Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION FOUR a) Explain how volatility affects the values of call and put options. BE332-6-AU/5 (7 marks) b) A bull spread strategy is created

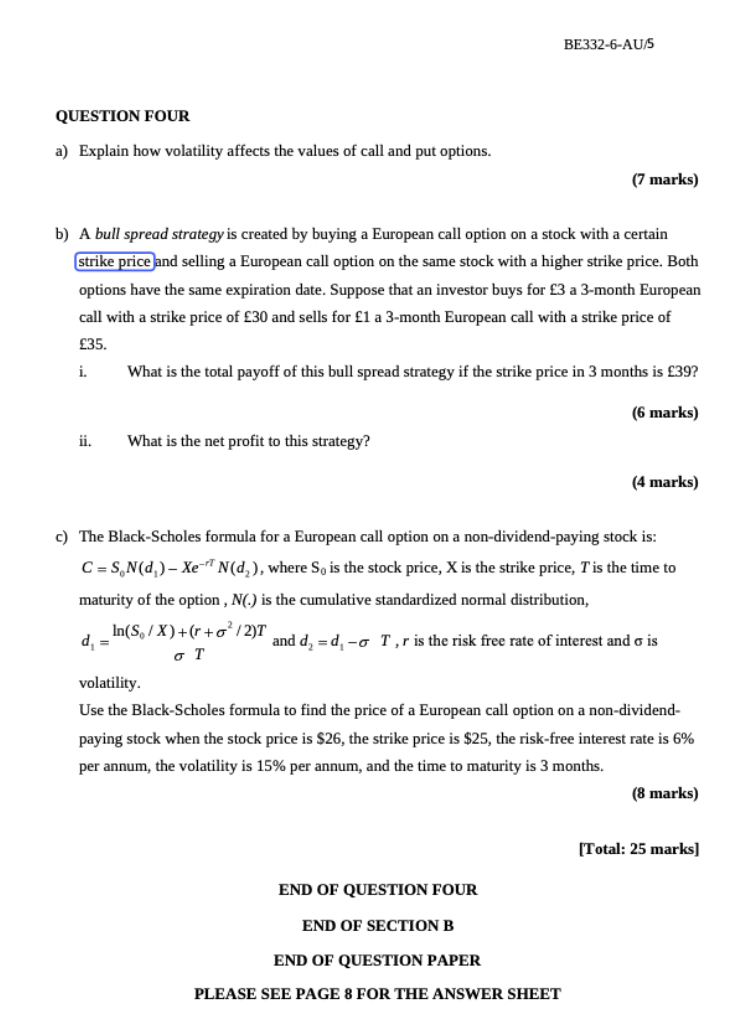

QUESTION FOUR a) Explain how volatility affects the values of call and put options. BE332-6-AU/5 (7 marks) b) A bull spread strategy is created by buying a European call option on a stock with a certain strike price and selling a European call option on the same stock with a higher strike price. Both options have the same expiration date. Suppose that an investor buys for 3 a 3-month European call with a strike price of 30 and sells for 1 a 3-month European call with a strike price of 35. i. What is the total payoff of this bull spread strategy if the strike price in 3 months is 39? (6 marks) ii. What is the net profit to this strategy? (4 marks) c) The Black-Scholes formula for a European call option on a non-dividend-paying stock is: -T C=S,N(d,)- Xe N(d), where So is the stock price, X is the strike price, T'is the time to maturity of the option, N(.) is the cumulative standardized normal distribution, In(S,/X)+(r+o2/2)T d = and d =d, T, r is the risk free rate of interest and is volatility. Use the Black-Scholes formula to find the price of a European call option on a non-dividend- paying stock when the stock price is $26, the strike price is $25, the risk-free interest rate is 6% per annum, the volatility is 15% per annum, and the time to maturity is 3 months. (8 marks) END OF QUESTION FOUR END OF SECTION B END OF QUESTION PAPER PLEASE SEE PAGE 8 FOR THE ANSWER SHEET [Total: 25 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started