Answered step by step

Verified Expert Solution

Question

1 Approved Answer

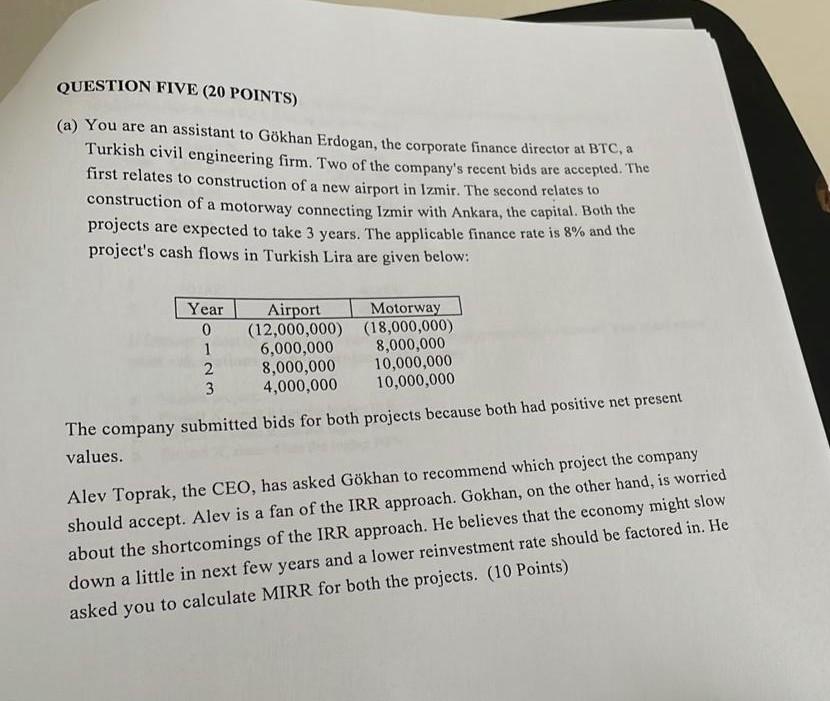

QUESTION FIVE (20 POINTS) (a) You are an assistant to Gkhan Erdogan, the corporate finance director at BTC, a Turkish civil engineering firm. Two of

QUESTION FIVE (20 POINTS) (a) You are an assistant to Gkhan Erdogan, the corporate finance director at BTC, a Turkish civil engineering firm. Two of the company's recent bids are accepted. The first relates to construction of a new airport in Izmir. The second relates to construction of a motorway connecting Izmir with Ankara, the capital. Both the projects are expected to take 3 years. The applicable finance rate is 8% and the project's cash flows in Turkish Lira are given below: The company submitted bids for both projects because both had positive net present values. Alev Toprak, the CEO, has asked Gkhan to recommend which project the company should accept. Alev is a fan of the IRR approach. Gokhan, on the other hand, is worried about the shortcomings of the IRR approach. He believes that the economy might slow down a little in next few years and a lower reinvestment rate should be factored in. He asked you to calculate MIRR for both the projects. (10 Points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started