Answered step by step

Verified Expert Solution

Question

1 Approved Answer

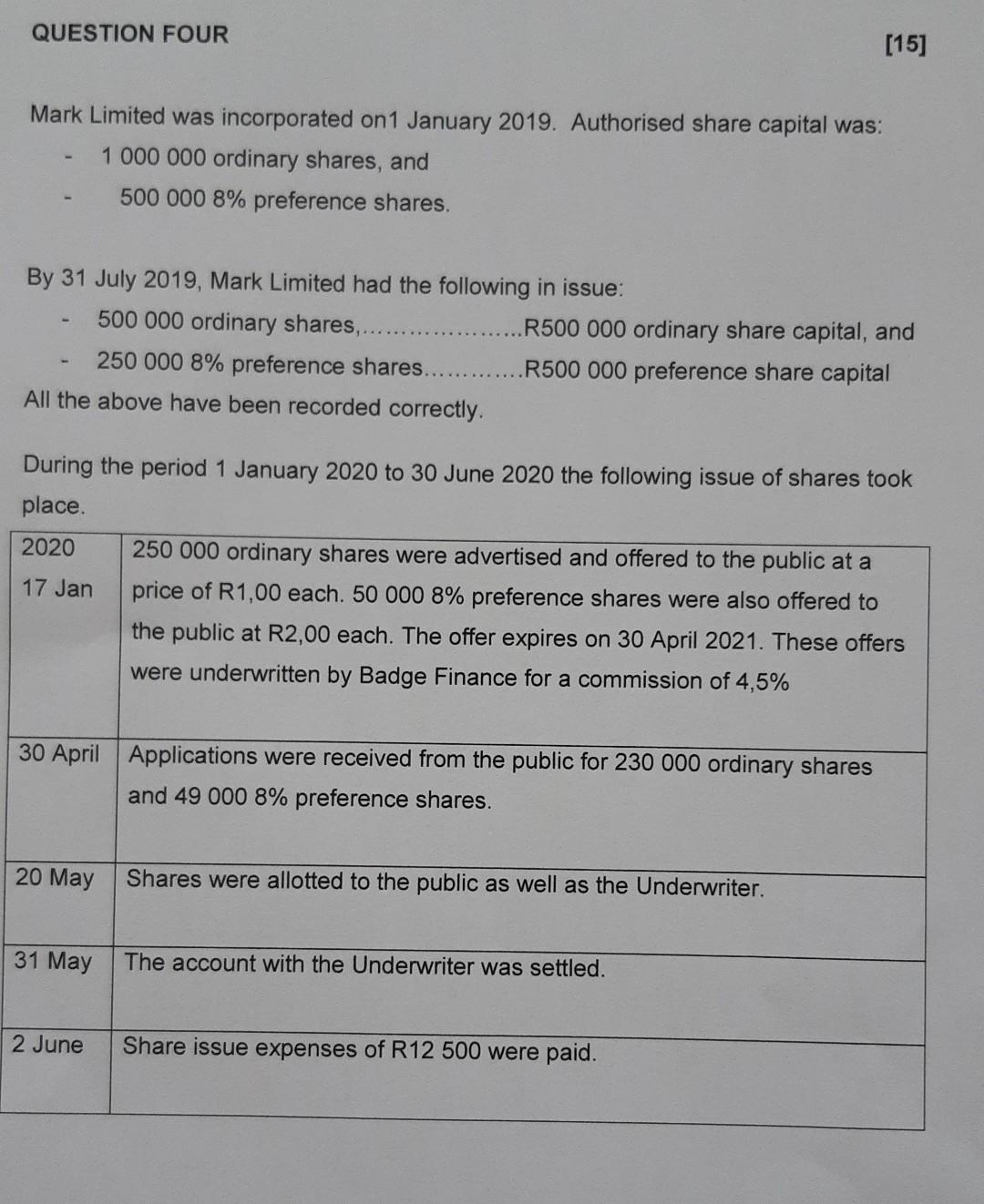

QUESTION FOUR [15] Mark Limited was incorporated on 1 January 2019. Authorised share capital was: 1 000 000 ordinary shares, and 500 000 8% preference

QUESTION FOUR [15] Mark Limited was incorporated on 1 January 2019. Authorised share capital was: 1 000 000 ordinary shares, and 500 000 8% preference shares. By 31 July 2019, Mark Limited had the following in issue: 500 000 ordinary shares, .R500 000 ordinary share capital, and 250 000 8% preference shares.. R500 000 preference share capital All the above have been recorded correctly. During the period 1 January 2020 to 30 June 2020 the following issue of shares took place. 2020 250 000 ordinary shares were advertised and offered to the public at a 17 Jan price of R1,00 each. 50 000 8% preference shares were also offered to the public at R2,00 each. The offer expires on 30 April 2021. These offers were underwritten by Badge Finance for a commission of 4,5% 30 April Applications were received from the public for 230 000 ordinary shares and 49 000 8% preference shares. 20 May Shares were allotted to the public as well as the Underwriter. 31 May The account with the Underwriter was settled. 2 June Share issue expenses of R12 500 were paid. BACHELOR OF COMMERCE YEAR 1 - ACADEMIC AND ASSESSMENT CALENDAR - DISTANCE Required: Record the above transactions in the general journal relating to the above issues of both the ordinary shares and preference shares Narrations are not required (15)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started