QUESTION

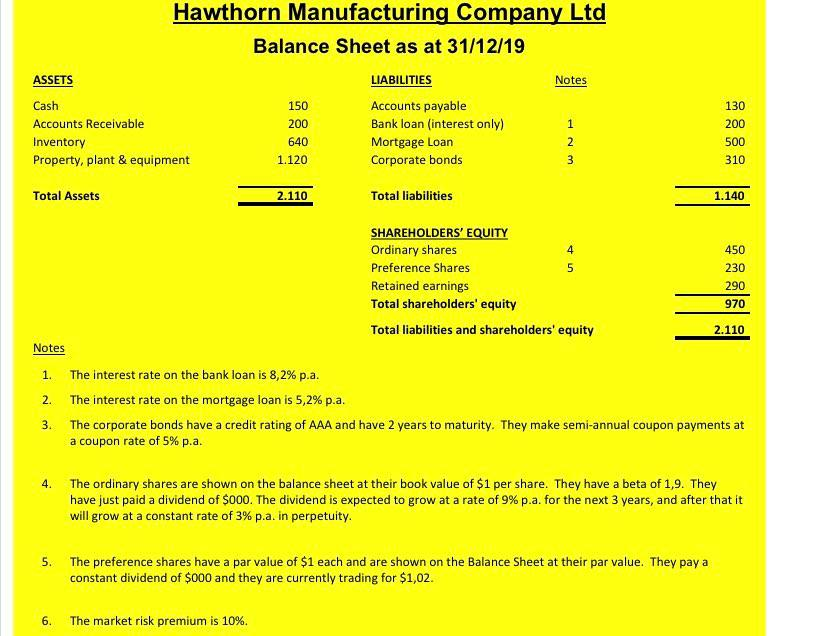

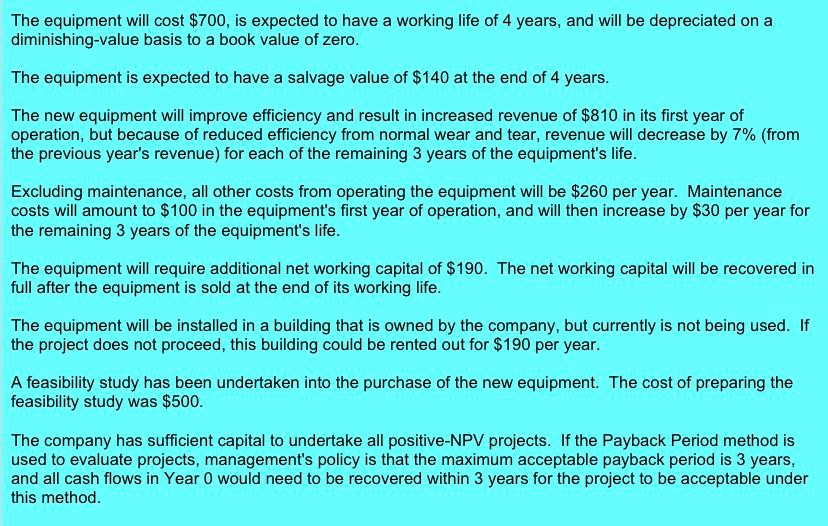

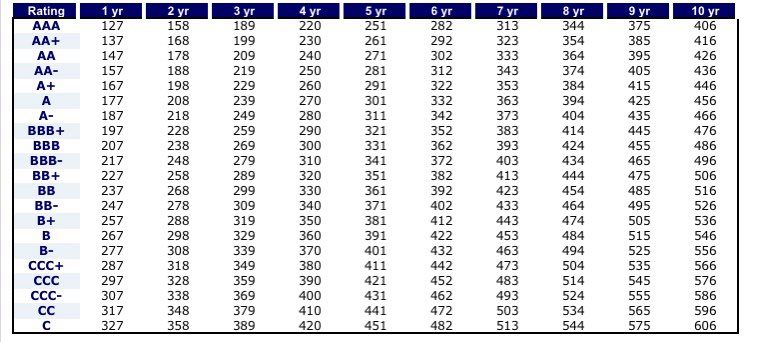

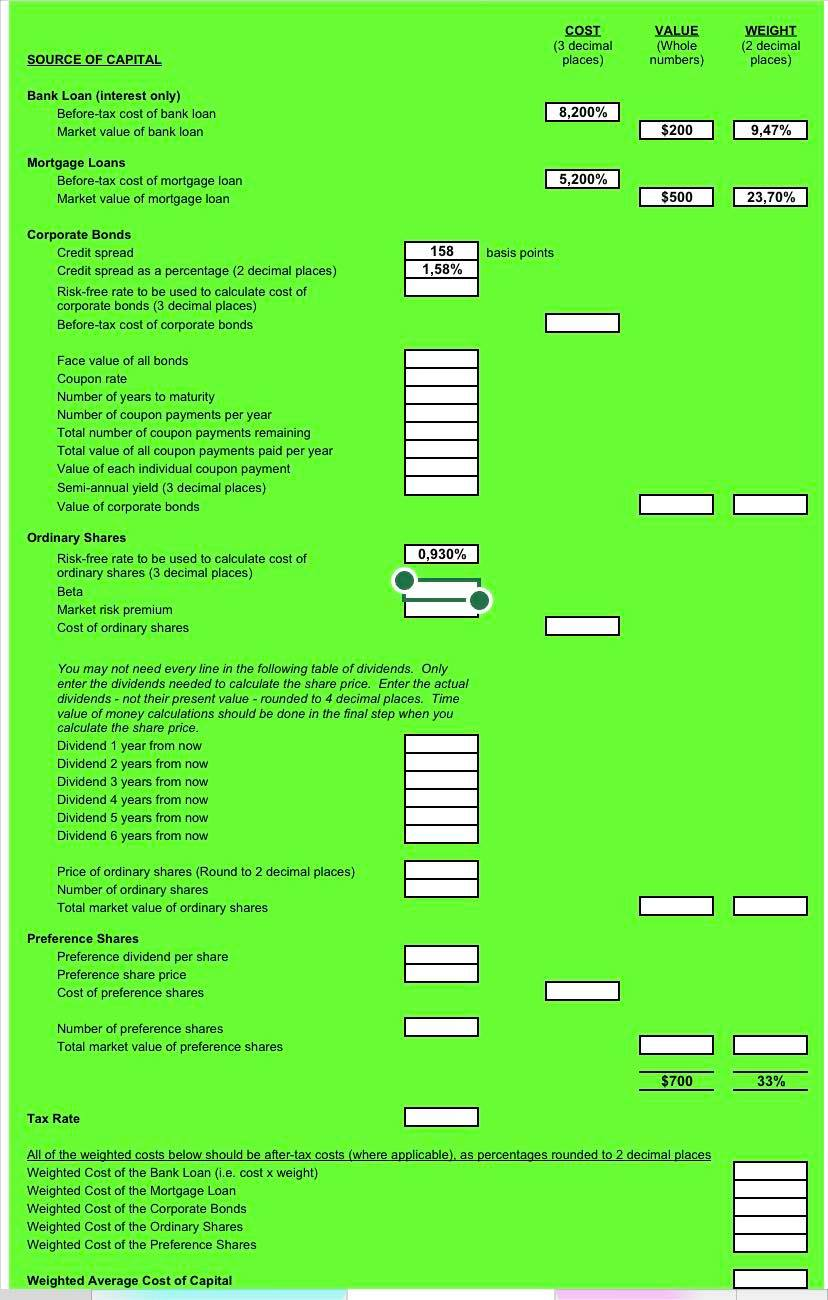

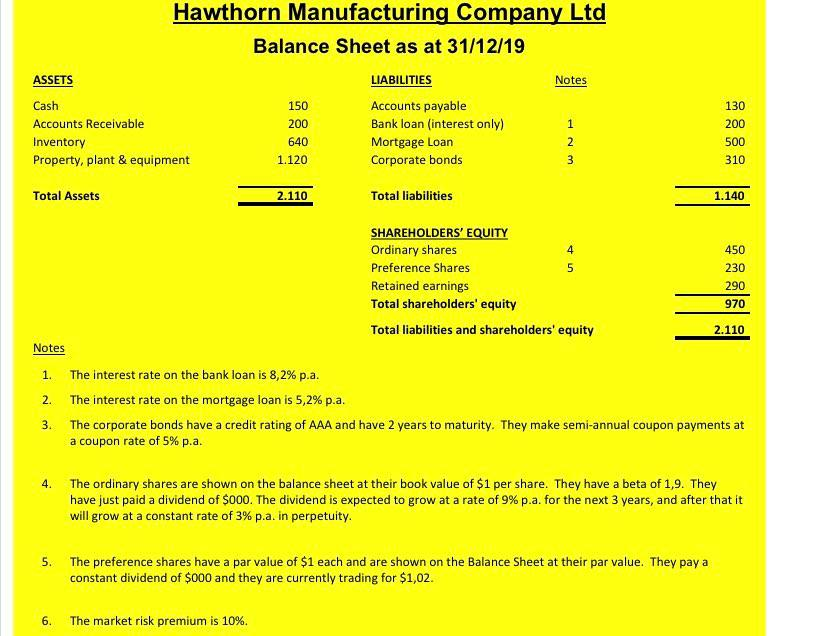

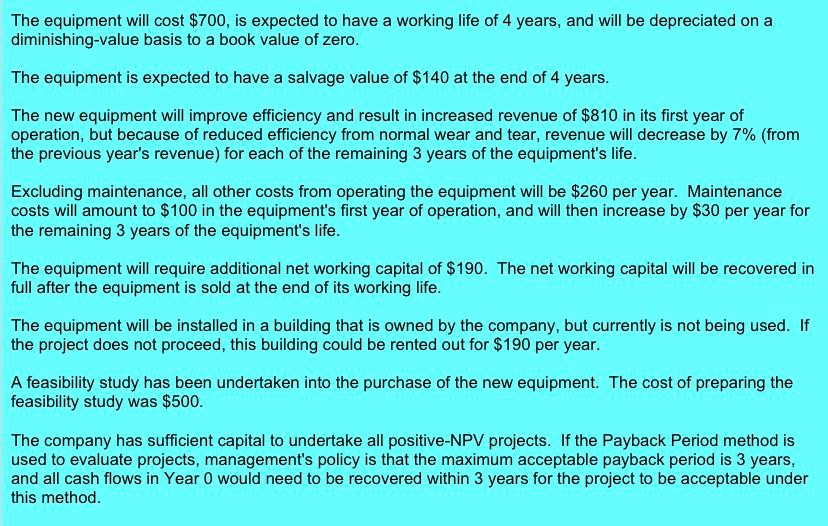

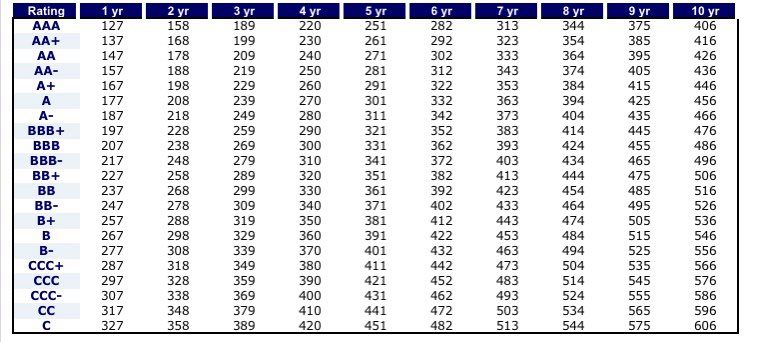

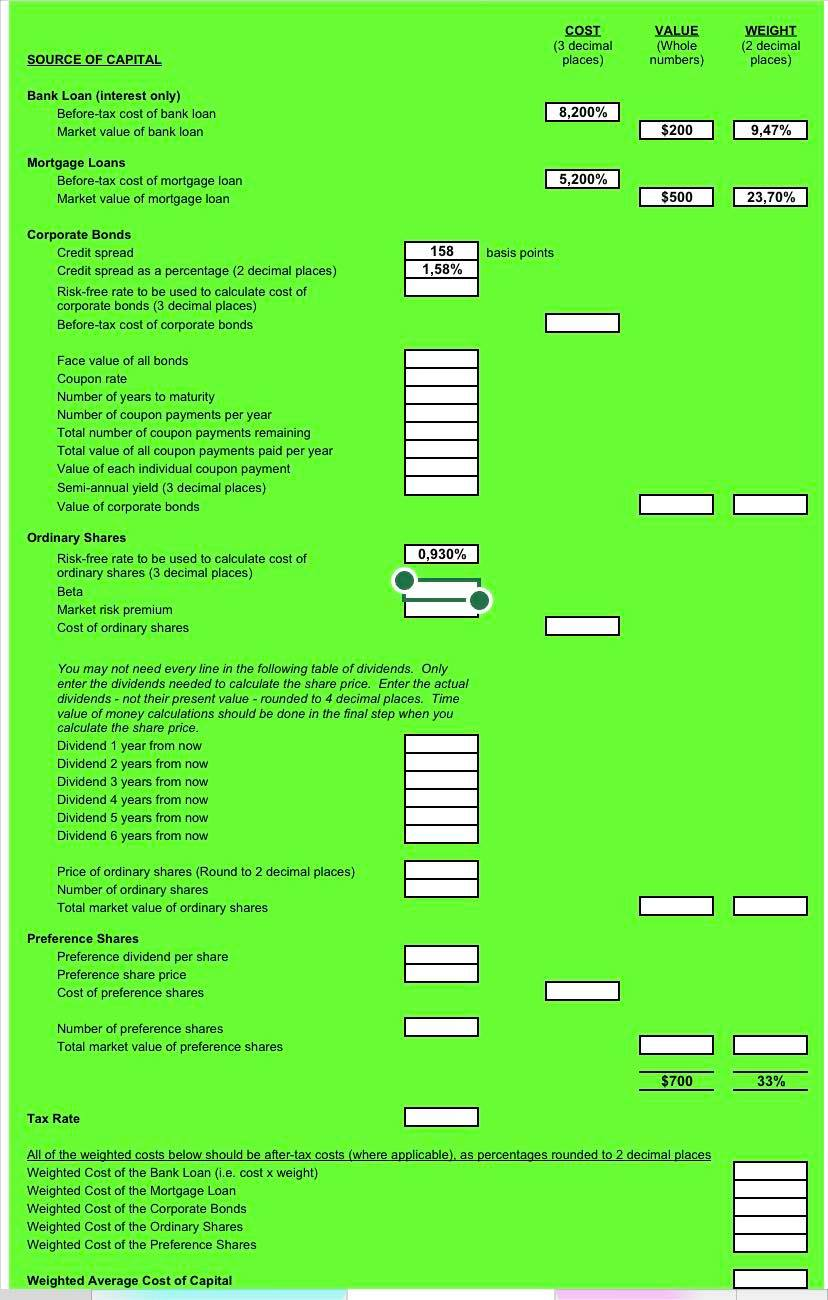

Hawthorn Manufacturing Company Ltd Balance Sheet as at 31/12/19 Notes ASSETS Cash Accounts Receivable Inventory Property, plant & equipment LIABILITIES Accounts payable Bank loan (interest only) Mortgage Loan Corporate bonds 150 200 640 1.120 1 130 200 500 310 w N Total Assets 2.110 Total liabilities 1.140 SHAREHOLDERS' EQUITY Ordinary shares 4 Preference Shares Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 450 230 290 970 2.110 Notes 1. 2. The interest rate on the bank loan is 8,2% p.a. The interest rate on the mortgage loan is 5,2% p.a. The corporate bonds have a credit rating of AAA and have 2 years to maturity. They make semi-annual coupon payments at a coupon rate of 5% p.a. 3. 4. The ordinary shares are shown on the balance sheet at their book value of $1 per share. They have a beta of 1,9. They have just paid a dividend of $000. The dividend is expected to grow at a rate of 9% p.a. for the next 3 years, and after that it will grow at a constant rate of 3% p.a. in perpetuity. 5. The preference shares have a par value of $1 each and are shown on the Balance Sheet at their par value. They pay a constant dividend of $000 and they are currently trading for $1,02. 6. The market risk premium is 10%. The equipment will cost $700, is expected to have a working life of 4 years, and will be depreciated on a diminishing-value basis to a book value of zero. The equipment is expected to have a salvage value of $140 at the end of 4 years. The new equipment will improve efficiency and result in increased revenue of $810 in its first year of operation, but because of reduced efficiency from normal wear and tear, revenue will decrease by 7% (from the previous year's revenue) for each of the remaining 3 years of the equipment's life. Excluding maintenance, all other costs from operating the equipment will be $260 per year. Maintenance costs will amount to $100 in the equipment's first year of operation, and will then increase by $30 per year for the remaining 3 years of the equipment's life. The equipment will require additional net working capital of $190. The net working capital will be recovered in full after the equipment is sold at the end of its working life. The equipment will be installed in a building that is owned by the company, but currently is not being used. If the project does not proceed, this building could be rented out for $190 per year. A feasibility study has been undertaken into the purchase of the new equipment. The cost of preparing the feasibility study was $500. The company has sufficient capital to undertake all positive-NPV projects. If the Payback Period method is used to evaluate projects, management's policy is that the maximum acceptable payback period is 3 years, and all cash flows in Year 0 would need to be recovered within 3 years for the project to be acceptable under this method. 1 2 4 5 6 8 9 10 313 323 333 343 353 363 373 Rating AAA AA+ AA AA- + A - BBB+ BBB- BB+ BB- + B - + - 127 137 147 157 167 177 187 197 207 217 227 237 247 257 267 277 287 297 307 317 327 158 168 178 188 198 208 218 228 238 248 258 268 278 288 298 308 318 328 338 348 358 3 189 199 209 219 229 239 249 259 269 279 289 299 309 319 329 339 349 359 369 379 389 220 230 240 250 260 270 280 290 300 310 320 330 340 350 360 370 380 390 400 410 420 251 261 271 281 291 301 311 321 331 341 351 361 371 381 391 401 411 421 431 441 451 282 292 302 312 322 332 342 352 362 372 382 392 402 412 422 432 442 452 462 472 482 383 393 403 413 423 433 443 453 463 344 354 364 374 384 394 404 414 424 434 444 454 464 474 484 494 504 514 524 534 544 375 385 395 405 415 425 435 445 455 465 475 485 495 505 515 525 535 545 555 565 575 406 416 426 436 446 456 466 476 486 496 506 516 526 536 546 556 566 576 586 596 606 473 483 493 503 513 COST (3 decimal places) VALUE (Whole numbers) WEIGHT (2 decimal places) SOURCE OF CAPITAL Bank Loan (interest only) Before-tax cost of bank loan Market value of bank loan 8,200% $200 9,47% Mortgage Loans Before-tax cost of mortgage loan Market value of mortgage loan 5,200% $500 23,70% 158 1,58% basis points Corporate Bonds Credit spread Credit spread as a percentage (2 decimal places) Risk-free rate to be used to calculate cost of corporate bonds (3 decimal places) Before-tax cost of corporate bonds Face value of all bonds Coupon rate Number of years to maturity Number of coupon payments per year Total number of coupon payments remaining Total value of all coupon payments paid per year Value of each individual coupon payment Semi-annual yield (3 decimal places) Value of corporate bonds 0,930% Ordinary Shares Risk-free rate to be used to calculate cost of ordinary shares (3 decimal places) Beta Market risk premium Cost of ordinary shares You may not need every line in the following table of dividends. Only enter the dividends needed to calculate the share price. Enter the actual dividends - not their present value - rounded to 4 decimal places. Time value of money calculations should be done in the final step when you calculate the share price. Dividend 1 year from now Dividend 2 years from now Dividend 3 years from now Dividend 4 years from now Dividend 5 years from now Dividend 6 years from now Price of ordinary shares (Round to 2 decimal places) Number of ordinary shares Total market value of ordinary shares Preference Shares Preference dividend per share Preference share price Cost of preference shares III Number of preference shares Total market value of preference shares $700 33% Tax Rate All of the weighted costs below should be after-tax costs (where applicable). as percentages rounded to 2 decimal places Weighted Cost of the Bank Loan (i.e. cost x weight) Weighted Cost of the Mortgage Loan Weighted Cost of the Corporate Bonds Weighted Cost of the Ordinary Shares Weighted Cost of the Preference Shares Weighted Average Cost of Capital Hawthorn Manufacturing Company Ltd Balance Sheet as at 31/12/19 Notes ASSETS Cash Accounts Receivable Inventory Property, plant & equipment LIABILITIES Accounts payable Bank loan (interest only) Mortgage Loan Corporate bonds 150 200 640 1.120 1 130 200 500 310 w N Total Assets 2.110 Total liabilities 1.140 SHAREHOLDERS' EQUITY Ordinary shares 4 Preference Shares Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 450 230 290 970 2.110 Notes 1. 2. The interest rate on the bank loan is 8,2% p.a. The interest rate on the mortgage loan is 5,2% p.a. The corporate bonds have a credit rating of AAA and have 2 years to maturity. They make semi-annual coupon payments at a coupon rate of 5% p.a. 3. 4. The ordinary shares are shown on the balance sheet at their book value of $1 per share. They have a beta of 1,9. They have just paid a dividend of $000. The dividend is expected to grow at a rate of 9% p.a. for the next 3 years, and after that it will grow at a constant rate of 3% p.a. in perpetuity. 5. The preference shares have a par value of $1 each and are shown on the Balance Sheet at their par value. They pay a constant dividend of $000 and they are currently trading for $1,02. 6. The market risk premium is 10%. The equipment will cost $700, is expected to have a working life of 4 years, and will be depreciated on a diminishing-value basis to a book value of zero. The equipment is expected to have a salvage value of $140 at the end of 4 years. The new equipment will improve efficiency and result in increased revenue of $810 in its first year of operation, but because of reduced efficiency from normal wear and tear, revenue will decrease by 7% (from the previous year's revenue) for each of the remaining 3 years of the equipment's life. Excluding maintenance, all other costs from operating the equipment will be $260 per year. Maintenance costs will amount to $100 in the equipment's first year of operation, and will then increase by $30 per year for the remaining 3 years of the equipment's life. The equipment will require additional net working capital of $190. The net working capital will be recovered in full after the equipment is sold at the end of its working life. The equipment will be installed in a building that is owned by the company, but currently is not being used. If the project does not proceed, this building could be rented out for $190 per year. A feasibility study has been undertaken into the purchase of the new equipment. The cost of preparing the feasibility study was $500. The company has sufficient capital to undertake all positive-NPV projects. If the Payback Period method is used to evaluate projects, management's policy is that the maximum acceptable payback period is 3 years, and all cash flows in Year 0 would need to be recovered within 3 years for the project to be acceptable under this method. 1 2 4 5 6 8 9 10 313 323 333 343 353 363 373 Rating AAA AA+ AA AA- + A - BBB+ BBB- BB+ BB- + B - + - 127 137 147 157 167 177 187 197 207 217 227 237 247 257 267 277 287 297 307 317 327 158 168 178 188 198 208 218 228 238 248 258 268 278 288 298 308 318 328 338 348 358 3 189 199 209 219 229 239 249 259 269 279 289 299 309 319 329 339 349 359 369 379 389 220 230 240 250 260 270 280 290 300 310 320 330 340 350 360 370 380 390 400 410 420 251 261 271 281 291 301 311 321 331 341 351 361 371 381 391 401 411 421 431 441 451 282 292 302 312 322 332 342 352 362 372 382 392 402 412 422 432 442 452 462 472 482 383 393 403 413 423 433 443 453 463 344 354 364 374 384 394 404 414 424 434 444 454 464 474 484 494 504 514 524 534 544 375 385 395 405 415 425 435 445 455 465 475 485 495 505 515 525 535 545 555 565 575 406 416 426 436 446 456 466 476 486 496 506 516 526 536 546 556 566 576 586 596 606 473 483 493 503 513 COST (3 decimal places) VALUE (Whole numbers) WEIGHT (2 decimal places) SOURCE OF CAPITAL Bank Loan (interest only) Before-tax cost of bank loan Market value of bank loan 8,200% $200 9,47% Mortgage Loans Before-tax cost of mortgage loan Market value of mortgage loan 5,200% $500 23,70% 158 1,58% basis points Corporate Bonds Credit spread Credit spread as a percentage (2 decimal places) Risk-free rate to be used to calculate cost of corporate bonds (3 decimal places) Before-tax cost of corporate bonds Face value of all bonds Coupon rate Number of years to maturity Number of coupon payments per year Total number of coupon payments remaining Total value of all coupon payments paid per year Value of each individual coupon payment Semi-annual yield (3 decimal places) Value of corporate bonds 0,930% Ordinary Shares Risk-free rate to be used to calculate cost of ordinary shares (3 decimal places) Beta Market risk premium Cost of ordinary shares You may not need every line in the following table of dividends. Only enter the dividends needed to calculate the share price. Enter the actual dividends - not their present value - rounded to 4 decimal places. Time value of money calculations should be done in the final step when you calculate the share price. Dividend 1 year from now Dividend 2 years from now Dividend 3 years from now Dividend 4 years from now Dividend 5 years from now Dividend 6 years from now Price of ordinary shares (Round to 2 decimal places) Number of ordinary shares Total market value of ordinary shares Preference Shares Preference dividend per share Preference share price Cost of preference shares III Number of preference shares Total market value of preference shares $700 33% Tax Rate All of the weighted costs below should be after-tax costs (where applicable). as percentages rounded to 2 decimal places Weighted Cost of the Bank Loan (i.e. cost x weight) Weighted Cost of the Mortgage Loan Weighted Cost of the Corporate Bonds Weighted Cost of the Ordinary Shares Weighted Cost of the Preference Shares Weighted Average Cost of Capital