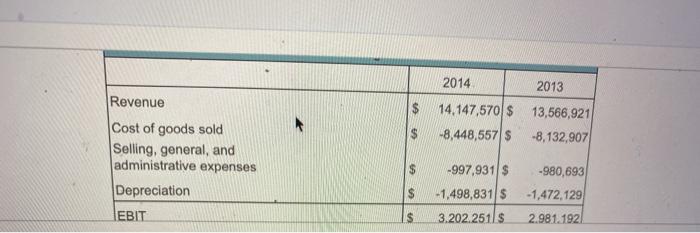

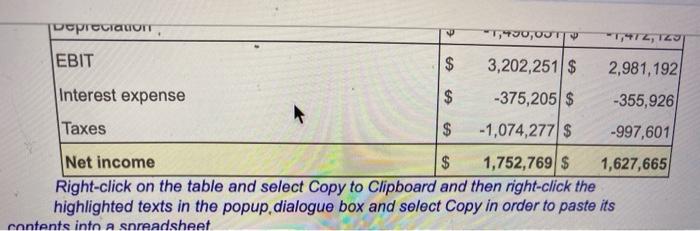

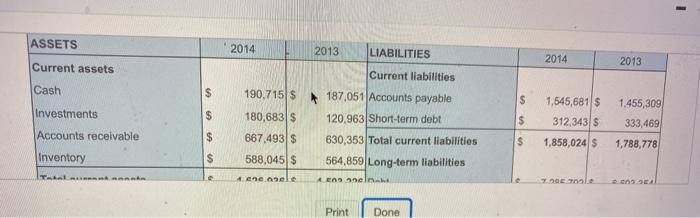

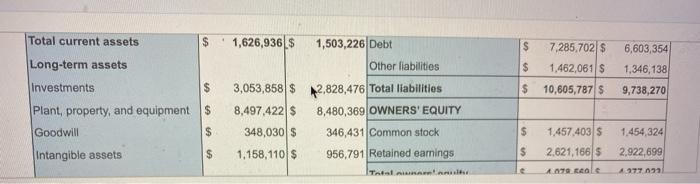

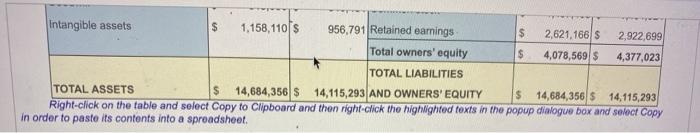

Question Help Financial ratios: Financial leverage. The financial statements for Tyler Toys, Inc. are shown in the popup window Calculate the debt ratio, me interesteamed ratio, and cash coverage for 2013 and 2014 for Tyler Toys Should any of these ratio of the change in a ratio warrant concern for the managers ayer Toys or the shareholders? What is the debt ratio for 2014? Round to four decimal places) Revenue 2014 2013 $ 14,147,570 $ 13,566,921 $ -8,448,557 $ -8,132,907 Cost of goods sold Selling, general, and administrative expenses Depreciation EBIT $ -997,931 $ $ -1,498,831$ 3.202.251 s -980,693 -1,472,129 2.981.1921 S w $ $ Depreciation, 5,790,OUTT T/T2, TZU EBIT $ 3,202,251 $ 2,981,192 Interest expense -375,205 $ -355,926 Taxes $ -1,074,277 $ -997,601 Net income $ 1,752,769 $ 1,627,665 Right-click on the table and select Copy to Clipboard and then right-click the highlighted texts in the popup, dialogue box and select Copy in order to paste its contents into a snreadsheet ASSETS 2014 2013 LIABILITIES 2014 2013 Current assets Current liabilities Cash 190,715$ 187,051 Accounts payable S 1,545,681 $ 1,455,309 Investments $ 180,683 $ 120,963 Short-term debt $ 312.343/S 333,469 $ 667.493 $ $ Accounts receivable Inventory 1,858,024 $ 1,788,778 630,353 Total current liabilities 564,859 Long-term liabilities $ 588,045 $ 4 engele Ennen Print Done Total current assets $ $ 7,285,702 $ 1,462,061 $ Long-term assets 6,603,354 1,346,138 $ Investments $ 10,605,787 $ 9,738,270 1,626,936 $ 1,503,226 Debt Other liabilities 3,053,858 $ 2,828,476 Total liabilities 8,497,422 $ 8,480,369 OWNERS' EQUITY 348,030$ 346,431 Common stock 1.158, 110$ 956,791 Retained earnings Plant, property, and equipment $ Goodwill $ Intangible assets $ 1.457.403S 1,454,324 2.922,699 $ $ 2,621,166 $ 079 ceale Intangible assets $ 1.158, 110$ 956,791 Retained earnings $ 2,621,166 2,922,699 Total owners' equity $ 4,078,569 $ 4,377,023 TOTAL LIABILITIES TOTAL ASSETS 14,684,356 $ 14, 115,293 AND OWNERS' EQUITY $ 14,684,356 $ 14, 115,293 Right click on the table and select Copy to clipboard and then right-click the highlighted texts in the popup dialogue box and select Copy in order to paste its contents into a spreadsheet