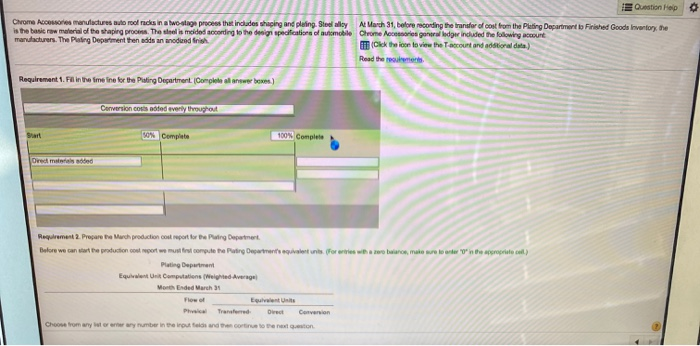

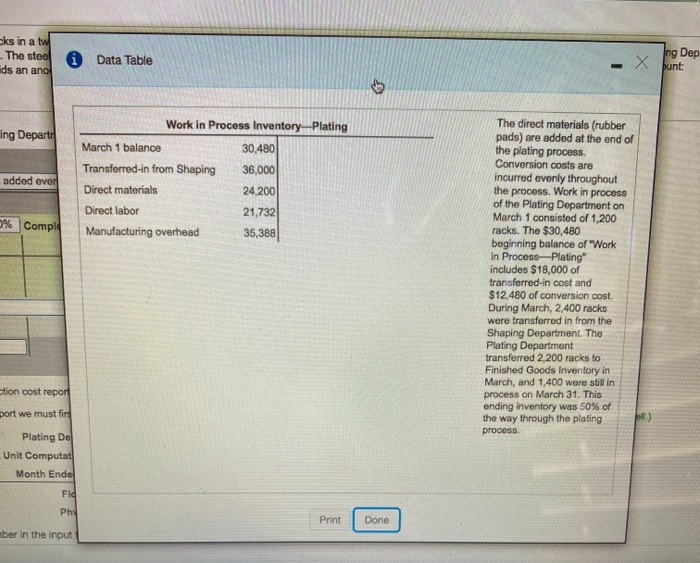

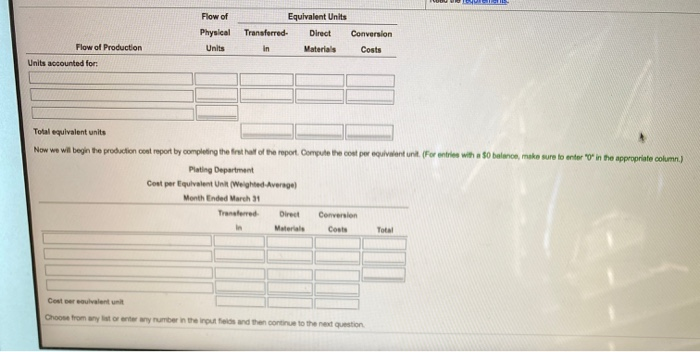

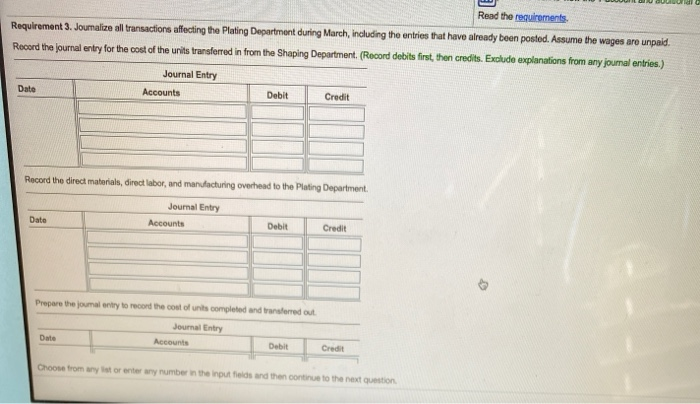

Question Help . Chrome Accessories manufactures auto rool racks in a two-stage process that includes shaping and plaing Steel alloy A. March 31, before recording the transfer of cost from the Plating Department to Finished Goods Inventory, the is the basic raw material of the shaping process. These is molded according to the design specifications of automobile Chrome responsal ledger included the following account manufacturers. The Plating Department then adds an anodized finish IT (Click the loon to view the account and additional data) Read the moment Requirement 1. Fill in the time in for the Pisting Department. (Complete wees Conversion conoted averly throughout Start SON Complete 100Complete Ord med Requirement 2. Prepare to March production cost report to the Ping Department Before we can production color complete Pwing Dresults for woman the propol Plating Department Equivalent Computations (Weighted Average Morten Ended March Flow of Equivalent Units Physical Transferred Det Conversion Choose from yorumber in the routes and the correo enton Eks in a tu The stoc Ids an ano Data Table -X ng Dep unt: ing Departe added ever Work in Process Inventory Plating March 1 balance 30,480 Transferred-in from Shaping 36,000 Direct materials 24,200 Direct labor 21,732 Manufacturing overhead 35,388 D. Comple The direct materials (rubber pads) are added at the end of the plating process Conversion costs are incurred evenly throughout the process. Work in process of the Plating Department on March 1 consisted of 1,200 racks. The $30,480 beginning balance of "Work in Process-Plating" includes $18,000 of transferred-in cost and $12,480 of conversion cost. During March, 2,400 racks were transferred in from the Shaping Department. The Plating Department transferred 2,200 racks to Finished Goods Inventory in March, and 1,400 were still in process on March 31. This ending inventory was 50% of the way through the plating process stion cost report port we must fire ) Plating De Unit Computat Month Ende Fid Phy Print Done aber in the input Flow of Physical Units Equivalent Units Transferred Direct Conversion In Materials Costs Flow of Production Vnits accounted for Total equivalent units Now we will begin the production cost report by completing the first half of the report Compute the cost per equivalent unit (For entries with a balance, make sure to enter "O' in the appropriate column) Plating Department Cost per Equivalent Unt (Weighted Average Month Ended March 31 Direct Conversion In Materiale Coats Total Costrouvaient Choose from any rere any number in the inputs and then continue to the next question Read the requirements Requirement 3. Journalize all transactions affecting the Plating Department during March, including the entries that have already been posted. Assume the wages are unpaid. Record the journal entry for the cost of the units transferred in from the Shaping Department. (Record debits first, then credits. Exclude explanations from any joumal entries.) Journal Entry Accounts Date Debit Credit Record the direct materials, direct labor, and manufacturing overhead to the Plating Department Journal Entry Accounts Date Debit Credit Prepare the journal entry to record the cost of completed and transferred out Journal Entry Date Accounts Debit Credit Choose from any stor enter any number in the input fields and then continue to the next