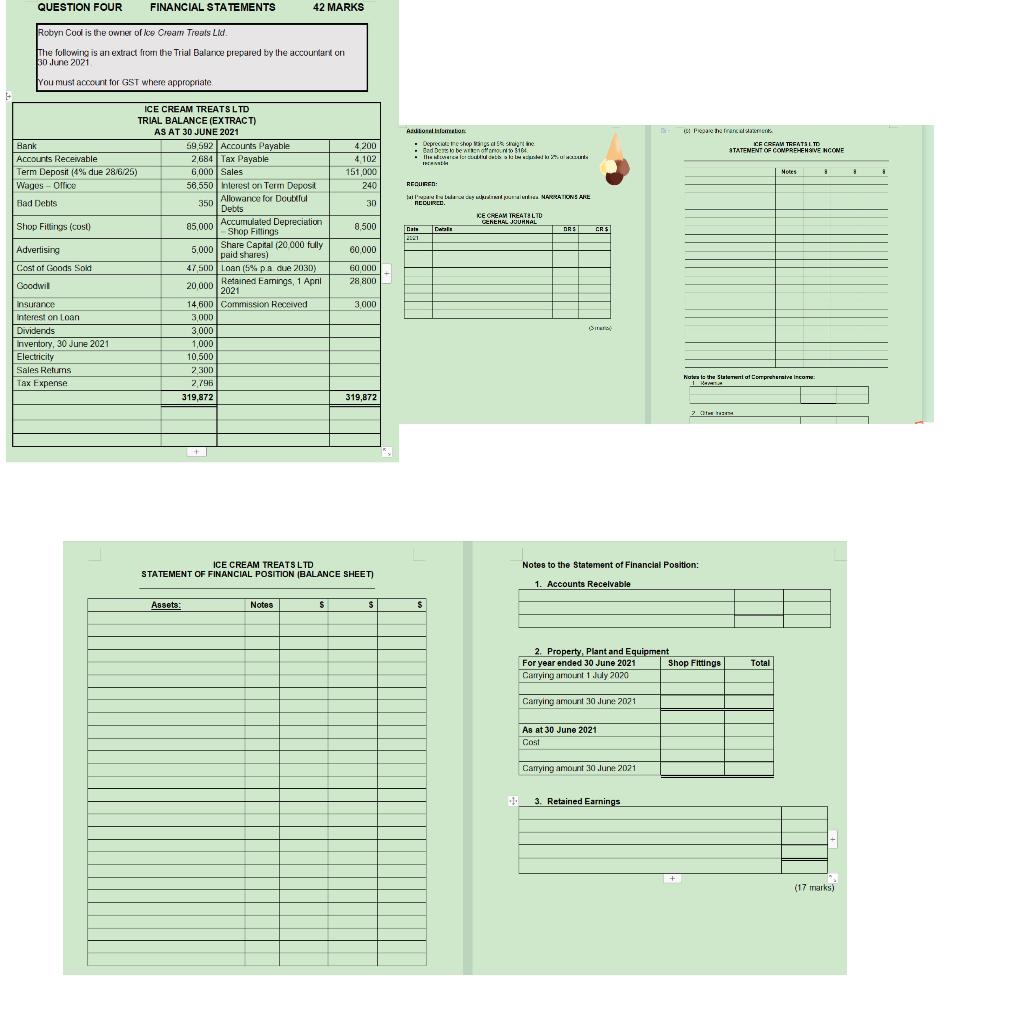

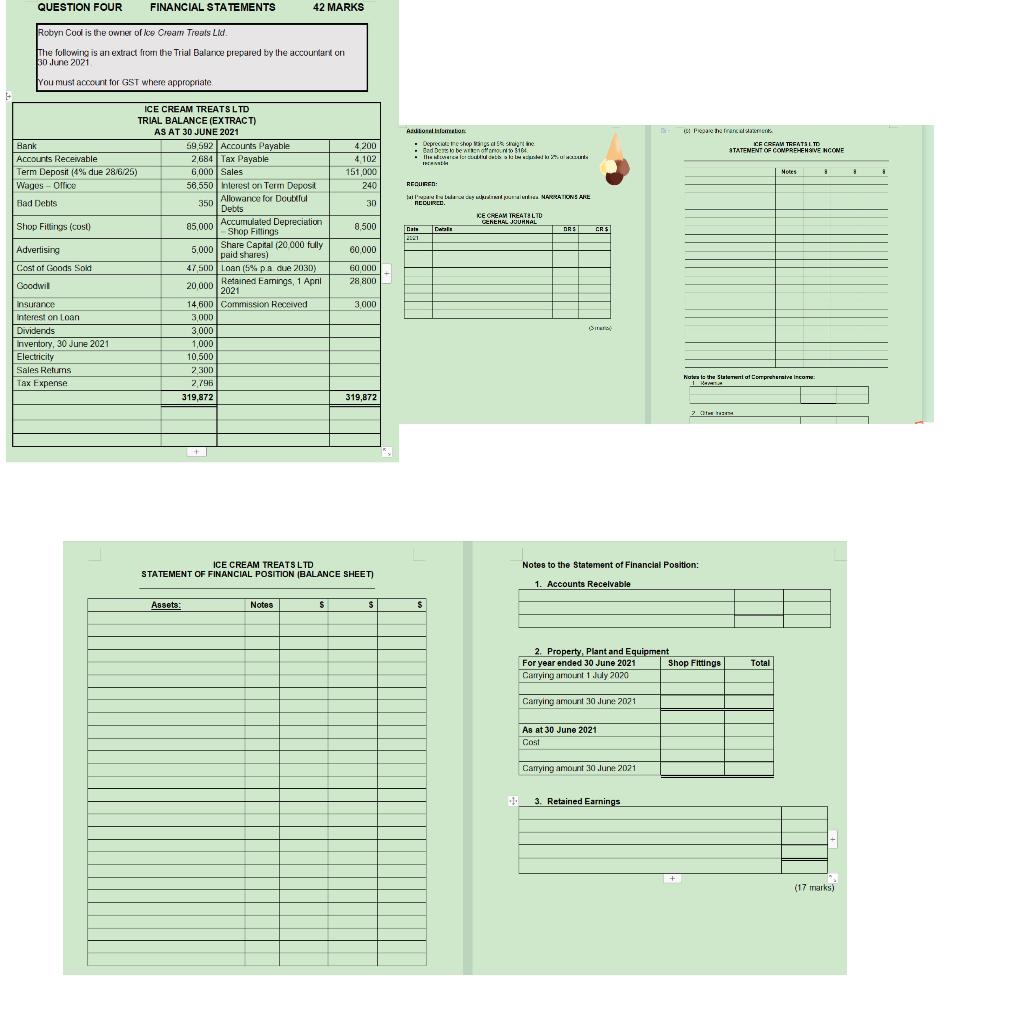

QUESTION FOUR FINANCIAL STATEMENTS 42 MARKS Robyn Cod is the owner of loe Cream Treals Ltd. The following is an extract from the Trial Balance prepared by the accountant on 30 June 2021 You must account for GST where appropriate ICE CREAM TREATS LTD TRIAL BALANCE (EXTRACT) AS AT 30 JUNE 2021 Pregate de france Bank 4 200 Aadion Oxprecursos - Bad De 1 . then wereldbold CE CREAM THEATS LTD STATEMENT OF COMPREHENSIVE NGONE 4102 INH Accounts Receivable Term Deposit (4% due 28/6/25) Wages - Office 151,000 Moles a 240 REGUREN: Rad Debts 30 INNE NARRATIONS ARE TECURED KE CREAM TREAT LTD KEHAL JOURNAL Data Tawali DRS CRS 2121 Shop Fittings (COSC) 8.500 Advertising 59 592 Accounts Payable 2 684 Tax Payable 6000 Sales 58,550 Interest on Term Dopos Allowance for Doubtful 350 Debts 85,000 Accumulated Depreciation Shop Fittings 5,000 Share Capital (20.000 fully paid shares) 47 500 Loan (5% pa cu 2030) Retained Eamings, 1 April 20.000 2021 14 600 Commission Received 3,000 3.000 1,000 10,500 60.000 Cost of Goods Sold 60 000 Goodwil 28 800 Insurance 3 000 interest on loon Dividends Inventory, 30 June 2021 Electricity Sales Reums 2 300 2.796 Tax Expense hat is the statement Corporate Inco: 1 Wem 319,872 319,872 7 CH334 Notes to the Statement of Financial Position: ICE CREAM TREATS LTD STATEMENT OF FINANCIAL POSITION (BALANCE SHEET) 1. Accounts Receivable Assets Notes $ $ $ 2. Property, plant and Equipment For year ended 30 June 2021 Shop Fittings Carrying amount 1 July 2020 Total Carrying amount 30 June 2021 As at 30 June 2021 Cost Carrying amount 30 June 2021 10 3. Retained Earnings + (17 tarks) QUESTION FOUR FINANCIAL STATEMENTS 42 MARKS Robyn Cod is the owner of loe Cream Treals Ltd. The following is an extract from the Trial Balance prepared by the accountant on 30 June 2021 You must account for GST where appropriate ICE CREAM TREATS LTD TRIAL BALANCE (EXTRACT) AS AT 30 JUNE 2021 Pregate de france Bank 4 200 Aadion Oxprecursos - Bad De 1 . then wereldbold CE CREAM THEATS LTD STATEMENT OF COMPREHENSIVE NGONE 4102 INH Accounts Receivable Term Deposit (4% due 28/6/25) Wages - Office 151,000 Moles a 240 REGUREN: Rad Debts 30 INNE NARRATIONS ARE TECURED KE CREAM TREAT LTD KEHAL JOURNAL Data Tawali DRS CRS 2121 Shop Fittings (COSC) 8.500 Advertising 59 592 Accounts Payable 2 684 Tax Payable 6000 Sales 58,550 Interest on Term Dopos Allowance for Doubtful 350 Debts 85,000 Accumulated Depreciation Shop Fittings 5,000 Share Capital (20.000 fully paid shares) 47 500 Loan (5% pa cu 2030) Retained Eamings, 1 April 20.000 2021 14 600 Commission Received 3,000 3.000 1,000 10,500 60.000 Cost of Goods Sold 60 000 Goodwil 28 800 Insurance 3 000 interest on loon Dividends Inventory, 30 June 2021 Electricity Sales Reums 2 300 2.796 Tax Expense hat is the statement Corporate Inco: 1 Wem 319,872 319,872 7 CH334 Notes to the Statement of Financial Position: ICE CREAM TREATS LTD STATEMENT OF FINANCIAL POSITION (BALANCE SHEET) 1. Accounts Receivable Assets Notes $ $ $ 2. Property, plant and Equipment For year ended 30 June 2021 Shop Fittings Carrying amount 1 July 2020 Total Carrying amount 30 June 2021 As at 30 June 2021 Cost Carrying amount 30 June 2021 10 3. Retained Earnings + (17 tarks)