Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question: format: 3. The controller of Shoe Mart Inc. asks you to prepare a monthly cash budget for the next three months. You are presented

question:  format:

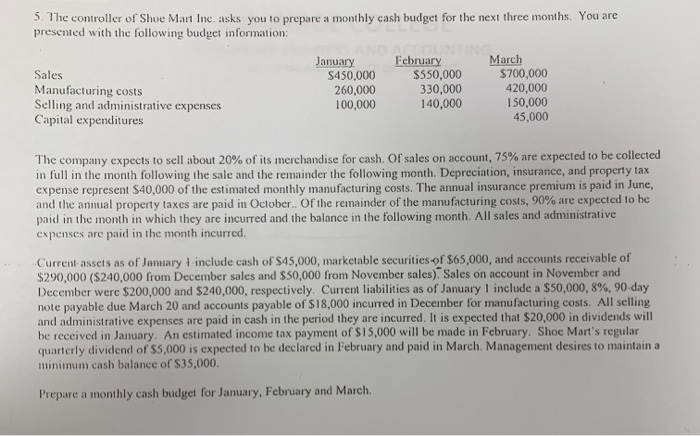

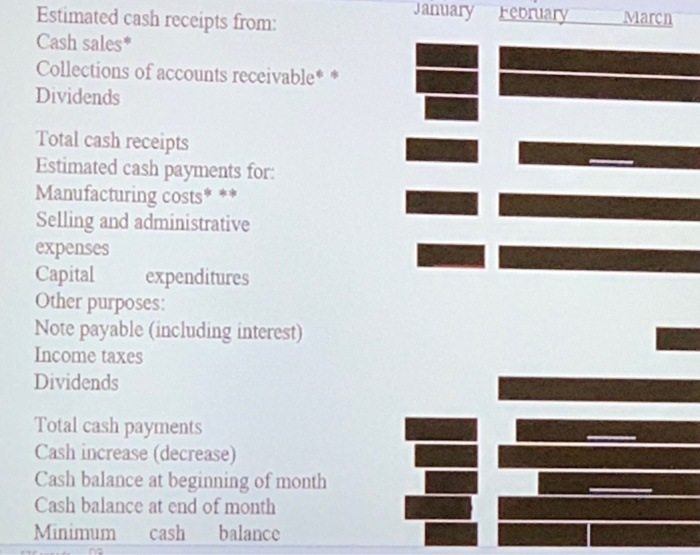

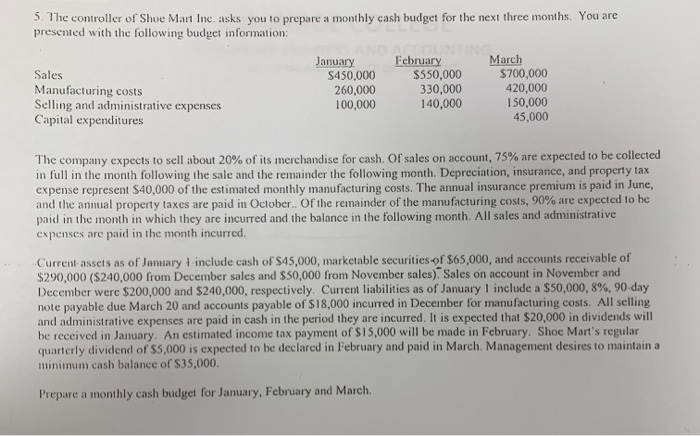

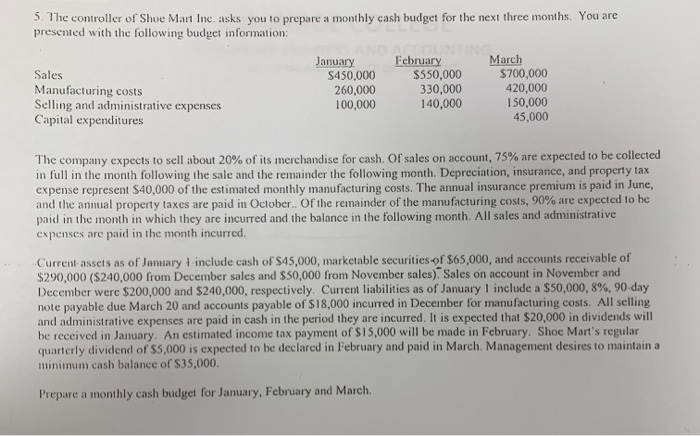

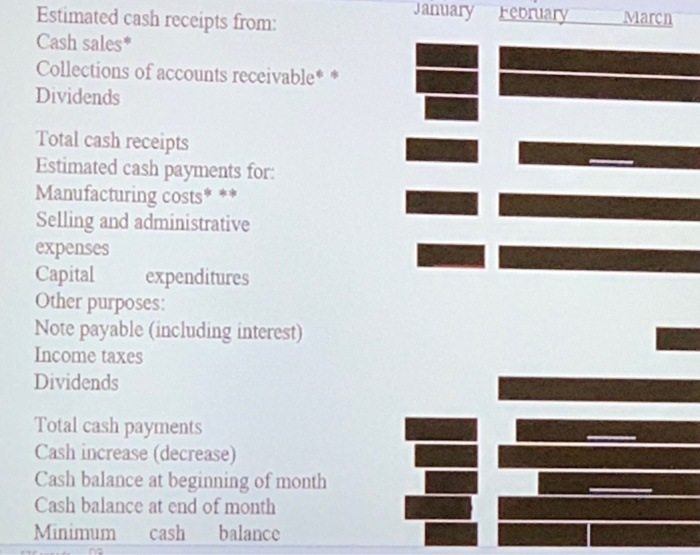

format:  3. The controller of Shoe Mart Inc. asks you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: January February March Sales $450.000 $550,000 $700,000 Manufacturing costs 260,000 330,000 420,000 Selling and administrative expenses 100,000 140,000 150,000 Capital expenditures 45,000 The company expects to sell about 20% of its merchandise for cash or sales on account, 75% are expected to be collected in full in the month following the sale and the remainder the following month. Depreciation, insurance, and property tax expense represent $40,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in June, and the annual property taxes are paid in October. Of the remainder of the manufacturing costs, 90% are expected to he paid in the month in which they are incurred and the balance in the following month. All sales and administrative expenses are paid in the month incurred. Current assets as of January 1-include cash of $45,000, marketable securities of $65,000, and accounts receivable of $290,000 (S240,000 from December sales and S50,000 from November sales). Sales on account in November and December were $200,000 and $240,000, respectively. Current liabilities as of January 1 include a $50,000, 8%, 90-day note payable due March 20 and accounts payable of $18,000 incurred in December for manufacturing costs. All selling and administrative expenses are paid in cash in the period they are incurred. It is expected that $20,000 in dividends will be received in January. An estimated income tax payment of $15,000 will be made in February. Shoe Mart's regular quarterly dividend of $5,000 is expected to be declared in February and p minimum cash balance of 535,000. Prepare a monthly cash budget for January, February and March January February March Estimated cash receipts from: Cash sales Collections of accounts receivable Dividends Total cash receipts Estimated cash payments for: Manufacturing costs* ** Selling and administrative expenses Capital expenditures Other purposes: Note payable (including interest) Income taxes Dividends Total cash payments Cash increase (decrease) Cash balance at beginning of month Cash balance at end of month Minimum cash balance

3. The controller of Shoe Mart Inc. asks you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: January February March Sales $450.000 $550,000 $700,000 Manufacturing costs 260,000 330,000 420,000 Selling and administrative expenses 100,000 140,000 150,000 Capital expenditures 45,000 The company expects to sell about 20% of its merchandise for cash or sales on account, 75% are expected to be collected in full in the month following the sale and the remainder the following month. Depreciation, insurance, and property tax expense represent $40,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in June, and the annual property taxes are paid in October. Of the remainder of the manufacturing costs, 90% are expected to he paid in the month in which they are incurred and the balance in the following month. All sales and administrative expenses are paid in the month incurred. Current assets as of January 1-include cash of $45,000, marketable securities of $65,000, and accounts receivable of $290,000 (S240,000 from December sales and S50,000 from November sales). Sales on account in November and December were $200,000 and $240,000, respectively. Current liabilities as of January 1 include a $50,000, 8%, 90-day note payable due March 20 and accounts payable of $18,000 incurred in December for manufacturing costs. All selling and administrative expenses are paid in cash in the period they are incurred. It is expected that $20,000 in dividends will be received in January. An estimated income tax payment of $15,000 will be made in February. Shoe Mart's regular quarterly dividend of $5,000 is expected to be declared in February and p minimum cash balance of 535,000. Prepare a monthly cash budget for January, February and March January February March Estimated cash receipts from: Cash sales Collections of accounts receivable Dividends Total cash receipts Estimated cash payments for: Manufacturing costs* ** Selling and administrative expenses Capital expenditures Other purposes: Note payable (including interest) Income taxes Dividends Total cash payments Cash increase (decrease) Cash balance at beginning of month Cash balance at end of month Minimum cash balance

question:

format:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started