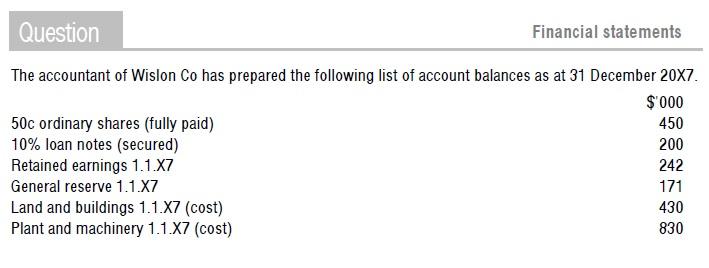

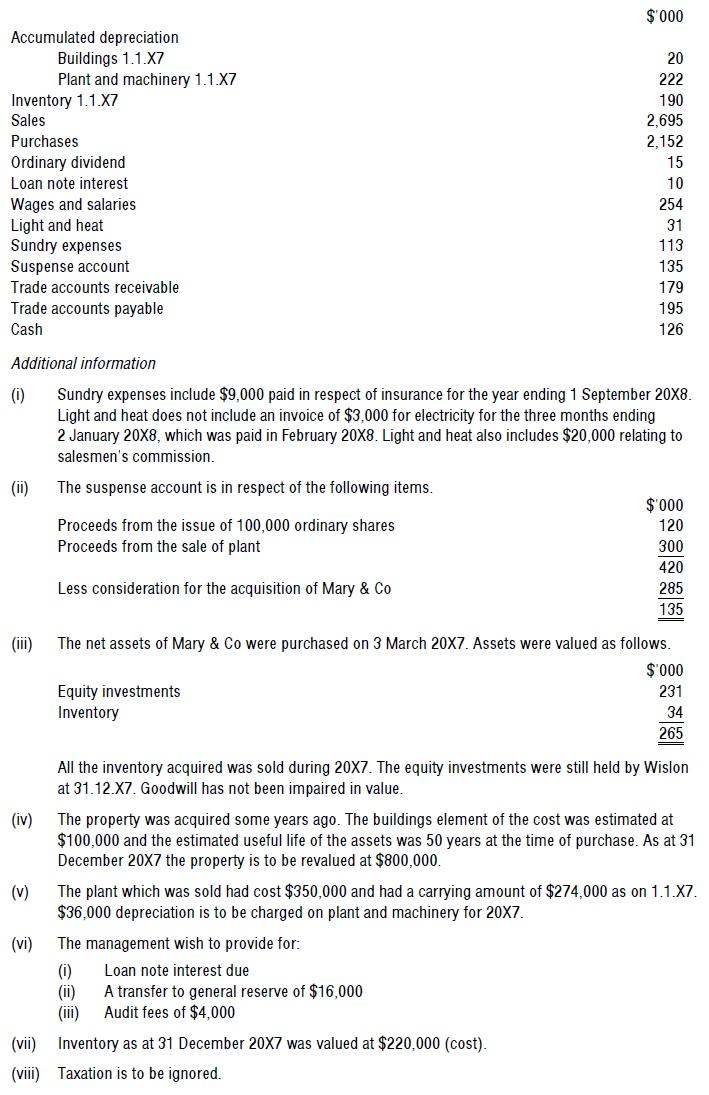

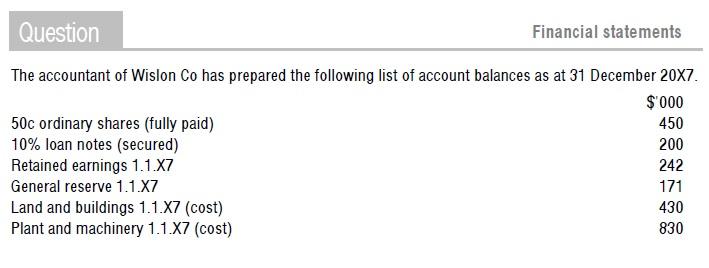

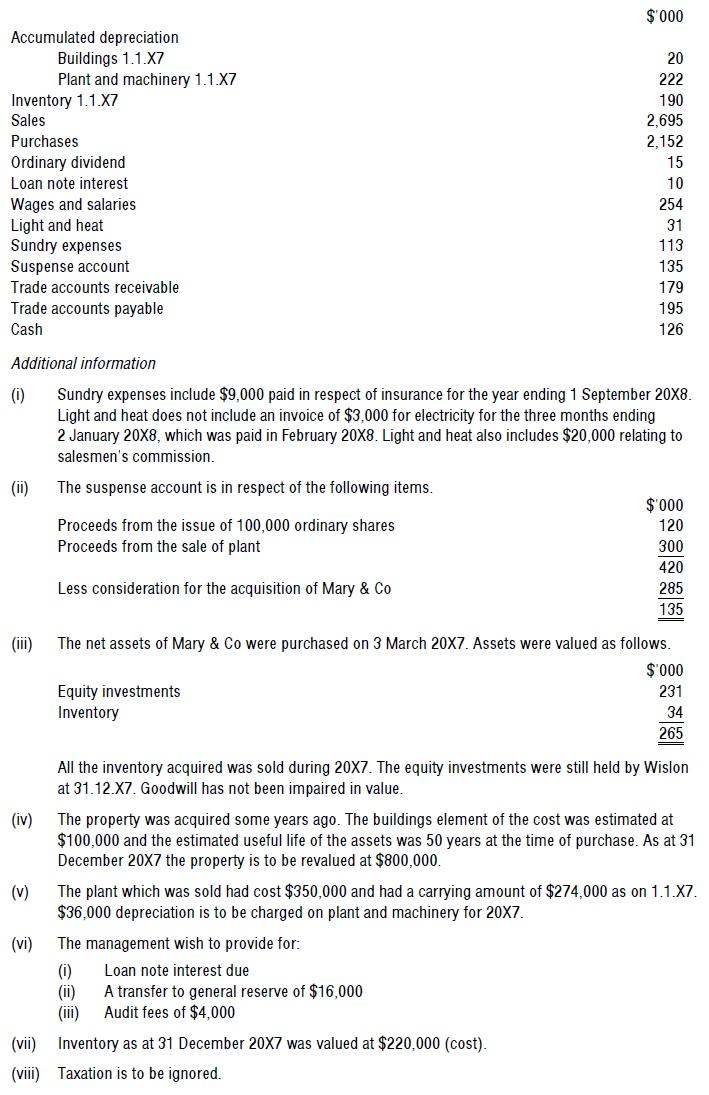

Question Financial statements The accountant of Wislon Co has prepared the following list of account balances as at 31 December 20x7. $'000 50c ordinary shares (fully paid) 450 10% loan notes (secured) 200 Retained earnings 1.1.X7 242 General reserve 1.1.X7 171 Land and buildings 1.1.X7 (cost) 430 Plant and machinery 1.1.X7 (cost) 830 $'000 Accumulated depreciation Buildings 1.1.X7 Plant and machinery 1.1.X7 Inventory 1.1.X7 Sales Purchases Ordinary dividend Loan note interest Wages and salaries Light and heat Sundry expenses Suspense account Trade accounts receivable Trade accounts payable Cash 20 222 190 2,695 2,152 15 10 254 31 113 135 179 195 126 Additional information (i) Sundry expenses include $9,000 paid in respect of insurance for the year ending 1 September 20X8. Light and heat does not include an invoice of $3,000 for electricity for the three months ending 2 January 20X8, which was paid in February 20X8. Light and heat also includes $20,000 relating to salesmen's commission. (1) The suspense account is in respect of the following items. Proceeds from the issue of 100,000 ordinary shares Proceeds from the sale of plant $'000 120 300 420 285 135 Less consideration for the acquisition of Mary & Co (iii) The net assets of Mary & Co were purchased on 3 March 20X7. Assets were valued as follows. $'000 Equity investments 231 Inventory 34 265 All the inventory acquired was sold during 20X7. The equity investments were still held by Wislon at 31.12.X7. Goodwill has not been impaired in value. (iv) The property was acquired some years ago. The buildings element of the cost was estimated at $100,000 and the estimated useful life of the assets was 50 years at the time of purchase. As at 31 December 20X7 the property is to be revalued at $800,000. (v) The plant which was sold had cost $350,000 and had a carrying amount of $274,000 as on 1.1.X7. $36,000 depreciation is to be charged on plant and machinery for 20x7. (vi) The management wish to provide for: (0) Loan note interest due (ii) A transfer to general reserve of $16,000 (iii) Audit fees of $4,000 (vii) Inventory as at 31 December 20X7 was valued at $220,000 (cost). (viii) Taxation is to be ignored. Question Financial statements The accountant of Wislon Co has prepared the following list of account balances as at 31 December 20x7. $'000 50c ordinary shares (fully paid) 450 10% loan notes (secured) 200 Retained earnings 1.1.X7 242 General reserve 1.1.X7 171 Land and buildings 1.1.X7 (cost) 430 Plant and machinery 1.1.X7 (cost) 830 $'000 Accumulated depreciation Buildings 1.1.X7 Plant and machinery 1.1.X7 Inventory 1.1.X7 Sales Purchases Ordinary dividend Loan note interest Wages and salaries Light and heat Sundry expenses Suspense account Trade accounts receivable Trade accounts payable Cash 20 222 190 2,695 2,152 15 10 254 31 113 135 179 195 126 Additional information (i) Sundry expenses include $9,000 paid in respect of insurance for the year ending 1 September 20X8. Light and heat does not include an invoice of $3,000 for electricity for the three months ending 2 January 20X8, which was paid in February 20X8. Light and heat also includes $20,000 relating to salesmen's commission. (1) The suspense account is in respect of the following items. Proceeds from the issue of 100,000 ordinary shares Proceeds from the sale of plant $'000 120 300 420 285 135 Less consideration for the acquisition of Mary & Co (iii) The net assets of Mary & Co were purchased on 3 March 20X7. Assets were valued as follows. $'000 Equity investments 231 Inventory 34 265 All the inventory acquired was sold during 20X7. The equity investments were still held by Wislon at 31.12.X7. Goodwill has not been impaired in value. (iv) The property was acquired some years ago. The buildings element of the cost was estimated at $100,000 and the estimated useful life of the assets was 50 years at the time of purchase. As at 31 December 20X7 the property is to be revalued at $800,000. (v) The plant which was sold had cost $350,000 and had a carrying amount of $274,000 as on 1.1.X7. $36,000 depreciation is to be charged on plant and machinery for 20x7. (vi) The management wish to provide for: (0) Loan note interest due (ii) A transfer to general reserve of $16,000 (iii) Audit fees of $4,000 (vii) Inventory as at 31 December 20X7 was valued at $220,000 (cost). (viii) Taxation is to be ignored