Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION: Estimate the Cash flows for parent and calculate NPV and IRR for the parent. Shall the parent company accept the project? INFO BELOW: Elaine

QUESTION: Estimate the Cash flows for parent and calculate NPV and IRR for the parent. Shall the parent company accept the project?

INFO BELOW:

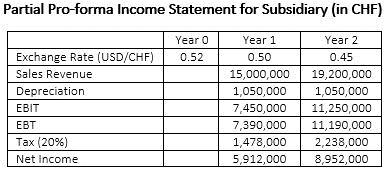

Elaine Corporation plans to expand its current operation to Switzerland. The following information has been gathered to assess this project:

- The initial investment required is CHF 7 million. The current spot rate is 0.52 USD/CHF.

- The project will be terminated at the end of Year 2, when the subsidiary will be sold.

- Elaine is planning on taking a CHF 1.0 million loan from Switzerland banking system for 5 years. The interest on the loan is 6% and the annual interest expense is CHF 60,000. The principal amount will be repaid end of the term as a lump sum. Also assume that Swiss subsidiary will not require any additional working capital.

- The following information is available for the analyst:

- The Swiss government will impose an income tax of 20% on income. The US corporate income tax is 35%.

- All cash flows received by the subsidiary are sent to the parent at the end of each year. The Swiss government will impose 5% withholding tax.

- In two years the subsidiary is to be sold. Elaine expects to receive CHF 750,000 which is subject to withholding tax in Switzerland.

- Elaine requires a 15% rate of return on this project also use the same discount rate for valuing subsidiarys cash flow.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started