Answered step by step

Verified Expert Solution

Question

1 Approved Answer

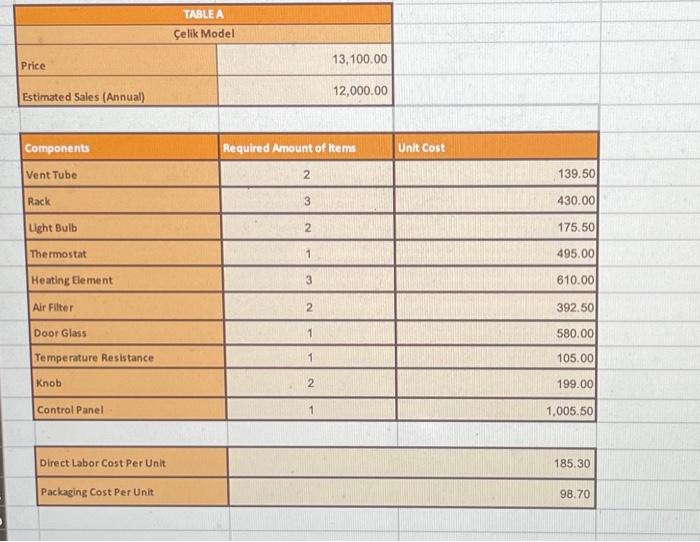

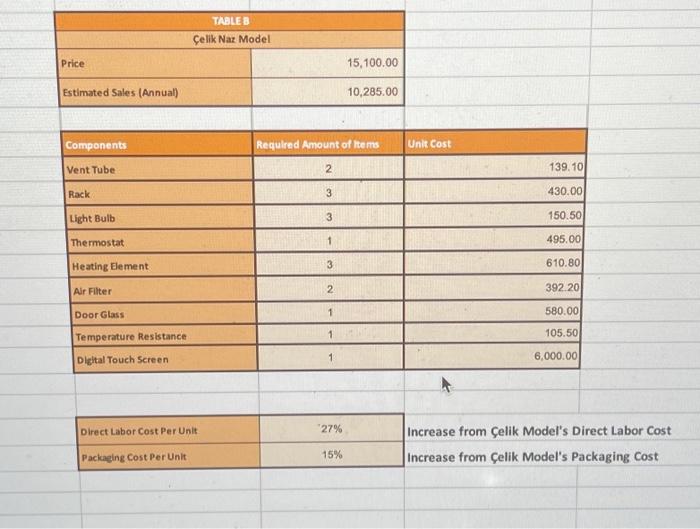

question (excell) Evtel Kitchen Appliances is considering releasing a new line of smart oven called elik Naz Model, which will feature digital touch-screen technology instead

question (excell)

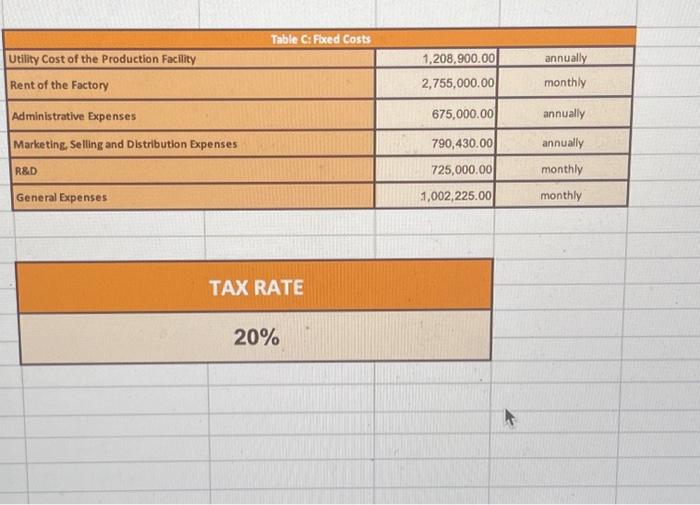

Evtel Kitchen Appliances is considering releasing a new line of smart oven called elik Naz Model, which will feature digital touch-screen technology instead of knobs and control panels. elik Model lost 10% of its customers to elik Naz Model, resulting in a total sales of 10,285.00 units for elik Naz Model. Also, with the launch of this series Evtel expects Utility Cost of the Production Facility to become 160,000.00 monthly and R&D cost to increase by 37% annually. Answer the questions accordingly. (Remark: Use Table B for smart oven.) (Remark: All questions are independent.)

subquestions

a) How many more elik Model sales can EvTel lose without any reduction in profits? (Round your answer to the nearest integer.)

b) EvTel expects success with elik Naz Model. So they consider purchasing machinery. The new machinery has the economic life of 3 years. How much should the cost of the machinery be so that the Net Income becomes 10,000,000.00 ? (Do not round your answer.) (Do not forget to undo changes from the previous question.) (Evtel sells both products in this question.)

c) EvTel wants to boost its sales. In order to do that, EvTel has decided to invest more in R&D and Marketing, Selling and Distribution processes. With the hiring of a new R&D team and changes in marketing strategies, R&D Cost increases by 68% annually and Marketing, Selling and Distribution Expenses increases by a factor of a half by annually. In return, elik Model's sales rate increases by 17%. What percentage increase in the elik Naz Model's sales rate is required so that the new income is 60,000,000.00? (Report positive number)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started