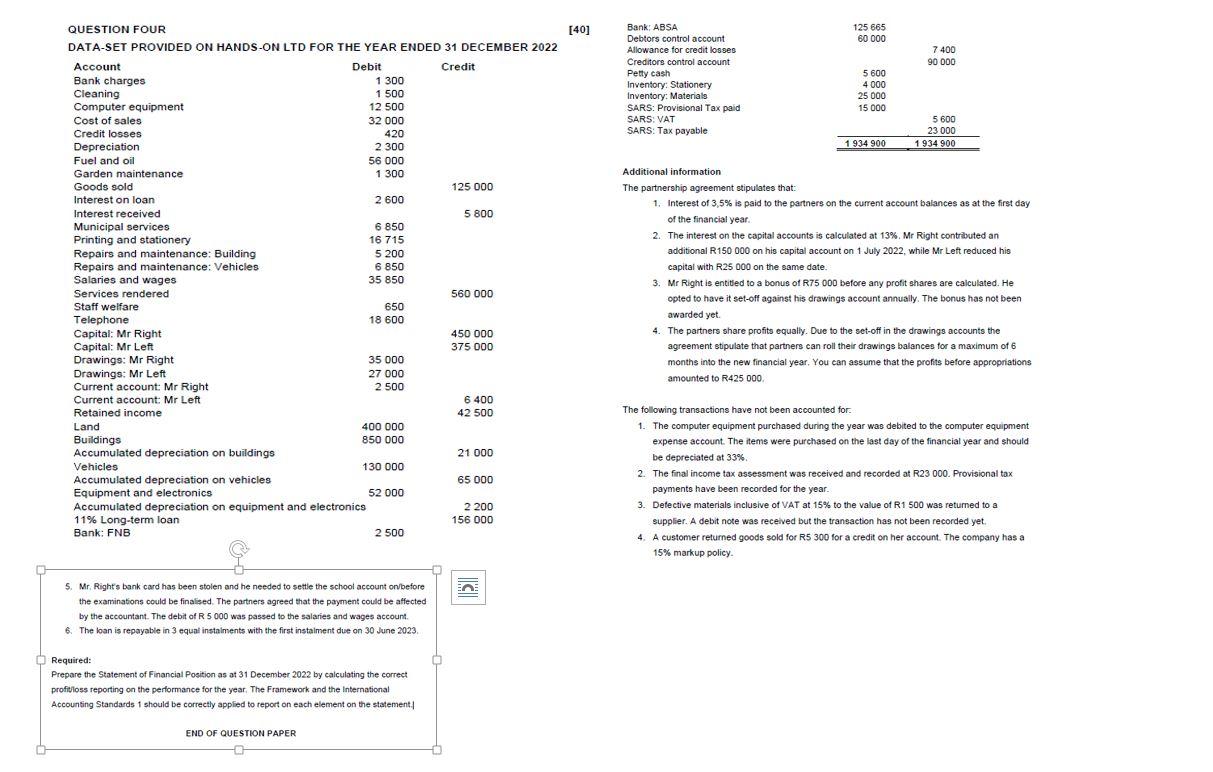

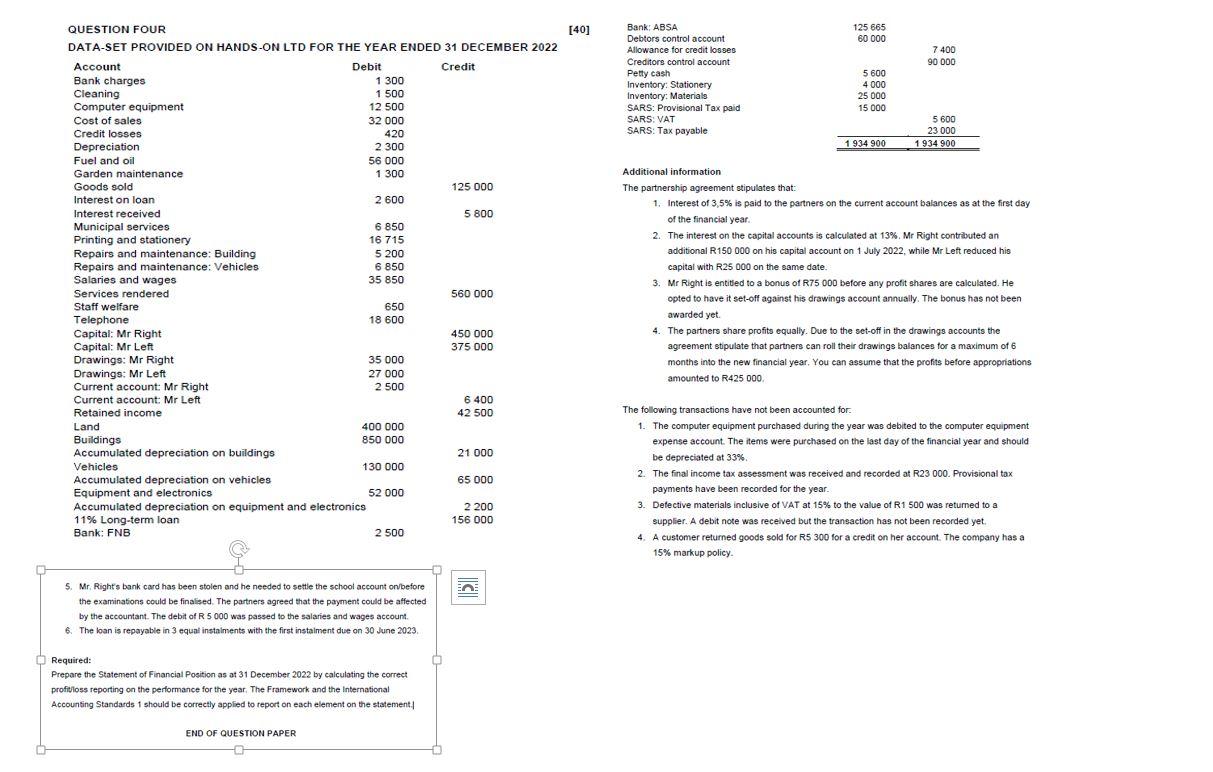

QUESTION FOUR [40] DATA-SET PROVIDED ON HANDS-ON LTD FOR THE YEAR ENDED 31 DECEMBER 2022 Additional information The partnership agreement stipulates that: 1. Interest of 3,5% is paid to the partners on the current account balances as at the first day of the financial year. 2. The interest on the capital accounts is calculated at 13%, Mr Right contributed an additional R150000 on his capital account on 1 July 2022 , while Mr Left reduced his capital with R25 000 on the same date. 3. Mr Right is entitled to a bonus of R75 000 before any profit shares are calculated. He opted to have it set-off against his drawings account annually. The bonus has not been awarded yet. 4. The partners share profits equally. Due to the set-off in the drawings accounts the agreement stipulate that partners can roll their drawings balances for a maximum of 6 months into the new financial year, You can assume that the profits before appropriations amounted to R425 000 . The following transactions have not been accounted for: 1. The computer equipment purchased during the year was debited to the computer equipment expense account. The items were purchased on the last day of the financial year and should be depreciated at 33%. 2. The final income tax assessment was received and recorded at R23 000 . Provisional tax payments have been recorded for the year. 3. Detective materials inclusive of VAT at 15% to the value of R1 500 was returned to a supplier. A debit note was received but the transaction has not been recorded yet. 4. A customer returned goods sold for R5 300 for a credit on her account. The company has a 15% markup policy. 5. Mr. Right's bank card has been stolen and he needed to settle the school account on/before the examinations could be finalised. The partners agreed that the payment could be affected by the accountant. The debit of R5000 was passed to the salaries and wages account. 6. The loan is repayable in 3 equal instaiments with the first instaiment due on 30 June 2023. Required: Prepare the Statement of Financial Poeition as at 31 December 2022 by calculating the correct profitloss reporting on the performance for the year. The Framework and the International Accounting Standards 1 should be correctly applied to report on each element on the statement.1 END OF QUESTION PAPER