Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION FOUR Pan African Ltd is a Kenya multinational company with subsidiary in Tanzania. The Tanzania subsidiary has an opportunity to invest in a project

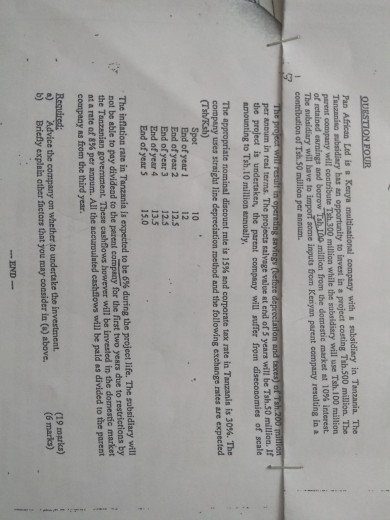

QUESTION FOUR Pan African Ltd is a Kenya multinational company with subsidiary in Tanzania. The Tanzania subsidiary has an opportunity to invest in a project costing Tsh.500 million. The parent company will contribute Tsh.300 million while the subsidiary will use Tsh.100 million of retained earnings and borrow Tsh 10 million from the domestic market at 10% interest The subsidiary will bave to import some inputs from Kenyan parent company resulting in a contribution of Tsh 50 million per annum The poor w a t in operating saving (before depreciation and axes) of th e per annum in real terms. The projects salvage value at end of 5 years will be Tsh.30 min . the project is undertaken the parent company will suffer from diseconomies of scale amounting to Tsh.10 million annually, The appropriate nominal discount ma is 15% and corporate tax rate in Tanzania is 30%. The company uses straight line depreciation method and the following exchange rates are expected (ish) Spot 10 End of year 1 End of year 2 12.5 End of year 3 End of year 4 13.5 End of years 15.0 12 The inflation rate in Tanzania is expected to be 6% during the project life. The subsidiary will not be able to pay divided to the parent company for the first two years due to restrictions by the Tanzanian government. These cashflows however will be invested in the domestic market at amte of 8% per annum. All the accurulated cashflows will be paid as divided to the parent company as from the third year. Required: a) Advice the company on whether to undertake the investment b) Briefly explain other factors that you may consider in ) above. (19 oprks) (6 marks) --END- QUESTION FOUR Pan African Ltd is a Kenya multinational company with a subsidiary in Tanzania. The Tanzanian subsidiary has an opportunity to invest in a project costing Tsh.500 million. The parent company will contribute Tsh 300 million while the subsidiary will use Tsh. 100 million of retained earnings and borrow Tsh. 100 million from the domestic market st 10% interest The subsidiary will have to import some inputs from Kenyan parent company resulting in a contribution of Tsh.50 million per annum. DN- Page 2 of 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started