Question: Give a short explanation of your conclusions about your company after each category of ratios (i.e. How liquid is your company? How efficiently is it using its assets? etc.).

I need help with my explanations. the company I chose is Ralph Lauren. The red sentences are example sentences.

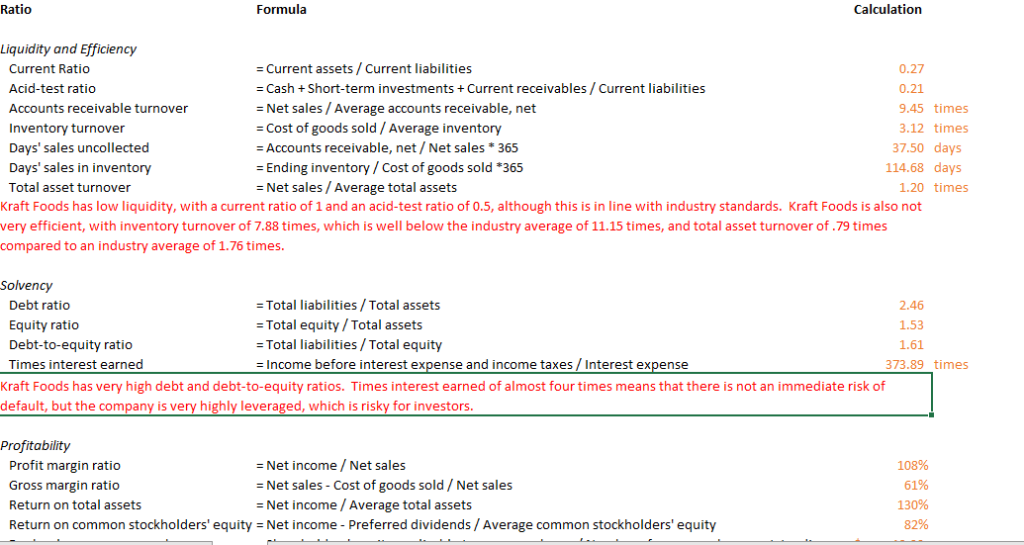

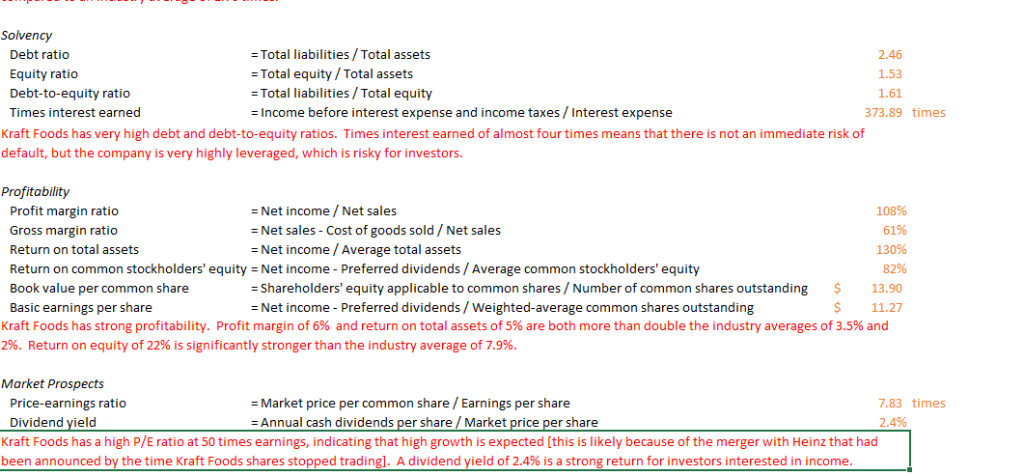

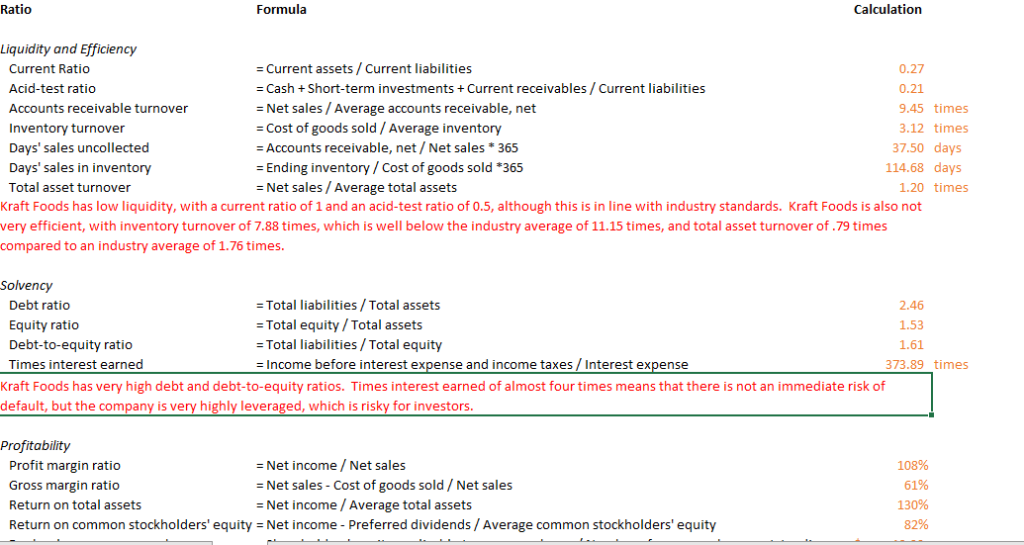

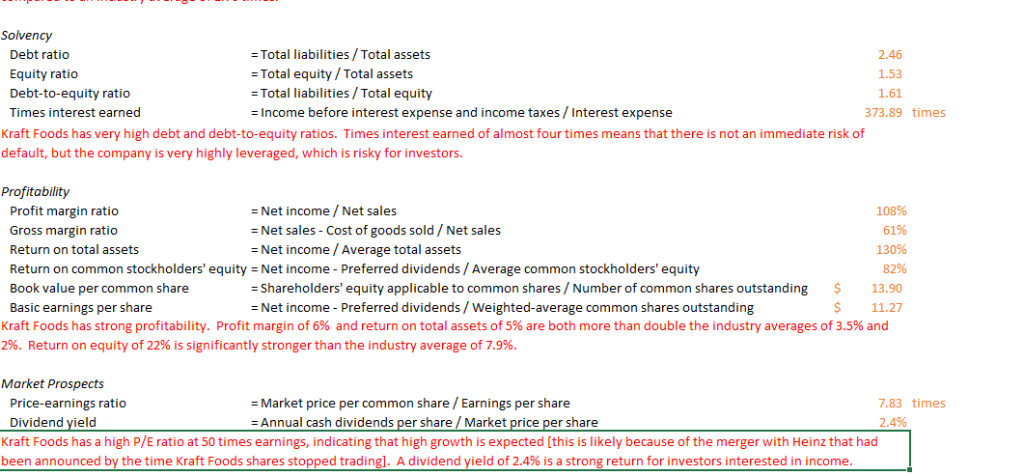

Ratio Formula Calculation Liquidity and Efficiency Current Ratio Acid-test ratio Accounts receivable turnover Inventory turnover Days' sales uncollected Days' sales in inventory Total asset turnover Current assets/Current liabilities -Cash Short-term investmentsCurrent receivables/Current liabilities -Net sales/ Average accounts receivable, net Cost of goods sold / Average inventory 0.27 0.21 9.45 times 3.12 times 7.50 days Accounts receivable, net/Net sales 365 -Ending inventory/ Cost of goods sold *365 -Net sales/ Average total assets 114.68 days 1.20 times Kraft Foods has low liquidity, with a current ratio of 1 and an acid-test ratio of 0.5, although this is in line with industry standards. Kraft Foods is also not very efficient, with inventory turnover of 7.88 times, which is well below the industry average of 11.15 times, and total asset turnover of .79 times compared to an industry average of 1.76 times. -Total liabilities /Total assets Debt ratio Equity ratio Debt-to-equity ratio Times interest earned Total equity/Total assets -Total liabilities/Total equity - Income before interest expense and income taxes Interest expense 2.46 1.53 1.61 373.89 times Kraft Foods has very high debt and debt-to-equity ratios. Times interest earned of almost four times means that there is not an immediate risk of default, but the company is very highly leveraged, which is risky for investors Profitability Profit margin ratio Gross margin ratio Return on total assets Return on common stockholders' equity Net income/Net sales -Net sales-Cost of goods sold/Net sales Net income/ Average total assets Net income - Preferred dividends/Average common stockholders' equity 108% 61% 13096 82% Solvency -Total liabilities/Total assets -Total equity Total assets Debt ratic Equity ratio Debt-to-equity ratio Times interest earned 2.46 1.53 1.61 Total liabilities/Total equity -Income before interest expense and income taxes/Interest expense 373.89 times Kraft Foods has very high debt and debt-to-equity ratios. Times interest earned of almost four times means that there is not an immediate risk of default, but the company is very highly leveraged, which is risky for investors. Profitability - Net income/Net sales Net sales- Cost of goods sold/ Net sale:s - Net income /Average total assets Profit margin ratio Gross margin ratio Return on total assets Return on common stockholders' equity Net income - Preferred dividends/Average common stockholders' equity Book value per common share Basic earnings per share 108% 61% 130% 82% Shareholders' equity applicable to common shares/Number of common shares outstanding 13.90 - Net income Preferred dividends/ Weighted-average common shares outstanding $11.27 Kraft Foods has strong profitability. Profit margin of 6% and return on total assets of 5% are both more than double the industry averages of 3.5% and 2%. Return on equity of 22% is significantly stronger than the industry average of 7.9% Market Prospects Price-earnings ratio Dividend yield Market price per common share/Earnings per share - Annual cash dividends per share/Market price per share 7.83 times 2.4% Kraft Foods has a high P/E ratio at 50 times earnings, indicating that high growth is expected [this is likely because of the merger with Heinz that had been announced by the time Kraft Foods shares stopped trading. A dividend yield of 2.4% is a strong return for investors interested in income