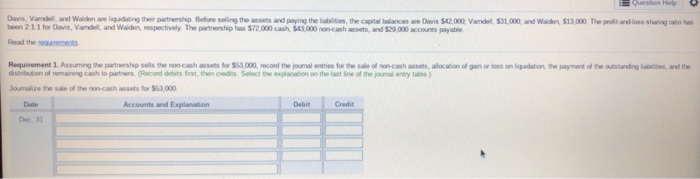

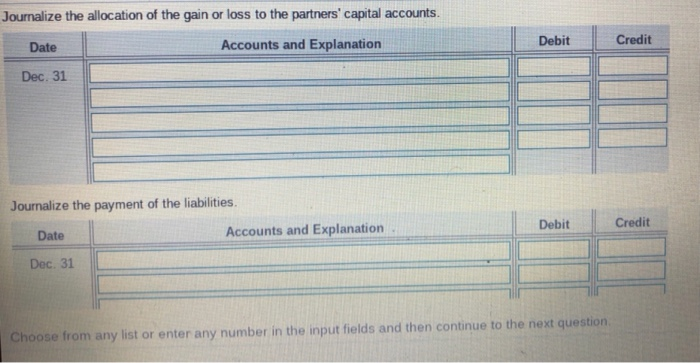

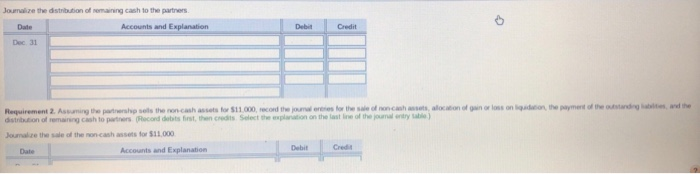

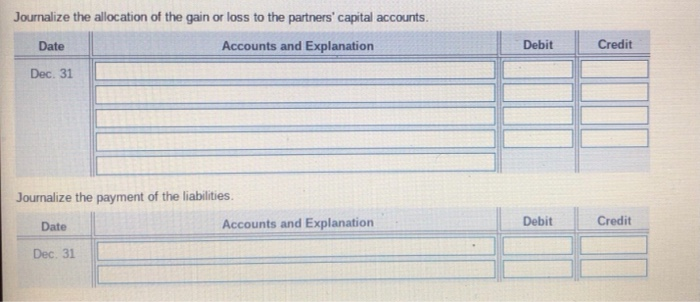

Question Help Davis Vandel and Wald we liquidating their partnership. Before sling the assets and paying the late the capital balances w Davis $12,000 Vamdel, $31.000 and Walden $13,000. The proltando swing ratio has beon 21.1 for Davis, Vandel, and Walden, respectively. The partnerships $72.000 cash. 543.000 roncassets, and $29.000 accounts payable Read the rest Requirement 1. Assuming the partnership sols the non cash assets to $53.000. record the journal entre for the trenches, location of gain or loss on lqudation, the payment of the outstanding habites, and the distribution of remaining cash to partners Record debits first, then credits Select the explanation on the last line of the jouma entry table) Journalize the sale of the non-cash assets for $53,000 Date Accounts and Explanation Debit Credit Dec. 31 Journalize the allocation of the gain or loss to the partners' capital accounts. Date Accounts and Explanation Debit Credit Dec. 31 Journalize the payment of the liabilities. Date Accounts and Explanation Debit Credit Dec. 31 Choose from any list or enter any number in the input fields and then continue to the next question Journalize the distribution of remaining cash to the partiers Date Accounts and Explanation Dec 31 Debid Credit Requirement 2. Assuming the partnership of the rocash assets for $11.000, record the jours for the sale of rocash, location of gain or loss onion, the payment of the desired the distribution of remaining cash to partners Record debit first, then credits Select the exploration on the last line of the journal entry) Joumalize the sale of the non-cassets for $11.000 Date Accounts and Explanation Debit Crede Journalize the allocation of the gain or loss to the partners' capital accounts. Accounts and Explanation Date Debit Credit Dec. 31 Journalize the payment of the liabilities Date Accounts and Explanation Debit Credit Dec. 31 Journalize the distribution of remaining cash to the partners. Date Accounts and Explanation Debit Credit Dec. 31 Question Help Davis Vandel and Wald we liquidating their partnership. Before sling the assets and paying the late the capital balances w Davis $12,000 Vamdel, $31.000 and Walden $13,000. The proltando swing ratio has beon 21.1 for Davis, Vandel, and Walden, respectively. The partnerships $72.000 cash. 543.000 roncassets, and $29.000 accounts payable Read the rest Requirement 1. Assuming the partnership sols the non cash assets to $53.000. record the journal entre for the trenches, location of gain or loss on lqudation, the payment of the outstanding habites, and the distribution of remaining cash to partners Record debits first, then credits Select the explanation on the last line of the jouma entry table) Journalize the sale of the non-cash assets for $53,000 Date Accounts and Explanation Debit Credit Dec. 31 Journalize the allocation of the gain or loss to the partners' capital accounts. Date Accounts and Explanation Debit Credit Dec. 31 Journalize the payment of the liabilities. Date Accounts and Explanation Debit Credit Dec. 31 Choose from any list or enter any number in the input fields and then continue to the next question Journalize the distribution of remaining cash to the partiers Date Accounts and Explanation Dec 31 Debid Credit Requirement 2. Assuming the partnership of the rocash assets for $11.000, record the jours for the sale of rocash, location of gain or loss onion, the payment of the desired the distribution of remaining cash to partners Record debit first, then credits Select the exploration on the last line of the journal entry) Joumalize the sale of the non-cassets for $11.000 Date Accounts and Explanation Debit Crede Journalize the allocation of the gain or loss to the partners' capital accounts. Accounts and Explanation Date Debit Credit Dec. 31 Journalize the payment of the liabilities Date Accounts and Explanation Debit Credit Dec. 31 Journalize the distribution of remaining cash to the partners. Date Accounts and Explanation Debit Credit Dec. 31