Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question: FlyHigh Ltd is an airline operator based in South Australia. Assume you are the accountant for FlyHigh Ltd and are currently drafting the financial

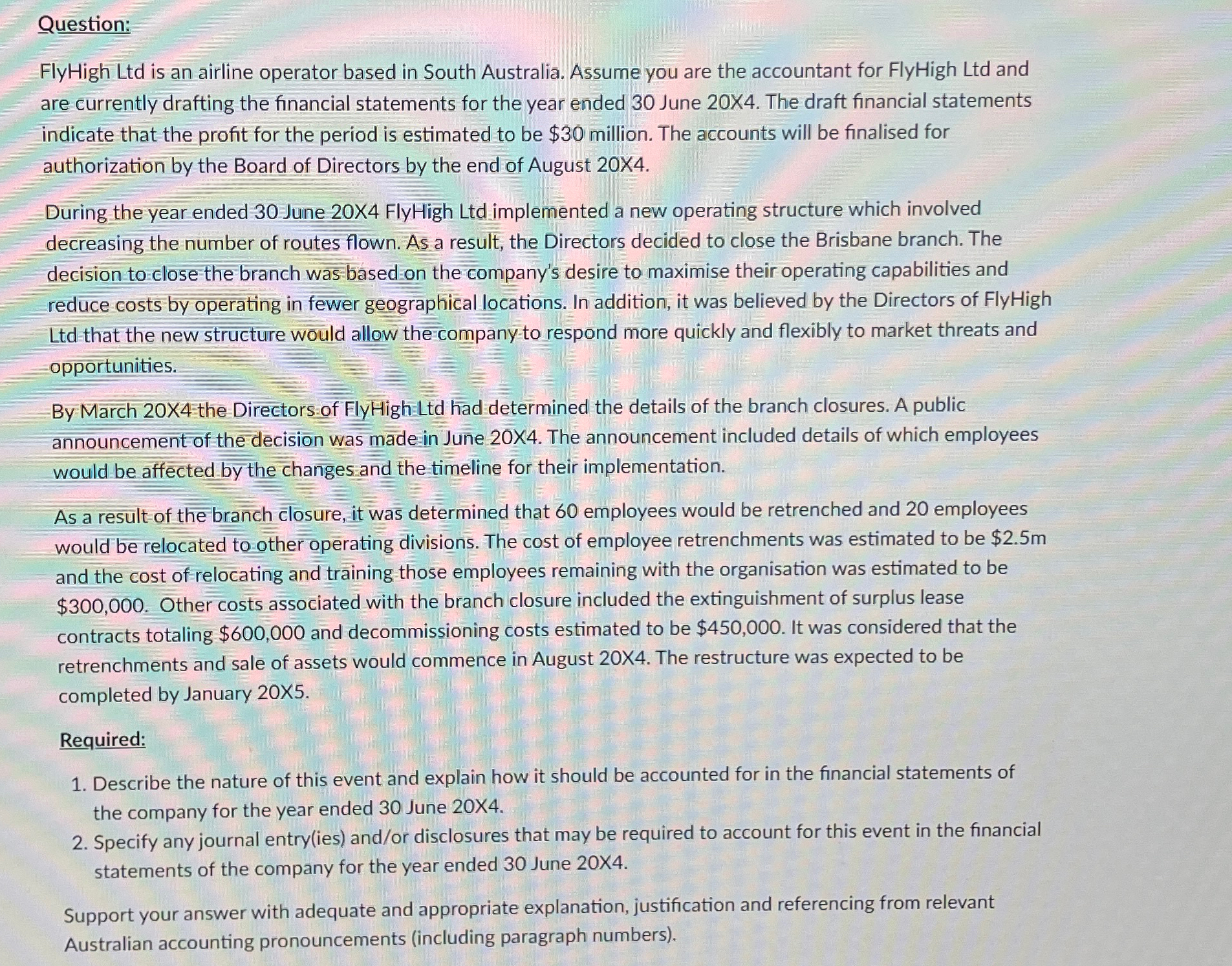

Question:

FlyHigh Ltd is an airline operator based in South Australia. Assume you are the accountant for FlyHigh Ltd and are currently drafting the financial statements for the year ended June X The draft financial statements indicate that the profit for the period is estimated to be $ million. The accounts will be finalised for authorization by the Board of Directors by the end of August X

During the year ended June X FlyHigh Ltd implemented a new operating structure which involved decreasing the number of routes flown. As a result, the Directors decided to close the Brisbane branch. The decision to close the branch was based on the company's desire to maximise their operating capabilities and reduce costs by operating in fewer geographical locations. In addition, it was believed by the Directors of FlyHigh Ltd that the new structure would allow the company to respond more quickly and flexibly to market threats and opportunities.

By March X the Directors of FlyHigh Ltd had determined the details of the branch closures. A public announcement of the decision was made in June X The announcement included details of which employees would be affected by the changes and the timeline for their implementation.

As a result of the branch closure, it was determined that employees would be retrenched and employees would be relocated to other operating divisions. The cost of employee retrenchments was estimated to be $ and the cost of relocating and training those employees remaining with the organisation was estimated to be $ Other costs associated with the branch closure included the extinguishment of surplus lease contracts totaling $ and decommissioning costs estimated to be $ It was considered that the retrenchments and sale of assets would commence in August The restructure was expected to be completed by January X

Required:

Describe the nature of this event and explain how it should be accounted for in the financial statements of the company for the year ended June

Specify any journal entryies andor disclosures that may be required to account for this event in the financial statements of the company for the year ended June

Support your answer with adequate and appropriate explanation, justification and referencing from relevant Australian accounting pronouncements including paragraph numbers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started