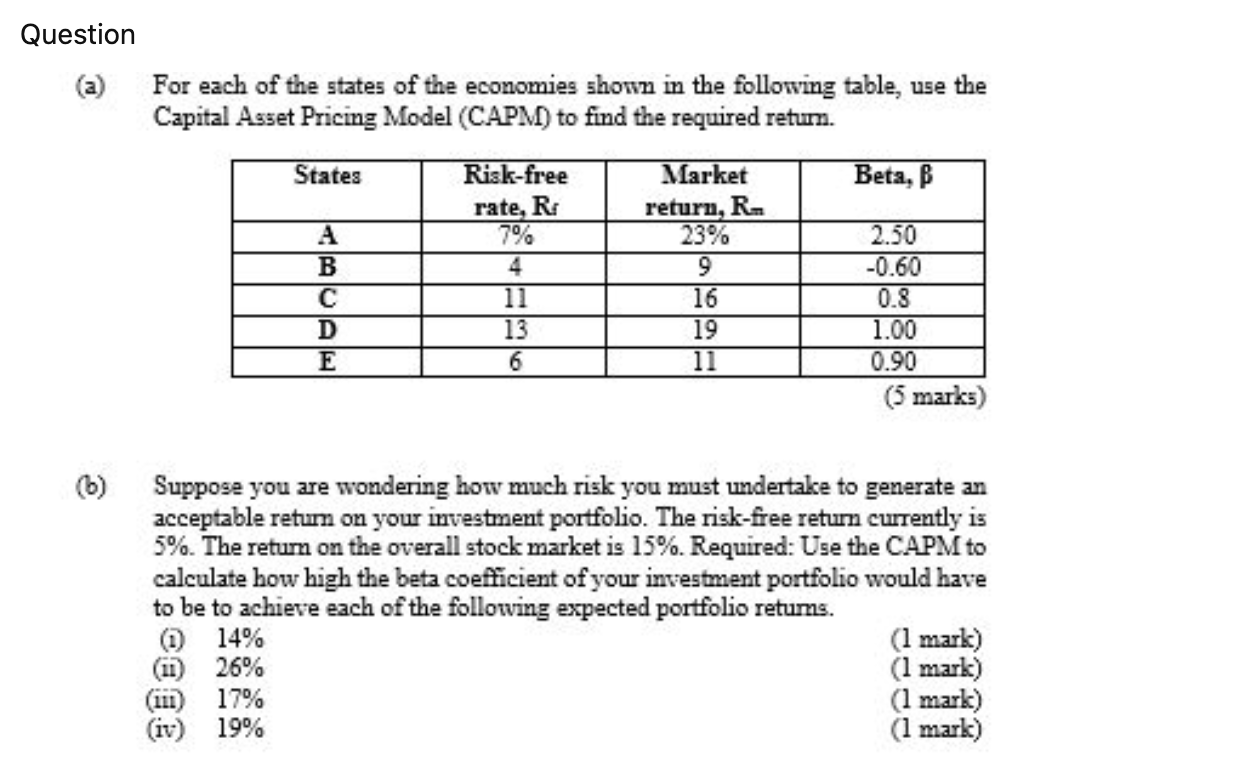

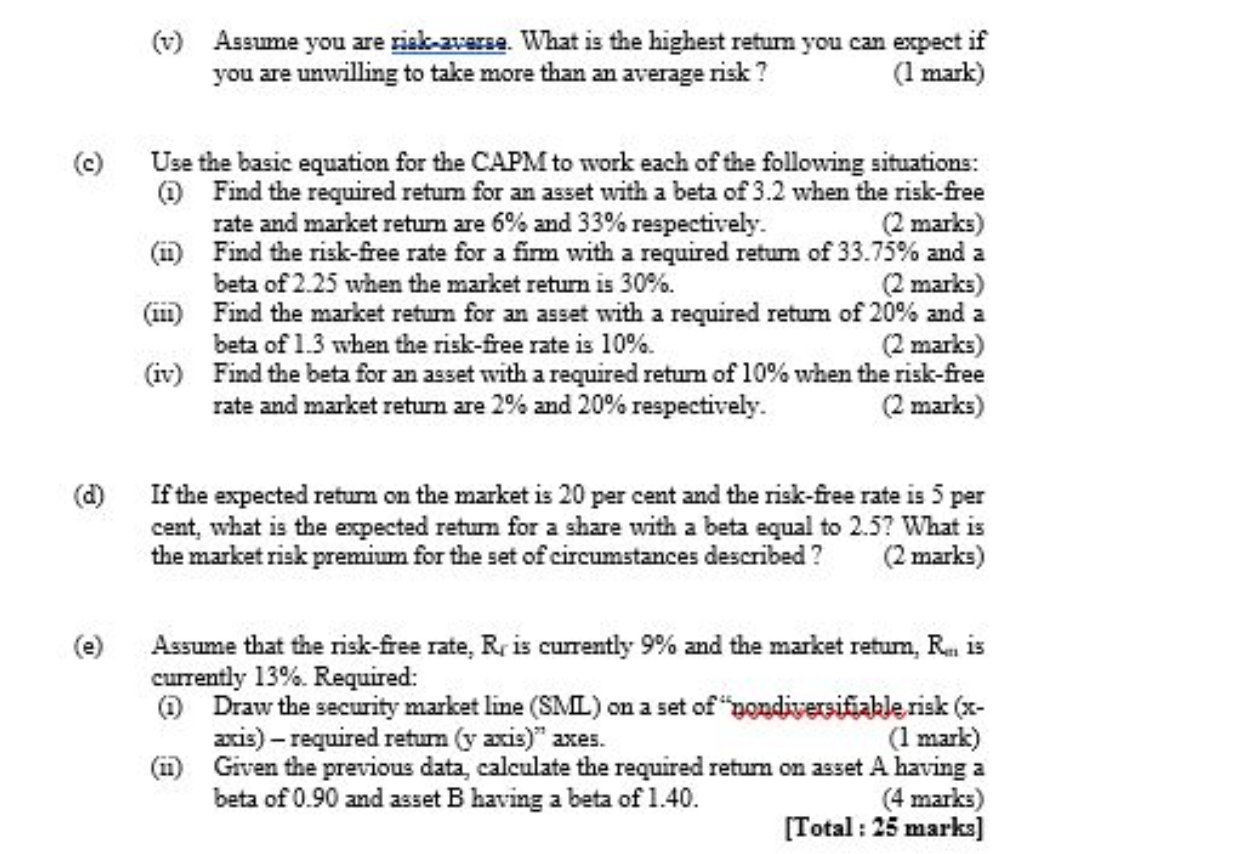

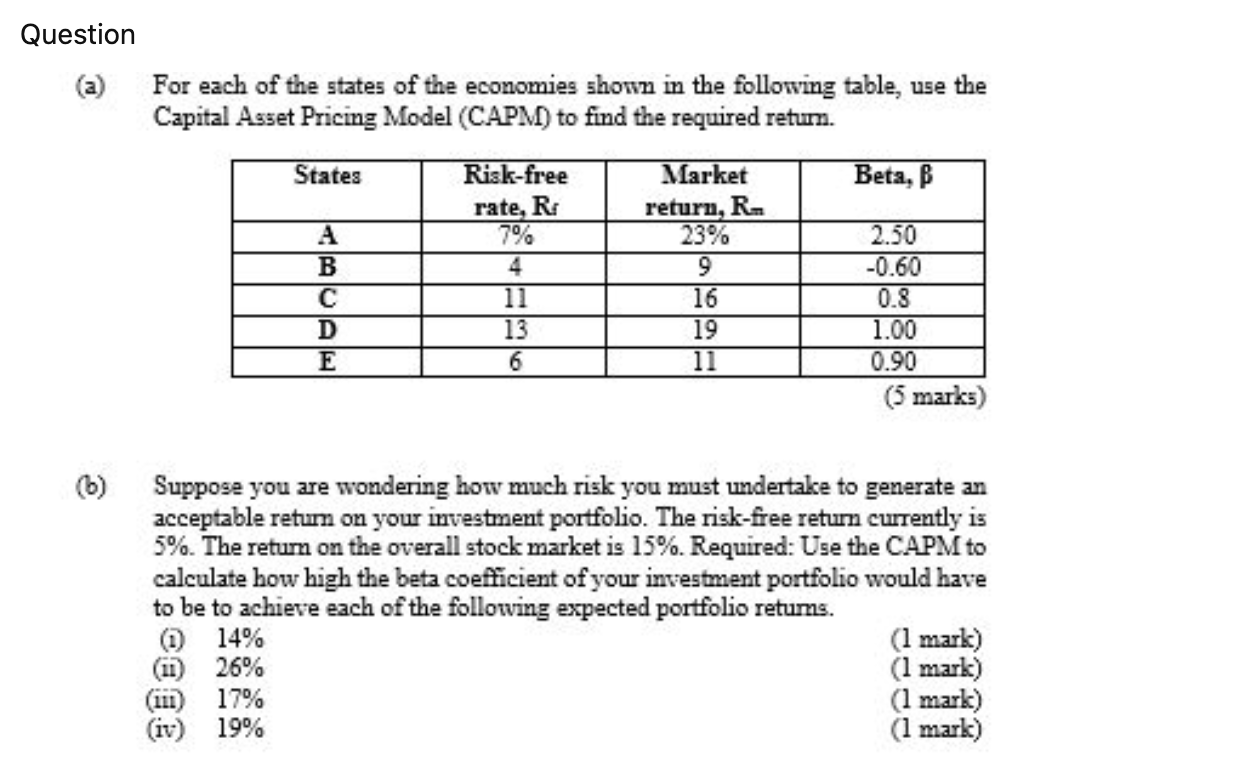

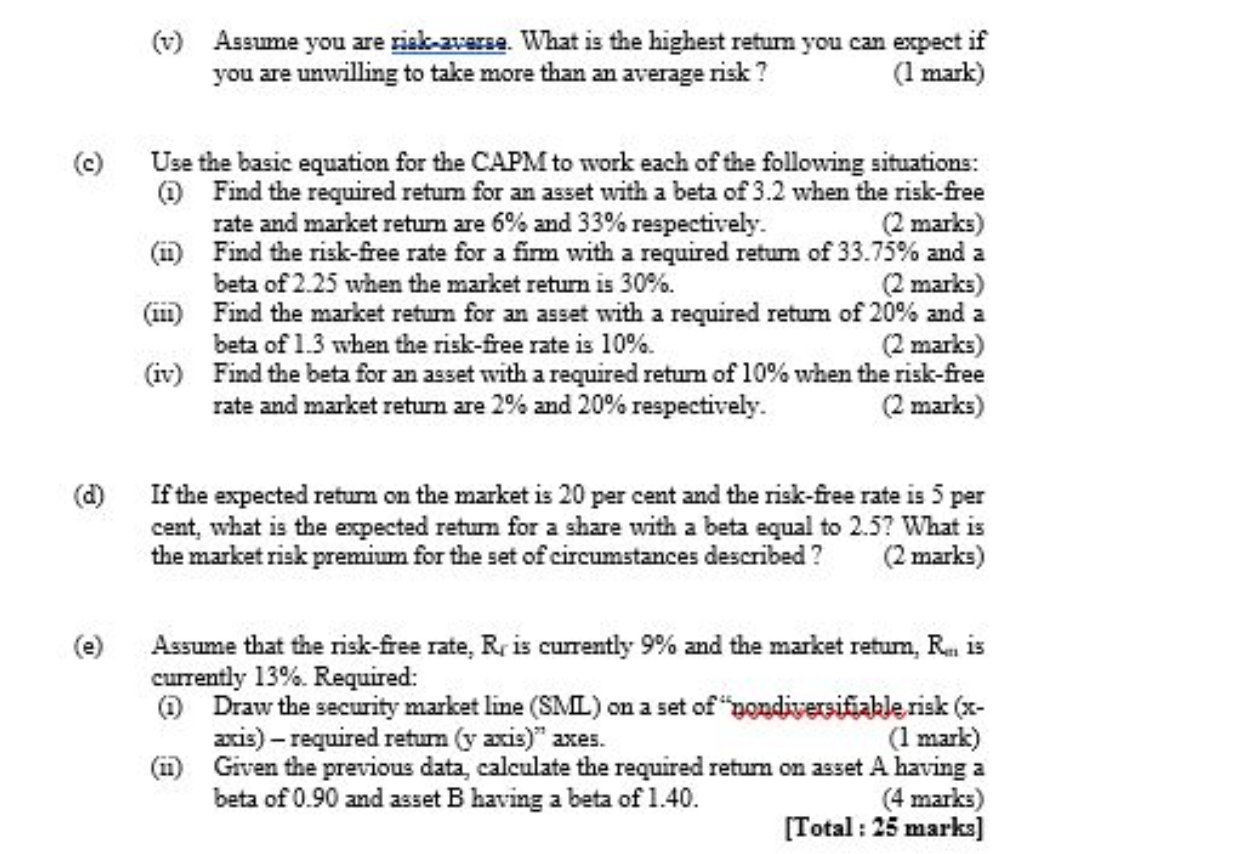

Question For each of the states of the economies shown in the following table, use the Capital Asset Pricing Model (CAPM) to find the required retum. States Beta, A B D E Risk-free rate, R 7% 4 11 13 6 Market return, R. 23% 9 16 19 11 2.50 -0.60 0.8 1.00 0.90 (5 marks) 2 Suppose you are wondering how much risk you must undertake to generate an acceptable return on your investment portfolio. The risk-free return currently is 5%. The return on the overall stock market is 15%. Required: Use the CAPM to calculate how high the beta coefficient of your investment portfolio would have to be to achieve each of the following expected portfolio retums. () 14% (1 mark) () 26% (1 mark) 17% (1 mark) (iv) 19% (1 mark) (v) Assume you are risk-averse. What is the highest retum you can expect if you are unwilling to take more than an average risk? (1 mark) Use the basic equation for the CAPM to work each of the following situations: @ Find the required return for an asset with a beta of 3.2 when the risk-free rate and market return are 6% and 33% respectively. (2 marks) (m) Find the risk-free rate for a firm with a required return of 33.75% and a beta of 2.25 when the market return is 30%. (2 marks) (in) Find the market return for an asset with a required retum of 20% and a beta of 1.3 when the risk-free rate is 10%. (2 marks) (iv) Find the beta for an asset with a required return of 10% when the risk-free rate and market return are 2% and 20% respectively. (2 marks) If the expected return on the market is 20 per cent and the risk-free rate is 5 per cent, what is the expected return for a share with a beta equal to 2.5? What is the market risk premium for the set of circumstances described ? (2 marks) Assume that the risk-free rate, Rr is currently 9% and the market retum, Ry, is currently 13%. Required: Draw the security market line (SML) on a set of nondiversifiable risk (x- axis) - required return (y axis)" axes. (1 mark) Given the previous data, calculate the required retum on asset A having a beta of 0.90 and asset B having a beta of 1.40. (4 marks) [Total : 25 marks] (11)