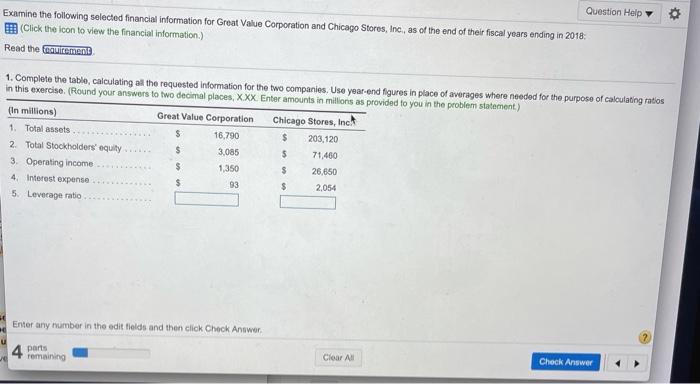

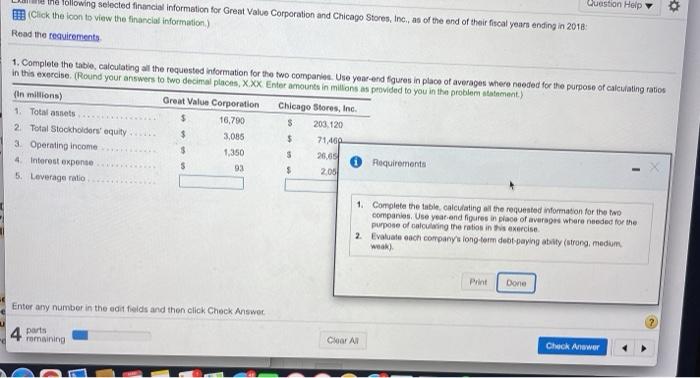

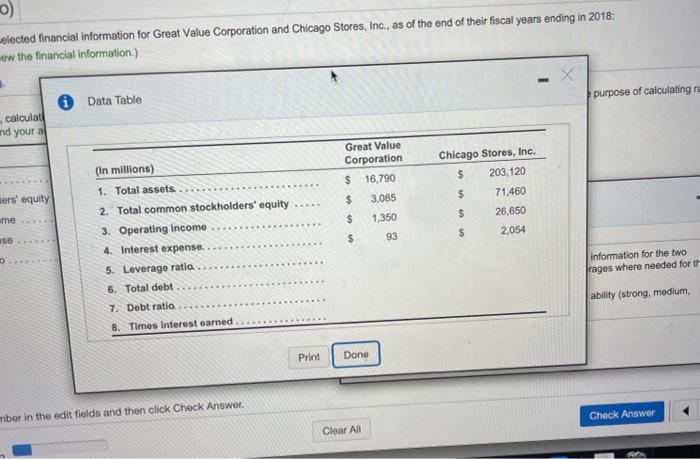

Question Help Examine the following selected financial information for Great Value Corporation and Chicago Stores, Inc., as of the end of their fiscal years ending in 2018: (Click the icon to view the financial Information) Read the futurement 1. Complete the table, calculating all the requested information for the two companies. Use year-end figures in place of averages where needed for the purpose of calculating ratios in this exercise (Round your answers to two decimal places, XXX. Enter amounts in millions as provided to you in the problem statement) (In millions) Great Value Corporation Chicago Stores, Inc. 1. Total assets 16,790 $ 203,120 2. Total Stockholders' equity $ 5 71,460 3. Operating income $ 1,350 $ 26,650 4 Interest expense $ 93 $ 2,054 5. Leverage ratio 3,085 Enter any number in the edit fields and then click Check Answer parts remaining Clear All Check Answer Question Help The following selected financial Information for Great Value Corporation and Chicago Stores, Inc., as of the end of their focal years ending in 2018 Click the icon to view the financial information) Read the requirements 1. Complete the table calculating all the requested information for the two companies. Use year-end figures in place of averages where needed for the purpose of calculating ratios In this exercise (Round your answers to two decimal places, Xxx Enter amounts in millions as provided to you in the problem statement) (In millions) Great Value Corporation Chicago Stores, Inc 1. Total assets $ 16,790 $ 203. 120 2. Total Stockholders' equity $ 3.085 $ 71 460 3 Operating income $ 1,350 S 20,65 Requirements 4 Interest expense $ 93 $ 2001 5. Leverage ratio 1. Complete the table calculating all the requested Information for the two companies. Use year and figures in place of averages where needed for the purpose of calculating the ration in this exercise 2 Evaluate each company's long-term det paying ability (strong, medium wek) Done Enter any number in the edit fields and then click Check Answer parts romaining Clear All Check Allower elected financial information for Great Value Corporation and Chicago Stores, Inc., as of the end of their fiscal years ending in 2018: ew the financial Information) purpose of calculating ra Data Table calculat and your al (In millions) Great Value Corporation $ 16.790 $ 3,085 1. Total assets. ers' equity Chicago Stores, Inc. $ 203,120 $ 71.460 S 26,650 $ 2,054 me $ 1,350 se $ 93 D 2. Total common stockholders' equity 3. Operating Income 4. Interest expense... 5. Leverage ratio 6. Total debt 7. Debt ratio 8. Times Interest earned information for the two rages where needed for ability (strong, medium, Print Done mbor in the edit fields and then click Check Answer. Check Answer Clear All