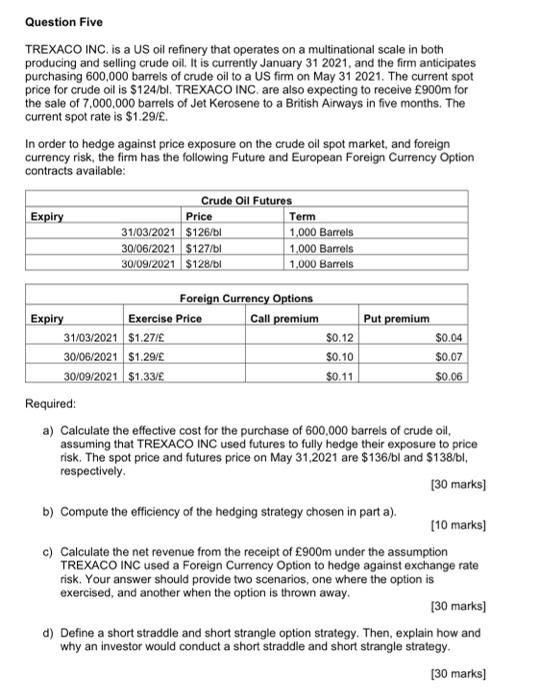

Question Five TREXACO INC. is a US oil refinery that operates on a multinational scale in both producing and selling crude oil. It is currently January 31 2021, and the firm anticipates purchasing 600,000 barrels of crude oil to a US firm on May 31 2021. The current spot price for crude oil is $124/bl. TREXACO INC. are also expecting to receive 900m for the sale of 7,000,000 barrels of Jet Kerosene to a British Airways in five months. The current spot rate is $1.29/. In order to hedge against price exposure on the crude oil spot market, and foreign currency risk, the firm has the following Future and European Foreign Currency Option contracts available: Crude Oil Futures Expiry Price Term 31/03/2021 S126/b! 1,000 Barrels 30/06/2021 $127/01 1.000 Barrels 30/09/2021 $128/bi 1.000 Barrels Foreign Currency Options Expiry Exercise Price Call premium Put premium 31/03/2021 $1.27/ $0.12 $0.04 30/06/2021 $1.2918 $0.10 $0.07 30/09/2021 $1.33/ $0.11 $0.06 Required: a) Calculate the effective cost for the purchase of 600,000 barrels of crude oil, assuming that TREXACO INC used futures to fully hedge their exposure to price risk. The spot price and futures price on May 31,2021 are $136/bl and $138/bl, respectively [30 marks) b) Compute the efficiency of the hedging strategy chosen in part a). [10 marks) c) Calculate the net revenue from the receipt of 900m under the assumption TREXACO INC used a Foreign Currency Option to hedge against exchange rate risk. Your answer should provide two scenarios, one where the option is exercised, and another when the option is thrown away. (30 marks) d) Define a short straddle and short strangle option strategy. Then, explain how and why an investor would conduct a short straddle and short strangle strategy. (30 marks) Question Five TREXACO INC. is a US oil refinery that operates on a multinational scale in both producing and selling crude oil. It is currently January 31 2021, and the firm anticipates purchasing 600,000 barrels of crude oil to a US firm on May 31 2021. The current spot price for crude oil is $124/bl. TREXACO INC. are also expecting to receive 900m for the sale of 7,000,000 barrels of Jet Kerosene to a British Airways in five months. The current spot rate is $1.29/. In order to hedge against price exposure on the crude oil spot market, and foreign currency risk, the firm has the following Future and European Foreign Currency Option contracts available: Crude Oil Futures Expiry Price Term 31/03/2021 S126/b! 1,000 Barrels 30/06/2021 $127/01 1.000 Barrels 30/09/2021 $128/bi 1.000 Barrels Foreign Currency Options Expiry Exercise Price Call premium Put premium 31/03/2021 $1.27/ $0.12 $0.04 30/06/2021 $1.2918 $0.10 $0.07 30/09/2021 $1.33/ $0.11 $0.06 Required: a) Calculate the effective cost for the purchase of 600,000 barrels of crude oil, assuming that TREXACO INC used futures to fully hedge their exposure to price risk. The spot price and futures price on May 31,2021 are $136/bl and $138/bl, respectively [30 marks) b) Compute the efficiency of the hedging strategy chosen in part a). [10 marks) c) Calculate the net revenue from the receipt of 900m under the assumption TREXACO INC used a Foreign Currency Option to hedge against exchange rate risk. Your answer should provide two scenarios, one where the option is exercised, and another when the option is thrown away. (30 marks) d) Define a short straddle and short strangle option strategy. Then, explain how and why an investor would conduct a short straddle and short strangle strategy. (30 marks)