Question

QUESTION FIVE You are an Audit Supervisor of Taylor and Robert and the final audit of Derwent plc (Derwent) for the year ended 30 June

QUESTION FIVE

You are an Audit Supervisor of Taylor and Robert and the final audit of Derwent plc (Derwent) for the year ended 30 June 2021 is due to commence shortly.

Derwent is a retailer offering food, clothing and homeware products to about 30 million customers every year across the United Kingdom. Derwent serves its customers through a channel network of 1,200 stores and online services.

The Companys loss before tax per the draft financial statements for the year ended 30 June 2021 was 90.2m (2020: profit of 70.8m) and total assets as at that date were 2.2bn (2020: 3.1bn)

At a planning meeting held recently between the audit engagement team and the Finance Director of Derwent, you confirmed the following information obtained from Derwent accounting records and the notes to the draft financial statements:

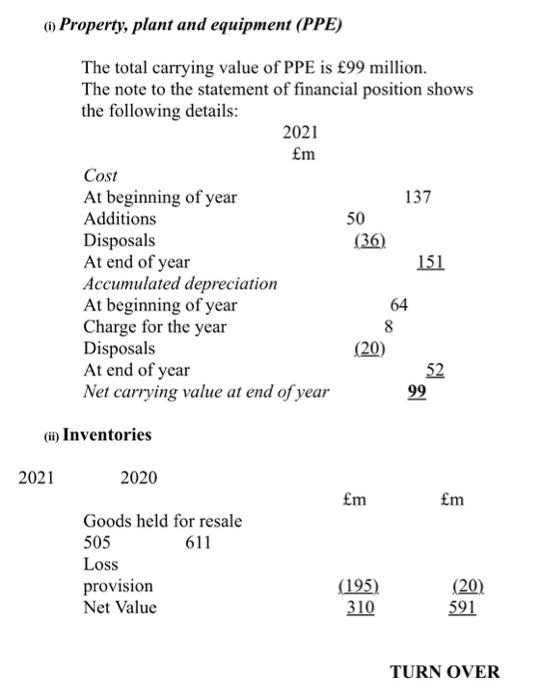

The total carrying value of PPE is 99 million.

The note to the statement of financial position shows the following details:

2021

m

Cost

At beginning of year 137

Additions 50

Disposals (36)

At end of year 151

Accumulated depreciation

At beginning of year 64

Charge for the year 8

Disposals (20)

At end of year 52

Net carrying value at end of year 99

2021 2020

mm

Goods held for resale 505611

Loss provision(195)(20)

Net Value 310591

TURN OVER

Inventories are valued on a weighted average cost basis and carried at the lower of cost and net realisable value. Cost includes all direct expenditure and other attributable costs incurred in bringing inventories to their present location and condition. All inventories are finished goods.

As a direct result of the restrictions on non-essential trade imposed in response to the Covid-19 pandemic, Derwent ability to sell through existing Clothing & Homeware inventories has been significantly impacted and additional inventory loss provisioning has been made in respect of Clothing & Homeware.

When calculating inventory loss provision, the Directors considered the nature and condition of inventory, as well as applying assumptions around when trade restrictions might be eased leading to resumption of sales.

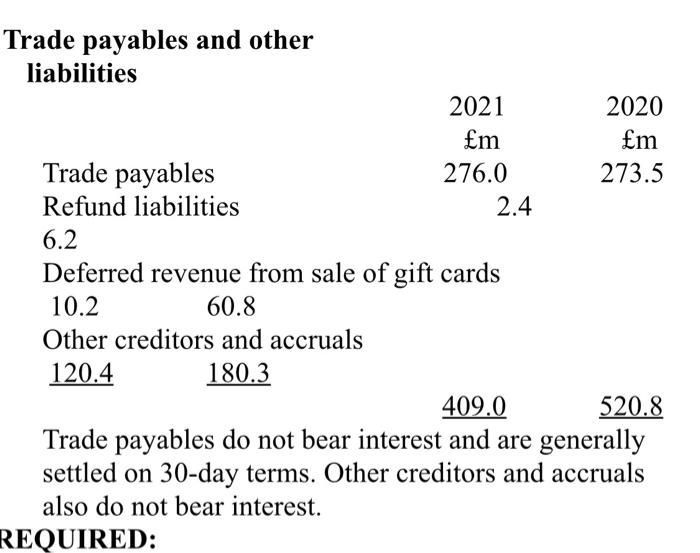

2021 2020

m m

Trade payables276.0 273.5

Refund liabilities 2.4 6.2

Deferred revenue from sale of gift cards 10.2 60.8

Other creditors and accruals 120.4 180.3

409.0 520.8

Trade payables do not bear interest and are generally settled on 30-day terms. Other creditors and accruals also do not bear interest.

REQUIRED:

(6 marks)

(6 marks)

TURN OVER

You should provide a minimum of one audit procedure for each item identified in the schedule of trade and other liabilities.

(13 marks)

Answers should cite relevant standards and provide examples, where appropriate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started