Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question given: What is the likely 1991 sales and profit impact of Circle K's announced turnaround strategy and your assessment of the strategy's potential success?

Question given: What is the likely 1991 sales and profit impact of Circle K's announced turnaround strategy and your assessment of the strategy's potential success?

- What Numbers and formula do I use to answer the question above?

it?

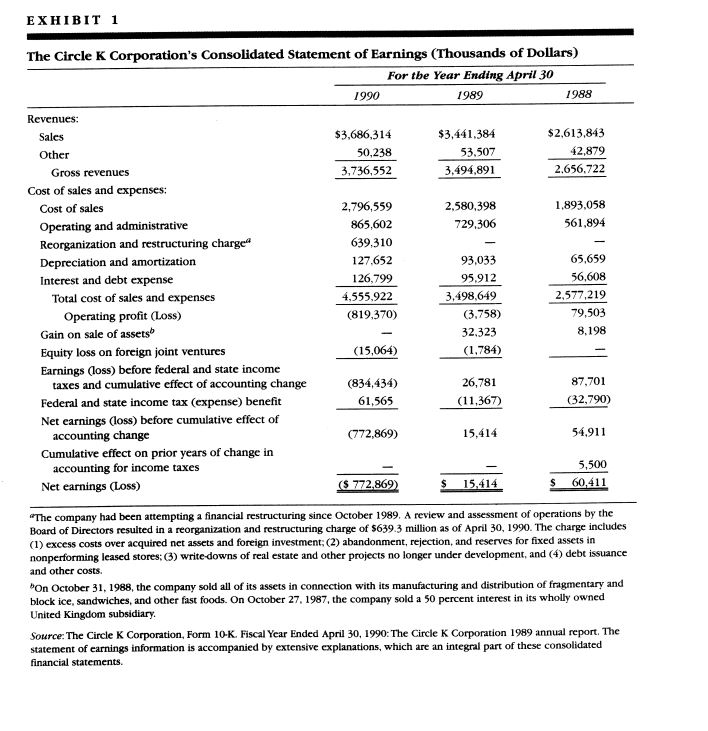

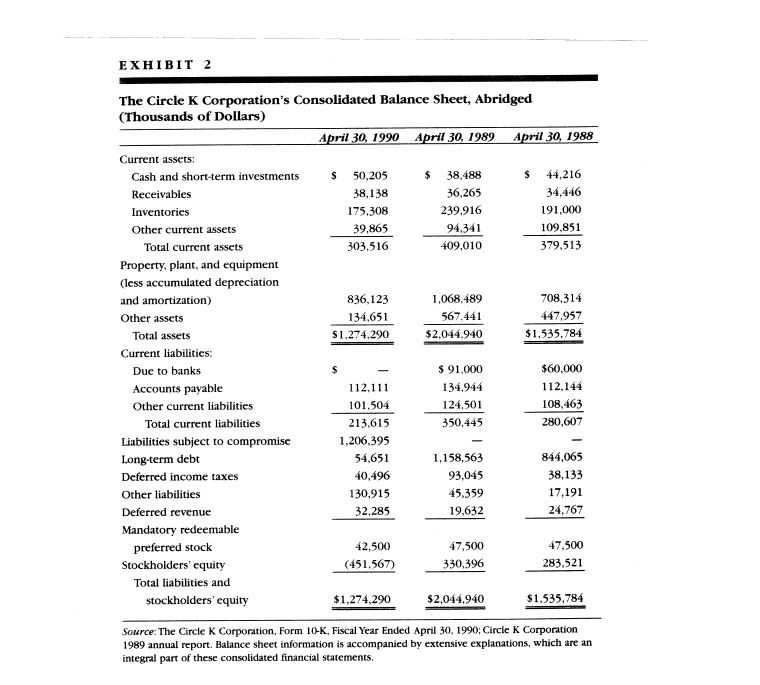

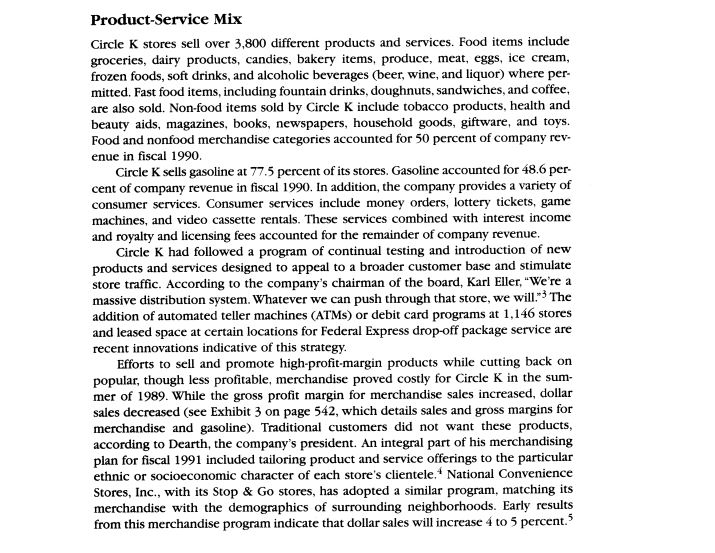

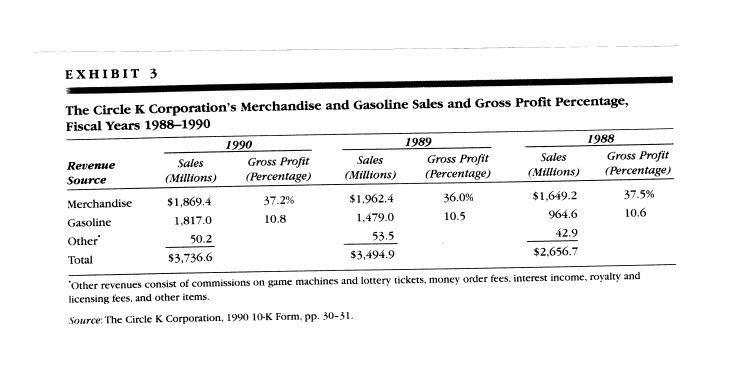

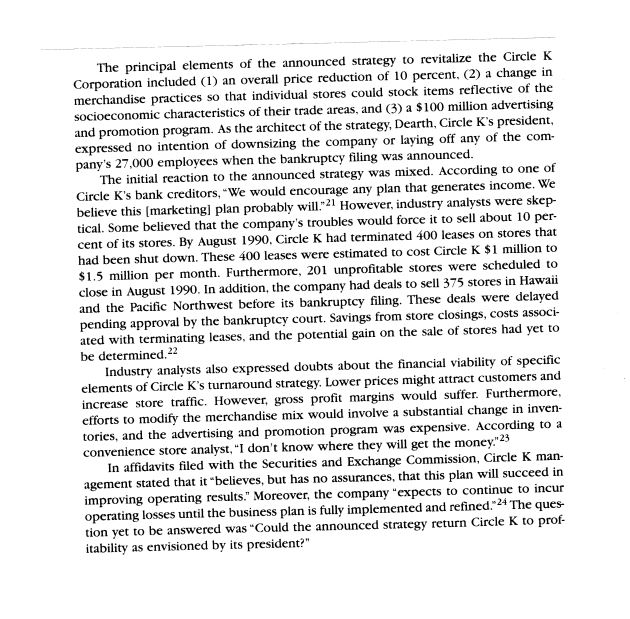

EXHIBIT 1 The Circle K Corporation's Consolidated Statement of Earnings (Thousands of Dollars) For the Year Ending April 30 1990 198.8 Revenues: Sales $3,686,314 $3,441.384 $2,613,843 Other 50.238 53.507 12,879 Gross revenues 3,736,552 3.494.891 2.656.722 Cost of sales and expenses: Cost of sales 2,796,559 2,580,398 1,893.058 Operating and administrative 865,602 729,306 561.894 Reorganization and restructuring charge" 639.310 Depreciation and amortization 127.652 93.033 65,659 Interest and debt expense 126,799 95.912 56,608 Total cost of sales and expenses 4,555.922 3,498,649 2,577,219 Operating profit (Loss) (819,370) (3.758) 79,503 Gain on sale of assets" 32.323 8.198 Equity loss on foreign joint ventures (15,064) (1,784) Earnings (loss) before federal and state income taxes and cumulative effect of accounting change (834,434) 26,781 87,701 Federal and state income tax (expense) benefit 61,565 (11,367) (32,790) Net earnings (loss) before cumulative effect of accounting change (772,869) 15,414 54,911 Cumulative effect on prior years of change in accounting for income taxes 5,500 Net earnings (Loss) ($ 772,869) $ 15.414 60,411 "The company had been attempting a financial restructuring since October 1989, A review and assessment of operations by the Board of Directors resulted in a reorganization and restructuring charge of $639.3 million as of April 30, 1990. The charge includes (1) excess costs over acquired net assets and foreign investment; (2) abandonment, rejection, and reserves for fixed assets in nonperforming leased stores: (3) write-downs of real estate and other projects no longer under development, and (4) debt issuance and other costs "On October 31, 1988, the company sold all of its assets in connection with its manufacturing and distribution of fragmentary and block ice, sandwiches, and other fast foods. On October 27. 1987, the company sold a 50 percent interest in its wholly owned United Kingdom subsidiary Source: The Circle K Corporation, Form 10-K. Fiscal Year Ended April 30, 1990: The Circle K Corporation 1989 annual report. The statement of earnings information is accompanied by extensive explanations, which are an integral part of these consolidated financial statements.EXHIBIT 2 The Circle K Corporation's Consolidated Balance Sheet, Abridged (Thousands of Dollars) April 30, 1990 April 30, 1989 April 30, 1988 Current assets: Cash and short-term investments S 50,205 $ 38,488 44,216 Receivables 38,138 36,265 34.446 Inventories 175,308 239,916 191,000 Other current assets 39.865 94,341 109,851 Total current assets 303.516 409,010 379.513 Property, plant, and equipment (less accumulated depreciation and amortization) 836,123 1,068,489 708,314 Other assets 134,651 567.441 147.957 Total assets $1,274.290 $2.044.940 $1,535,784 Current liabilities: Due to banks $ 91,000 $60,000 Accounts payable 112,1 1 1 134.944 112,144 Other current liabilities 101.504 124,501 108,463 Total current liabilities 213.615 350,445 280,607 Liabilities subject to compromise 1.206.395 Long-term debt 54,651 1,158,563 844,065 Deferred income taxes 10,496 93.045 38,133 Other liabilities 130,915 45.359 17,191 Deferred revenue 32,285 19.632 24,767 Mandatory redeemable preferred stock 42,500 47,500 47,500 Stockholders' equity (451.567) 330,396 283.521 Total liabilities and stockholders' equity $1,274,290 $2,044,940 $1,535,784 Source: The Circle K Corporation, Form 10-K, Fiscal Year Ended April 30, 1990; Circle K Corporation 1989 annual report. Balance sheet information is accompanied by extensive explanations, which are an integral part of these consolidated financial statements.Product-Service Mix Circle K stores sell over 3,800 different products and services. Food items include groceries, dairy products, candies, bakery items, produce, meat, eggs, ice cream, frozen foods, soft drinks, and alcoholic beverages (beer, wine, and liquor) where per- mitted. Fast food items, including fountain drinks, doughnuts, sandwiches, and coffee, are also sold. Non-food items sold by Circle K include tobacco products, health and beauty aids, magazines, books, newspapers, household goods, giftware, and toys. Food and nonfood merchandise categories accounted for 50 percent of company rev- enue in fiscal 1990. Circle K sells gasoline at 77.5 percent of its stores. Gasoline accounted for 48.6 per- cent of company revenue in fiscal 1990. In addition, the company provides a variety of consumer services. Consumer services include money orders, lottery tickets, game machines, and video cassette rentals. These services combined with interest income and royalty and licensing fees accounted for the remainder of company revenue, Circle K had followed a program of continual testing and introduction of new products and services designed to appeal to a broader customer base and stimulate store traffic. According to the company's chairman of the board, Karl Eller, "We're a massive distribution system. Whatever we can push through that store, we will." The addition of automated teller machines (ATMs) or debit card programs at 1,146 stores and leased space at certain locations for Federal Express drop-off package service are recent innovations indicative of this strategy. Efforts to sell and promote high-profit-margin products while cutting back on popular, though less profitable, merchandise proved costly for Circle K in the sum- mer of 1989. While the gross profit margin for merchandise sales increased, dollar sales decreased (see Exhibit 3 on page 542, which details sales and gross margins for merchandise and gasoline). Traditional customers did not want these products, according to Dearth, the company's president. An integral part of his merchandising plan for fiscal 1991 included tailoring product and service offerings to the particular ethnic or socioeconomic character of each store's clientele,* National Convenience Stores, Inc., with its Stop & Go stores, has adopted a similar program, matching its merchandise with the demographics of surrounding neighborhoods. Early results from this merchandise program indicate that dollar sales will increase 4 to 5 percent."EXHIBIT 3 The Circle K Corporation's Merchandise and Gasoline Sales and Gross Profit Percentage, Fiscal Years 1988-1990 1990 1989 1988 Revenue Sales Gross Profit Sales Gross Profit Sales Gross Profit Source (Millions) (Percentage) (Millions) (Percentage) (Millions) ( Percentage) Merchandise $1,869.4 37.2% $1.962.4 36.0% $1.649.2 37.5% Gasoline 1,817.0 10.8 1.479.0 10.5 964.6 10.6 Other 50.2 53.5 42.9 Total $3,736.6 $3,494.9 $2.656.7 Other revenues consist of commissions on game machines and lottery tickets, money order fees. interest income, royalty and licensing fees, and other items. Source: The Circle K Corporation, 1990 10-K Form. pp. 30-31.The principal elements of the announced strategy to revitaliae the Circle K Corporation included (I) an overall price reduction of It] percent. (2) a change in merchandise praco'ees so that individual stores could stock items reflective of the socioeconomic characteristics of their trade areas. and (3) a stall million advertising and promotion program. As the architoCt of the strategy. Dearth. Circle [Cs president. expressed no intention of dis-mailing; the company or laying off any of the oom- party's 2100!] employees when the bankruptcy filing was announced. The initial reaction to the announced strategy was mixed. sceording to one of Circle K's hanlt creditors. \"We would encourage any plan that generates incomelliie believe this [marketingl plan probably will.\"1 However. industryr analysts were sitep tical. Some believed that the company's troubles wotdd dome it to sell about 1'0 pot. eent of its stores. By Armor 1991}. Circle It had terminated and leases on stores that had been shut down. These and leases were estimated to cost Circle K $1 million to $1.5 million per month. Furdtertnore. 2m unprotable stores were scheduled to close in August 1990. In addition. the company had deals to sell 335 stores in Hawaii and the Pacific Northwest before its bankruptcy ling. These deals were delayed pending approval by the bankruptcy court. Savings from store closings. costs associ ared with terminating leases. and the potential gain on the sale of stores had yet to be determined.\" Industry analysts also expressed doubts about the elements of Circle K's turnaround strategy. Lower prices might atu-act customers and increase store name. However. gross prot margins would suffer. Furtherutom. efforts to modify the merchandise mix wmdd involve a substantial change in inven- tories. and the advertising and promotion program was expensive. According to a convenience store analyst. \"i don't know where they will get the mortality."25 In afdavits led with the Securities and Exchange Conunission. Circle K man agement stated that it 'believes. but has no assurances. that this plan will succeed in unproving operating results." Moreover. the company \"expects to continue it] incur operating losses until tlte business plan is fully implemented and rened.'24'l'be ques- tion yet to be answered was "Could the announced strategy return Circle K to prof' itability as envisioned by its president?" nancial viability of specic

EXHIBIT 1 The Circle K Corporation's Consolidated Statement of Earnings (Thousands of Dollars) For the Year Ending April 30 1990 198.8 Revenues: Sales $3,686,314 $3,441.384 $2,613,843 Other 50.238 53.507 12,879 Gross revenues 3,736,552 3.494.891 2.656.722 Cost of sales and expenses: Cost of sales 2,796,559 2,580,398 1,893.058 Operating and administrative 865,602 729,306 561.894 Reorganization and restructuring charge" 639.310 Depreciation and amortization 127.652 93.033 65,659 Interest and debt expense 126,799 95.912 56,608 Total cost of sales and expenses 4,555.922 3,498,649 2,577,219 Operating profit (Loss) (819,370) (3.758) 79,503 Gain on sale of assets" 32.323 8.198 Equity loss on foreign joint ventures (15,064) (1,784) Earnings (loss) before federal and state income taxes and cumulative effect of accounting change (834,434) 26,781 87,701 Federal and state income tax (expense) benefit 61,565 (11,367) (32,790) Net earnings (loss) before cumulative effect of accounting change (772,869) 15,414 54,911 Cumulative effect on prior years of change in accounting for income taxes 5,500 Net earnings (Loss) ($ 772,869) $ 15.414 60,411 "The company had been attempting a financial restructuring since October 1989, A review and assessment of operations by the Board of Directors resulted in a reorganization and restructuring charge of $639.3 million as of April 30, 1990. The charge includes (1) excess costs over acquired net assets and foreign investment; (2) abandonment, rejection, and reserves for fixed assets in nonperforming leased stores: (3) write-downs of real estate and other projects no longer under development, and (4) debt issuance and other costs "On October 31, 1988, the company sold all of its assets in connection with its manufacturing and distribution of fragmentary and block ice, sandwiches, and other fast foods. On October 27. 1987, the company sold a 50 percent interest in its wholly owned United Kingdom subsidiary Source: The Circle K Corporation, Form 10-K. Fiscal Year Ended April 30, 1990: The Circle K Corporation 1989 annual report. The statement of earnings information is accompanied by extensive explanations, which are an integral part of these consolidated financial statements.EXHIBIT 2 The Circle K Corporation's Consolidated Balance Sheet, Abridged (Thousands of Dollars) April 30, 1990 April 30, 1989 April 30, 1988 Current assets: Cash and short-term investments S 50,205 $ 38,488 44,216 Receivables 38,138 36,265 34.446 Inventories 175,308 239,916 191,000 Other current assets 39.865 94,341 109,851 Total current assets 303.516 409,010 379.513 Property, plant, and equipment (less accumulated depreciation and amortization) 836,123 1,068,489 708,314 Other assets 134,651 567.441 147.957 Total assets $1,274.290 $2.044.940 $1,535,784 Current liabilities: Due to banks $ 91,000 $60,000 Accounts payable 112,1 1 1 134.944 112,144 Other current liabilities 101.504 124,501 108,463 Total current liabilities 213.615 350,445 280,607 Liabilities subject to compromise 1.206.395 Long-term debt 54,651 1,158,563 844,065 Deferred income taxes 10,496 93.045 38,133 Other liabilities 130,915 45.359 17,191 Deferred revenue 32,285 19.632 24,767 Mandatory redeemable preferred stock 42,500 47,500 47,500 Stockholders' equity (451.567) 330,396 283.521 Total liabilities and stockholders' equity $1,274,290 $2,044,940 $1,535,784 Source: The Circle K Corporation, Form 10-K, Fiscal Year Ended April 30, 1990; Circle K Corporation 1989 annual report. Balance sheet information is accompanied by extensive explanations, which are an integral part of these consolidated financial statements.Product-Service Mix Circle K stores sell over 3,800 different products and services. Food items include groceries, dairy products, candies, bakery items, produce, meat, eggs, ice cream, frozen foods, soft drinks, and alcoholic beverages (beer, wine, and liquor) where per- mitted. Fast food items, including fountain drinks, doughnuts, sandwiches, and coffee, are also sold. Non-food items sold by Circle K include tobacco products, health and beauty aids, magazines, books, newspapers, household goods, giftware, and toys. Food and nonfood merchandise categories accounted for 50 percent of company rev- enue in fiscal 1990. Circle K sells gasoline at 77.5 percent of its stores. Gasoline accounted for 48.6 per- cent of company revenue in fiscal 1990. In addition, the company provides a variety of consumer services. Consumer services include money orders, lottery tickets, game machines, and video cassette rentals. These services combined with interest income and royalty and licensing fees accounted for the remainder of company revenue, Circle K had followed a program of continual testing and introduction of new products and services designed to appeal to a broader customer base and stimulate store traffic. According to the company's chairman of the board, Karl Eller, "We're a massive distribution system. Whatever we can push through that store, we will." The addition of automated teller machines (ATMs) or debit card programs at 1,146 stores and leased space at certain locations for Federal Express drop-off package service are recent innovations indicative of this strategy. Efforts to sell and promote high-profit-margin products while cutting back on popular, though less profitable, merchandise proved costly for Circle K in the sum- mer of 1989. While the gross profit margin for merchandise sales increased, dollar sales decreased (see Exhibit 3 on page 542, which details sales and gross margins for merchandise and gasoline). Traditional customers did not want these products, according to Dearth, the company's president. An integral part of his merchandising plan for fiscal 1991 included tailoring product and service offerings to the particular ethnic or socioeconomic character of each store's clientele,* National Convenience Stores, Inc., with its Stop & Go stores, has adopted a similar program, matching its merchandise with the demographics of surrounding neighborhoods. Early results from this merchandise program indicate that dollar sales will increase 4 to 5 percent."EXHIBIT 3 The Circle K Corporation's Merchandise and Gasoline Sales and Gross Profit Percentage, Fiscal Years 1988-1990 1990 1989 1988 Revenue Sales Gross Profit Sales Gross Profit Sales Gross Profit Source (Millions) (Percentage) (Millions) (Percentage) (Millions) ( Percentage) Merchandise $1,869.4 37.2% $1.962.4 36.0% $1.649.2 37.5% Gasoline 1,817.0 10.8 1.479.0 10.5 964.6 10.6 Other 50.2 53.5 42.9 Total $3,736.6 $3,494.9 $2.656.7 Other revenues consist of commissions on game machines and lottery tickets, money order fees. interest income, royalty and licensing fees, and other items. Source: The Circle K Corporation, 1990 10-K Form. pp. 30-31.The principal elements of the announced strategy to revitaliae the Circle K Corporation included (I) an overall price reduction of It] percent. (2) a change in merchandise praco'ees so that individual stores could stock items reflective of the socioeconomic characteristics of their trade areas. and (3) a stall million advertising and promotion program. As the architoCt of the strategy. Dearth. Circle [Cs president. expressed no intention of dis-mailing; the company or laying off any of the oom- party's 2100!] employees when the bankruptcy filing was announced. The initial reaction to the announced strategy was mixed. sceording to one of Circle K's hanlt creditors. \"We would encourage any plan that generates incomelliie believe this [marketingl plan probably will.\"1 However. industryr analysts were sitep tical. Some believed that the company's troubles wotdd dome it to sell about 1'0 pot. eent of its stores. By Armor 1991}. Circle It had terminated and leases on stores that had been shut down. These and leases were estimated to cost Circle K $1 million to $1.5 million per month. Furdtertnore. 2m unprotable stores were scheduled to close in August 1990. In addition. the company had deals to sell 335 stores in Hawaii and the Pacific Northwest before its bankruptcy ling. These deals were delayed pending approval by the bankruptcy court. Savings from store closings. costs associ ared with terminating leases. and the potential gain on the sale of stores had yet to be determined.\" Industry analysts also expressed doubts about the elements of Circle K's turnaround strategy. Lower prices might atu-act customers and increase store name. However. gross prot margins would suffer. Furtherutom. efforts to modify the merchandise mix wmdd involve a substantial change in inven- tories. and the advertising and promotion program was expensive. According to a convenience store analyst. \"i don't know where they will get the mortality."25 In afdavits led with the Securities and Exchange Conunission. Circle K man agement stated that it 'believes. but has no assurances. that this plan will succeed in unproving operating results." Moreover. the company \"expects to continue it] incur operating losses until tlte business plan is fully implemented and rened.'24'l'be ques- tion yet to be answered was "Could the announced strategy return Circle K to prof' itability as envisioned by its president?" nancial viability of specic Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started