Question F please.

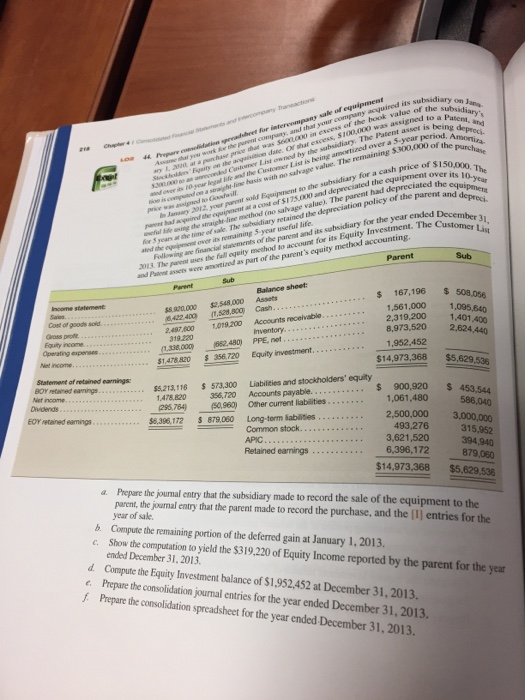

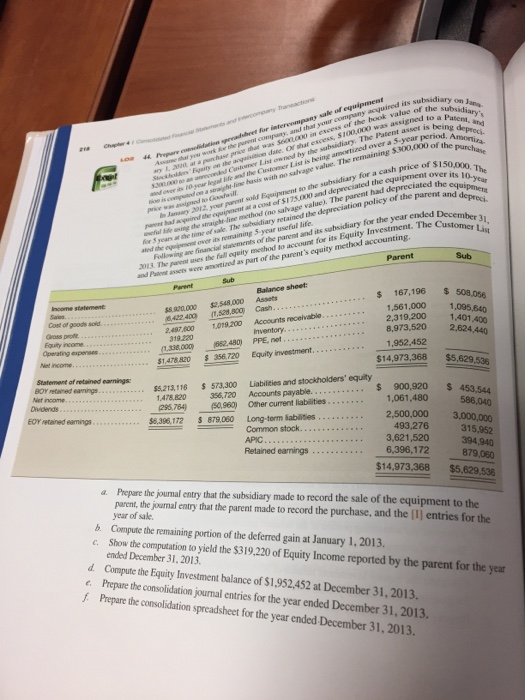

Assume that you work for the patent company, and that your company acquired its subsidiary on January 1, 2020, at a purchase price that was $600,000 in excess of the book value of the subsidiary's stockbroker's "Equity on the acquisition data. Of that excess $100,000 was assigned to a patent and $200,000 as on unrecorded customer List owned by the subsidiary. The patent asset is being depreciated over its 10 year legal life and the customer List is being amortized over a 5-year period. amortization is completed on a straight-line basis with no salvage value. The remaining $300,000 of the purchase price was assigned as Goodwill. In January, 2012, your patent sold Equipment to the subsidiary for a cash price of $1, 50,000. The parent has acquired the equipment at a cost of $1, 75,000 and depreciated the equipment over its 10 year useful life using the straight line method (no salvage value). The patent had depreciated the equipment for 5 years at the time of sale. The subsidiary retained the depreciation policy of the parent and depreciation and the equipment over its remaining 5 year useful life. Following are financial statements of the patent and its subsidiary for the year ended December 31, 2013. The parent uses the full equity method to account for its Equity Investment. The customer List and patent assets were amortized as part of the parent's equity method accounting. Prepare the journal entry that the subsidiary made to record the sale of the equipment to the parent, the journal entry that the parent made to record the purchase, and the [1] entries for the year of sale. Compute the remaining portion of the deferred gain at January 1, 2013. Show the computation to yield the $319, 220 of Equity Income reported by the parent for the year ended December 31, 2013. Compute the Equity Investment balance of $1, 952, 452 at December 31, 2013. prepare the consolidation journal entries for the year ended December 31, 2013. prepare the consolidation spreadsheet for the year ended December 31, 2013. Assume that you work for the patent company, and that your company acquired its subsidiary on January 1, 2020, at a purchase price that was $600,000 in excess of the book value of the subsidiary's stockbroker's "Equity on the acquisition data. Of that excess $100,000 was assigned to a patent and $200,000 as on unrecorded customer List owned by the subsidiary. The patent asset is being depreciated over its 10 year legal life and the customer List is being amortized over a 5-year period. amortization is completed on a straight-line basis with no salvage value. The remaining $300,000 of the purchase price was assigned as Goodwill. In January, 2012, your patent sold Equipment to the subsidiary for a cash price of $1, 50,000. The parent has acquired the equipment at a cost of $1, 75,000 and depreciated the equipment over its 10 year useful life using the straight line method (no salvage value). The patent had depreciated the equipment for 5 years at the time of sale. The subsidiary retained the depreciation policy of the parent and depreciation and the equipment over its remaining 5 year useful life. Following are financial statements of the patent and its subsidiary for the year ended December 31, 2013. The parent uses the full equity method to account for its Equity Investment. The customer List and patent assets were amortized as part of the parent's equity method accounting. Prepare the journal entry that the subsidiary made to record the sale of the equipment to the parent, the journal entry that the parent made to record the purchase, and the [1] entries for the year of sale. Compute the remaining portion of the deferred gain at January 1, 2013. Show the computation to yield the $319, 220 of Equity Income reported by the parent for the year ended December 31, 2013. Compute the Equity Investment balance of $1, 952, 452 at December 31, 2013. prepare the consolidation journal entries for the year ended December 31, 2013. prepare the consolidation spreadsheet for the year ended December 31, 2013

Question F please.

Question F please.