,546.00 & 519 & $18,477.30 & 95% \\ \hline 372705 & $ & 120,082.00 & 738 & $6,004.10 & 95% \\ \hline 394976 & $ & 376,269.00 & 489 & $18,813.45 & 95% \\ \hline 135587 & $ & 348,781.00 & 750 & $17,439.05 & 95% \\ \hline 435782 & $ & 111,905.00 & 774 & $5,595.25 & 95% \\ \hline 142881 & $ & 262,945.00 & 635 & $13,147.25 & 95% \\ \hline 266692 & $ & 390,340.00 & 705 & $19,517.00 & 95% \\ \hline 543283 & $ & 391,746.00 & 351 & $58,761.90 & 85% \\ \hline 290433 & $ & 173,540.00 & 431 & $26,031.00 & 85% \\ \hline 283444 & $ & 297,150.00 & 668 & $14,857.50 & 95% \\ \hline 100307 & $ & 264,567.00 & 690 & $13,228.35 & 95% \\ \hline 624582 & $ & 130,611.00 & 350 & $19,591.65 & 85% \\ \hline 598217 & $ & 295,136.00 & 597 & $14,756.80 & 95% \\ \hline 356725 & $ & 335,153.00 & 710 & $16,757.65 & 95% \\ \hline 262367 & $ & 247,494.00 & 544 & $12,374.70 & 95% \\ \hline 557585 & $ & 150,546.00 & 524 & $7,527.30 & 95% \\ \hline 235620 & $ & 151,154.00 & 509 & $7,557.70 & 95% \\ \hline 146243 & $ & 163,946.00 & 596 & $8,197.30 & 95% \\ \hline 605747 & $ & 137,707.00 & 739 & $6,885.35 & 95% \\ \hline 221998 & $ & 320,594.00 & 629 & $16,029.70 & 95% \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started