Answered step by step

Verified Expert Solution

Question

1 Approved Answer

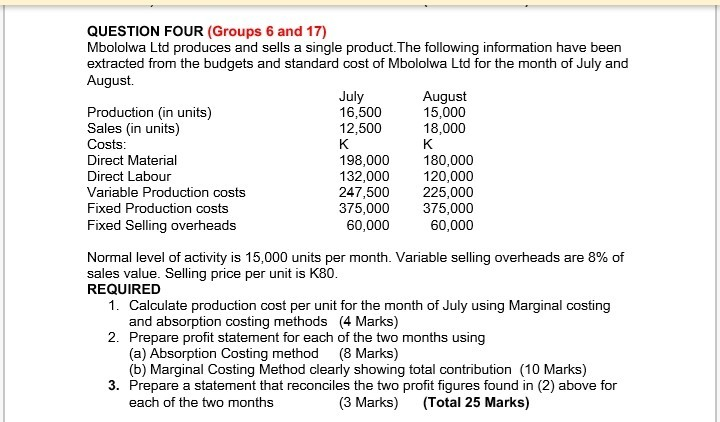

QUESTION FOUR (Groups 6 and 17) Mbololwa Ltd produces and sells a single product. The following information have been extracted from the budgets and standard

QUESTION FOUR (Groups 6 and 17) Mbololwa Ltd produces and sells a single product. The following information have been extracted from the budgets and standard cost of Mbololwa Ltd for the month of July and August. July 16,500 12,500 August 15,000 18,000 Production (in units) Sales (in units) Costs Direct Material Direct Labour Variable Production costs Fixed Production costs Fixed Selling overheads 198,000 132,000 247,500 375,000 180,000 120,000 225,000 375,000 60,000 60,000 Normal level of activity is 15,000 units per month. Variable selling overheads are 8% of sales value. Selling price per REQUIRED unit is K80 1. Calculate production cost per unit for the month of July using Marginal costing and absorption costing methods (4 Marks) 2. Prepare profit statement for each of the two months using (a) Absorption Costing method (8 Marks) (b) Marginal Costing Method clearly showing total contribution (10 Marks) 3. Prepare a statement that reconciles the two profit figures found in (2) above for (3 Marks) each of the two months (Total 25 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started