Answered step by step

Verified Expert Solution

Question

1 Approved Answer

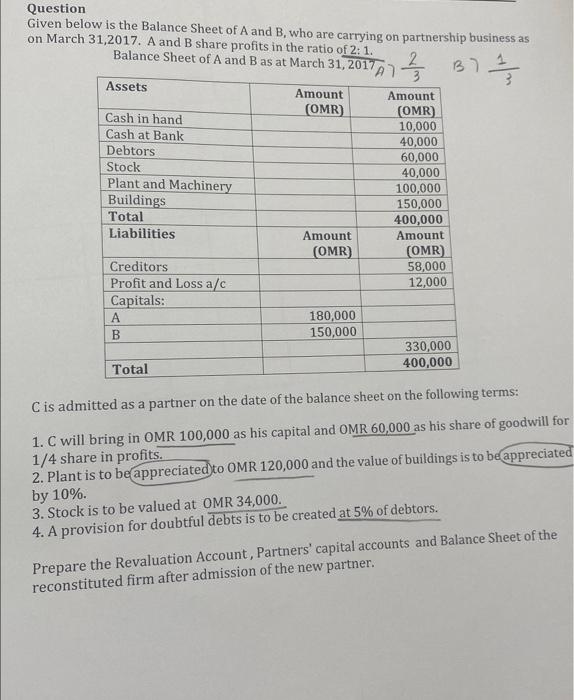

Question Given below is the Balance Sheet of A and B, who are carrying on partnership business as on March 31,2017. A andB share

Question Given below is the Balance Sheet of A and B, who are carrying on partnership business as on March 31,2017. A andB share profits in the ratio of 2: 1. Balance Sheet of A and B as at March 31, 2017 2 Assets Amount Amount (OMR) Cash in hand Cash at Bank (OMR) 10,000 40,000 60,000 40,000 100,000 Debtors Stock Plant and Machinery Buildings Total 150,000 400,000 Liabilities Amount Amount (OMR) 58,000 12,000 (OMR) Creditors Profit and Loss a/c Capitals: A 180,000 150,000 330,000 400,000 Total C is admitted as a partner on the date of the balance sheet on the following terms: 1. C will bring in OMR 100,000 as his capital and OMR 60,000 as his share of goodwill for 1/4 share in profits. 2. Plant is to be appreciated to OMR 120,000 and the value of buildings is to be appreciated by 10%. 3. Stock is to be valued at OMR 34,000. 4. A provision for doubtful debts is to be created at 5% of debtors. Prepare the Revaluation Account, Partners' capital accounts and Balance Sheet of the reconstituted firm after admission of the new partner.

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

i JOURNAL1 Cash ac Dr 160000 To Cs Capital ac 100000 To Premium for Goodwill ac 60000Being capital a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started