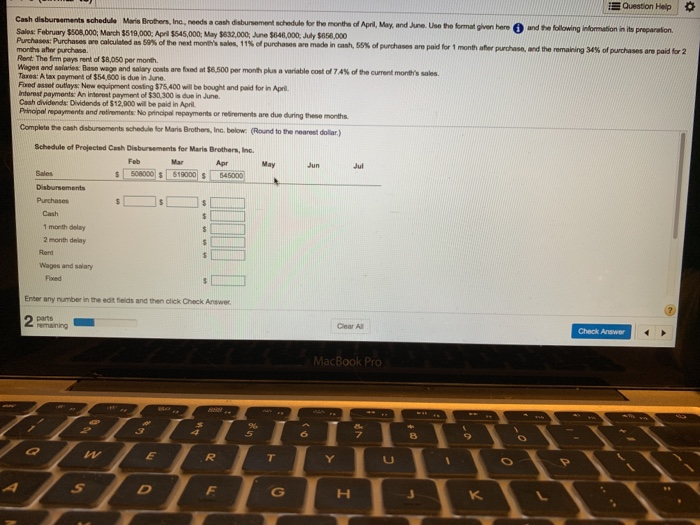

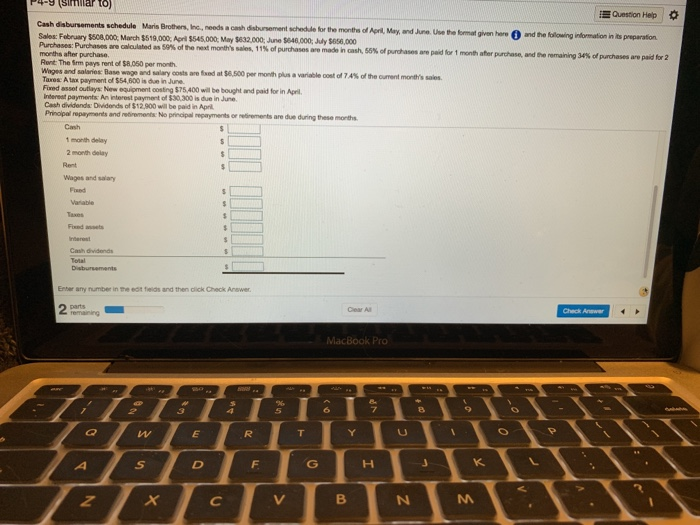

Question Help * Cash disbursements schedule Maris Brothers, Inc, needs a cash disbursement schedule for the monthe of April, May, and June. Use Sales: February $508,000, March $519,000: April $545,000; May $632,000 Ane $046,000, July $056,000 the format given here and the following inlomasion in its preparation. Purchases ar al ulated asse% ofthe next month 's sales, 11% of purchases are made in anh. gg% of punhases are paid fri month afer purchase, rdthe remaining 34% ofpurhases are paid fr 2 months after purchase. Rent: The frm pays rent of $8,050 per month. wages and saarer Base wage and salary costs are find at SOS00 per mont, plus a variable cost of 7A% of Taxes: A tax paymont of $54,600 is due in June. Fiured asset outlays: New equipment oosting $75,400 will be bought and paid for in April Intorest paymonts: An interest payment of $30,300 is due in June. Cash dividends: Dividends of $12,900 will be paid in April Prinoipal repayments and rotirements: No principal repayments or redirements are due during these months current morm's sales. Complete the cash disbursements schedule for Maris Brothers, Inc. below: (Round to the nearest dollar.) Schedule of Projected Cash Disbursements for Maris Brothers, Inc Jun Jul s 506005 $180094600 1 month delay 2 month delay Wages and salary Enter any number in the edit fleids and then click Check Answer Clear All Check Answer 8 4-9 (glmilar to Question Help Aonl, May, and Juna, Use the fomat gven hareatormation in its preparation Cash disbursements schedule Maris Brothers, Inc, needs a cash disbursement schedule for the months of Sales: February $508,000 March $519,000, April $545,000, May $632,000, June $646,000, July $656,000 Purchases: Purchases are morths after purchase. Rent: The Sm pays rent of $8,060 per month Weges and salanes Base woge rd siy costs an ted at se sooper morth plus.varable ost d 74% d te orent mothal Taxes: A tax payment of $54,600 is due in June. Fixed asset outlays: New equipment costing $75,400 will be bought and paid for in Apeil Inderest payments An interest payment of $30,300 is due in June Cash dividends Dividends of $12,900 will be paid in Apr Prinoipal repayments and retiremens No odalated as 5g% of formt ment's sales, 11% of purchases am madencash, S6% ofpre se. n p Simone, dr prate, and r princdipal eparyments or eirements are due during these months 1 month delay 2 month delay Wages and salary Fixed assebs Cash dividends Enter any number in the edit feids and then click Check Answer Clear Al Check Anawer MacBook Pro